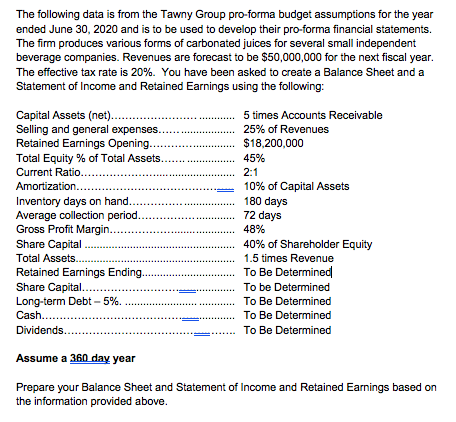

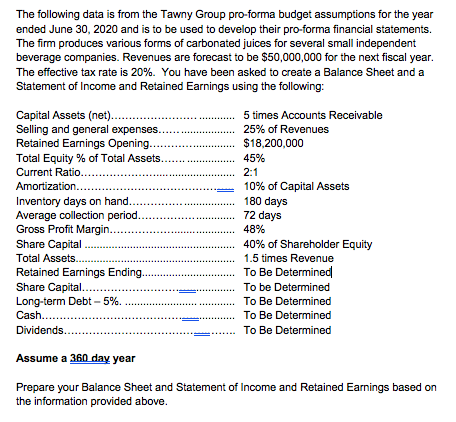

The following data is from the Tawny Group pro-forma budget assumptions for the year ended June 30, 2020 and is to be used to develop their pro-forma financial statements. The firm produces various forms of carbonated juices for several small independent beverage companies. Revenues are forecast to be $50,000,000 for the next fiscal year. The effective tax rate is 20%. You have been asked to create a Balance Sheet and a Statement of Income and Retained Earnings using the following: Capital Assets (net)...... Selling and general expenses. Retained Earnings Opening.. Total Equity % of Total Assets. Current Ratio..... Amortization....... Inventory days on hand.... Average collection period.. Gross Profit Margin... Share Capital Total Assets... Retained Earnings Ending. Share Capital... Long-term Debt-5% Cash........ Dividends... 5 times Accounts Receivable 25% of Revenues $18,200,000 45% 2:1 10% of Capital Assets 180 days 72 days 48% 40% of Shareholder Equity 1.5 times Revenue To Be Determined To be Determined To Be Determined To Be Determined To Be Determined Assume a 360 day year Prepare your Balance Sheet and Statement of Income and Retained Earnings based on the information provided above. The following data is from the Tawny Group pro-forma budget assumptions for the year ended June 30, 2020 and is to be used to develop their pro-forma financial statements. The firm produces various forms of carbonated juices for several small independent beverage companies. Revenues are forecast to be $50,000,000 for the next fiscal year. The effective tax rate is 20%. You have been asked to create a Balance Sheet and a Statement of Income and Retained Earnings using the following: Capital Assets (net)...... Selling and general expenses. Retained Earnings Opening.. Total Equity % of Total Assets. Current Ratio..... Amortization....... Inventory days on hand.... Average collection period.. Gross Profit Margin... Share Capital Total Assets... Retained Earnings Ending. Share Capital... Long-term Debt-5% Cash........ Dividends... 5 times Accounts Receivable 25% of Revenues $18,200,000 45% 2:1 10% of Capital Assets 180 days 72 days 48% 40% of Shareholder Equity 1.5 times Revenue To Be Determined To be Determined To Be Determined To Be Determined To Be Determined Assume a 360 day year Prepare your Balance Sheet and Statement of Income and Retained Earnings based on the information provided above