Question

The following data refer to snack maker Taquitos To Go for the year 2 0 x 1 . Work - in - process inventory, 1

The following data refer to snack maker Taquitos To Go for the year x

Workinprocess inventory, x ?$

Selling and administrative salaries

Insurance on factory and equipment

Workinprocess inventory, x

Finishedgoods inventory, x

Cash balance, x

Indirect material used

Depreciation on factory equipment

Rawmaterial inventory, x

Property taxes on factory

Finishedgoods inventory, x

Purchases of raw material in x

Utilities for factory

Utilities for sales and administrative offices

Other selling and administrative expenses

Indirectlabor cost incurred

Depreciation on factory building

Depreciation on cars used by sales personnel

Directlabor cost incurred

Rawmaterial inventory, x

Accounts receivable, x

Rental for warehouse space to store raw material

Rental of space for company presidents office

Applied manufacturing overhead

Sales revenue

Income tax expense

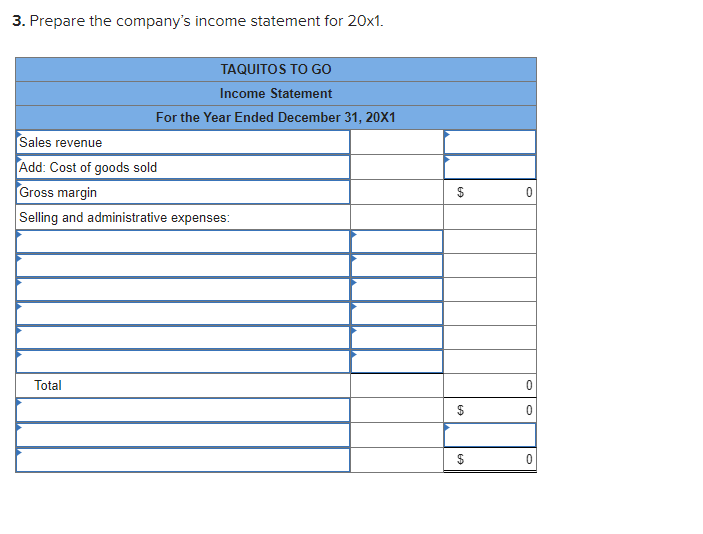

Prepare the company's income statement for

3. Prepare the company's income statement for 20x1. TAQUITOS TO GO Income Statement For the Year Ended December 31, 20X1 Sales revenue Add: Cost of goods sold Gross margin Selling and administrative expenses: Total $ 0 0 $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started