Question

The following data pertain to XYZ Company. Net income is assumed to be 8% of sales and the dividend payout ratio is 40%. The company

The following data pertain to XYZ Company. Net income is assumed to be 8% of sales and the dividend payout ratio is 40%.

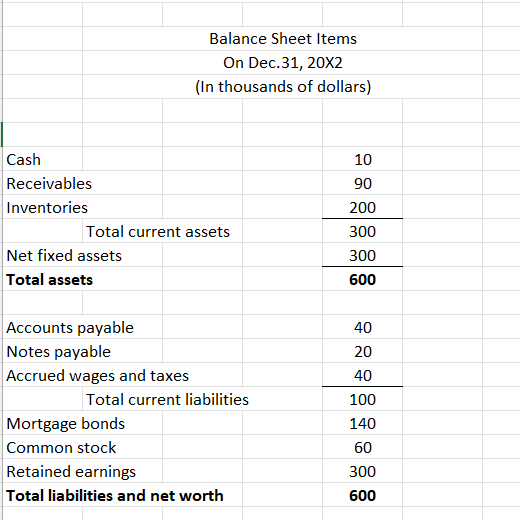

The company expects its sales to increase its sales from 400,000 in 20X1 to 600,000 in 20X2. In this problem, all the asset accounts (including fixed assets) and current liabilities vary directly with sales. The company is operating at full capacity.

Required:

a) Formulate a pro-forma balance sheet

b) Use the simple formula to determine the external funds needed by the company based on your answer in part (a)

Balance Sheet Items On Dec. 31, 20X2 (In thousands of dollars) Cash 10 Receivables 90 Inventories 200 Total current assets 300 Net fixed assets 300 Total assets 600 Accounts payable 40 Notes payable 20 Accrued wages and taxes 40 Total current liabilities 100 Mortgage bonds 140 Common stock 60 Retained earnings 300 Total liabilities and net worth 600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Proforma balance sheet of XYZ Company Particulars 20X1 20X2 Sales 400000 600...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d88aa4f288_965767.pdf

180 KBs PDF File

663d88aa4f288_965767.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started