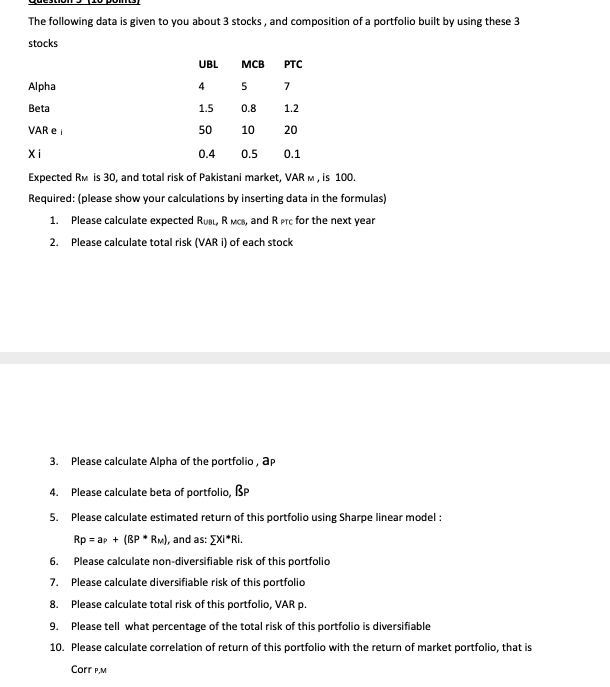

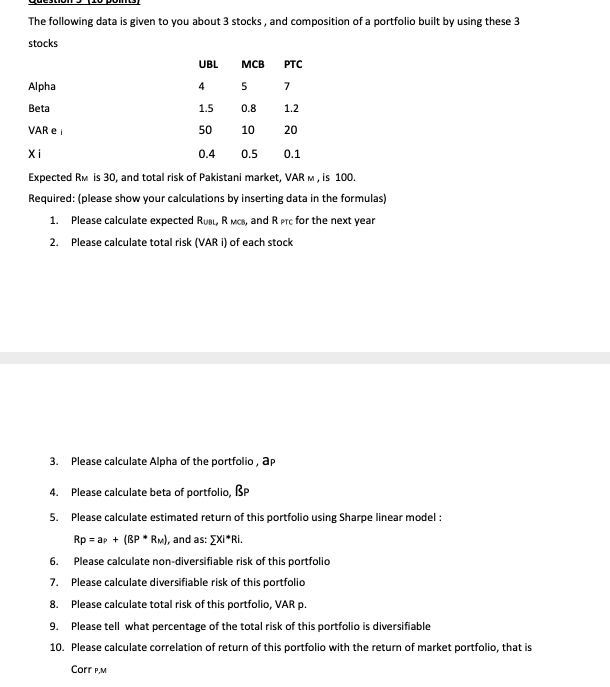

The following data is given to you about 3 stocks, and composition of a portfolio built by using these 3 stocks UBL MCB PTC Alpha 4 5 7 Beta 1.5 0.8 1.2 VAR ei 50 10 20 0.5 0.1 Xi 0.4 Expected RM is 30, and total risk of Pakistani market, VAR M, S 100. Required: (please show your calculations by inserting data in the formulas) 1. Please calculate expected RuB, Rmcs, and Rere for the next year 2. Please calculate total risk (VARI) of each stock 3. Please calculate Alpha of the portfolio, ap 4. 5. 6. Please calculate beta of portfolio, BP Please calculate estimated return of this portfolio using Sharpe linear model: Rp = ap + (BP* RM), and as: {XI*ri. Please calculate non-diversifiable risk of this portfolio Please calculate diversifiable risk of this portfolio Please calculate total risk of this portfolio, VARD. Please tell what percentage of the total risk of this portfolio is diversifiable 10. Please calculate correlation of return of this portfolio with the return of market portfolio, that is 7. 8. 9. Corr PM The following data is given to you about 3 stocks, and composition of a portfolio built by using these 3 stocks UBL MCB PTC Alpha 4 5 7 Beta 1.5 0.8 1.2 VAR ei 50 10 20 0.5 0.1 Xi 0.4 Expected RM is 30, and total risk of Pakistani market, VAR M, S 100. Required: (please show your calculations by inserting data in the formulas) 1. Please calculate expected RuB, Rmcs, and Rere for the next year 2. Please calculate total risk (VARI) of each stock 3. Please calculate Alpha of the portfolio, ap 4. 5. 6. Please calculate beta of portfolio, BP Please calculate estimated return of this portfolio using Sharpe linear model: Rp = ap + (BP* RM), and as: {XI*ri. Please calculate non-diversifiable risk of this portfolio Please calculate diversifiable risk of this portfolio Please calculate total risk of this portfolio, VARD. Please tell what percentage of the total risk of this portfolio is diversifiable 10. Please calculate correlation of return of this portfolio with the return of market portfolio, that is 7. 8. 9. Corr PM