Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following data refer to Huron Corporation for the year 20x2. $ 2,107,000 88,000 730,000 59,000 474,000 268,000. 150,000 90,000 125,000 23,000 46,000 Sales

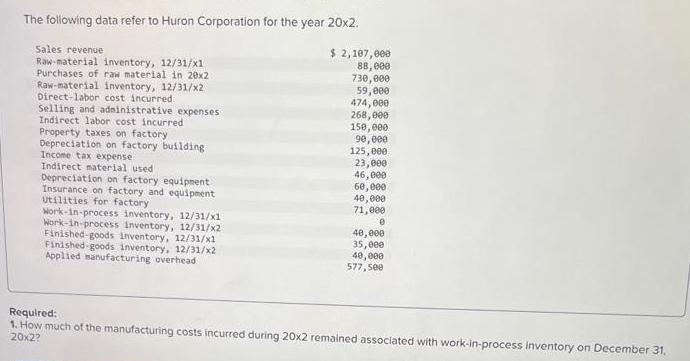

The following data refer to Huron Corporation for the year 20x2. $ 2,107,000 88,000 730,000 59,000 474,000 268,000. 150,000 90,000 125,000 23,000 46,000 Sales revenue Raw-material inventory, 12/31/x1 Purchases of raw material in 20x2 Raw-material inventory, 12/31/x2 Direct-labor cost incurred Selling and administrative expenses Indirect labor cost incurred Property taxes on factory Depreciation on factory building Income tax expense Indirect material used Depreciation on factory equipment Insurance on factory and equipment Utilities for factory Work-in-process inventory, 12/31/x1 Work-in-process inventory, 12/31/x2 Finished-goods inventory, 12/31/x1 Finished-goods inventory, 12/31/x2 Applied manufacturing overhead 60,000 40,000 71,000 0 40,000 35,000 40,000 577,500 Required: 1. How much of the manufacturing costs incurred during 20x2 remained associated with work-in-process inventory on December 31, 20x2?

Step by Step Solution

★★★★★

3.23 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To determine the manufacturing costs incurred during 20x2 that remained associated with workinproces...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started