Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joe, who is married (Julia, age 34) and the father of one (age 4), is 38 years old and expects to continue to work

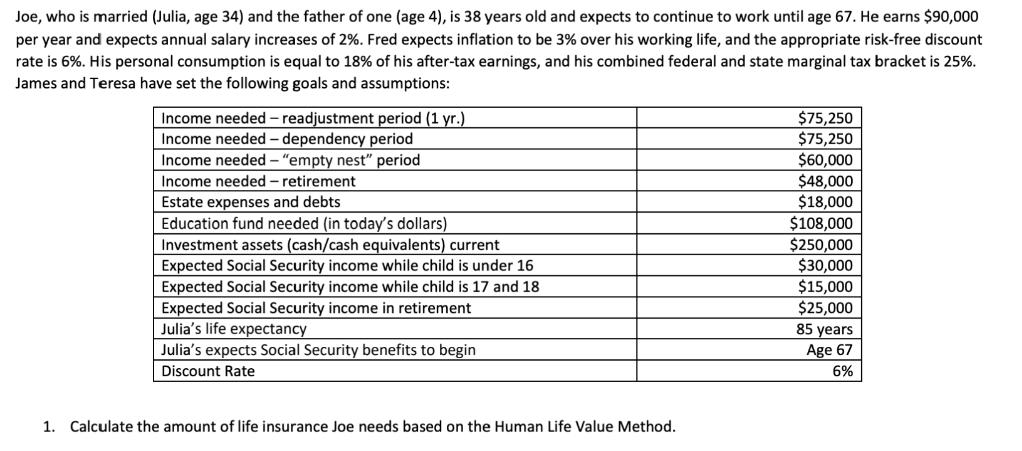

Joe, who is married (Julia, age 34) and the father of one (age 4), is 38 years old and expects to continue to work until age 67. He earns $90,000 per year and expects annual salary increases of 2%. Fred expects inflation to be 3% over his working life, and the appropriate risk-free discount rate is 6%. His personal consumption is equal to 18% of his after-tax earnings, and his combined federal and state marginal tax bracket is 25%. James and Teresa have set the following goals and assumptions: Income needed - readjustment period (1 yr.) Income needed - dependency period Income needed - "empty nest" period Income needed - retirement Estate expenses and debts Education fund needed (in today's dollars) Investment assets (cash/cash equivalents) current Expected Social Security income while child is under 16 Expected Social Security income while child is 17 and 18 Expected Social Security income in retirement Julia's life expectancy Julia's expects Social Security benefits to begin Discount Rate 1. Calculate the amount of life insurance Joe needs based on the Human Life Value Method. $75,250 $75,250 $60,000 $48,000 $18,000 $108,000 $250,000 $30,000 $15,000 $25,000 85 years Age 67 6% 2. Calculate the amount of life insurance Joe needs based on the Capitalization of Earnings Method. Joe, who is married (Julia, age 34) and the father of one (age 4), is 38 years old and expects to continue to work until age 67. He earns $90,000 per year and expects annual salary increases of 2%. Fred expects inflation to be 3% over his working life, and the appropriate risk-free discount rate is 6%. His personal consumption is equal to 18% of his after-tax earnings, and his combined federal and state marginal tax bracket is 25%. James and Teresa have set the following goals and assumptions: Income needed - readjustment period (1 yr.) Income needed - dependency period Income needed - "empty nest" period Income needed - retirement Estate expenses and debts Education fund needed (in today's dollars) Investment assets (cash/cash equivalents) current Expected Social Security income while child is under 16 Expected Social Security income while child is 17 and 18 Expected Social Security income in retirement Julia's life expectancy Julia's expects Social Security benefits to begin Discount Rate 1. Calculate the amount of life insurance Joe needs based on the Human Life Value Method. $75,250 $75,250 $60,000 $48,000 $18,000 $108,000 $250,000 $30,000 $15,000 $25,000 85 years Age 67 6% 2. Calculate the amount of life insurance Joe needs based on the Capitalization of Earnings Method.

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

1 Human Life Value Method The Human Life Value Method calculates the amount of life insurance needed based on Joes future earnings and the financial support he provides to his family To calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started