Answered step by step

Verified Expert Solution

Question

1 Approved Answer

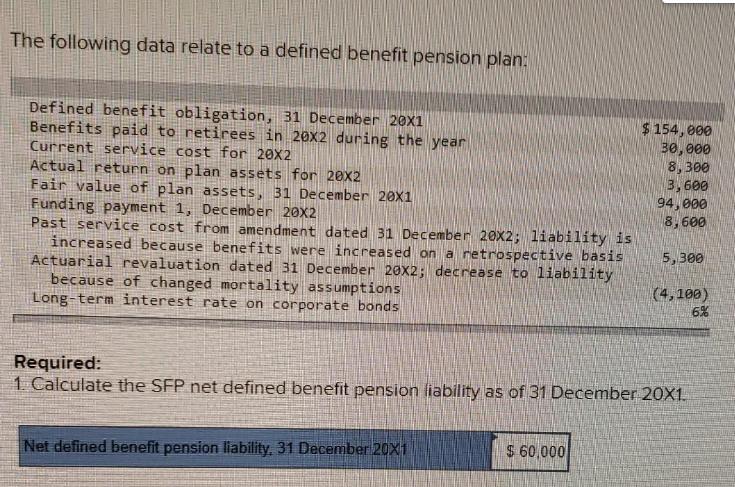

The following data relate to a defined benefit pension plan: Defined benefit obligation, 31 December 20x1 Benefits paid to retirees in 20x2 during the

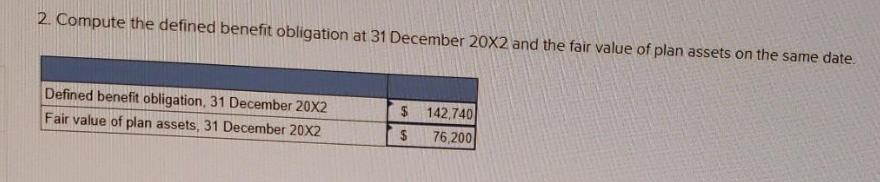

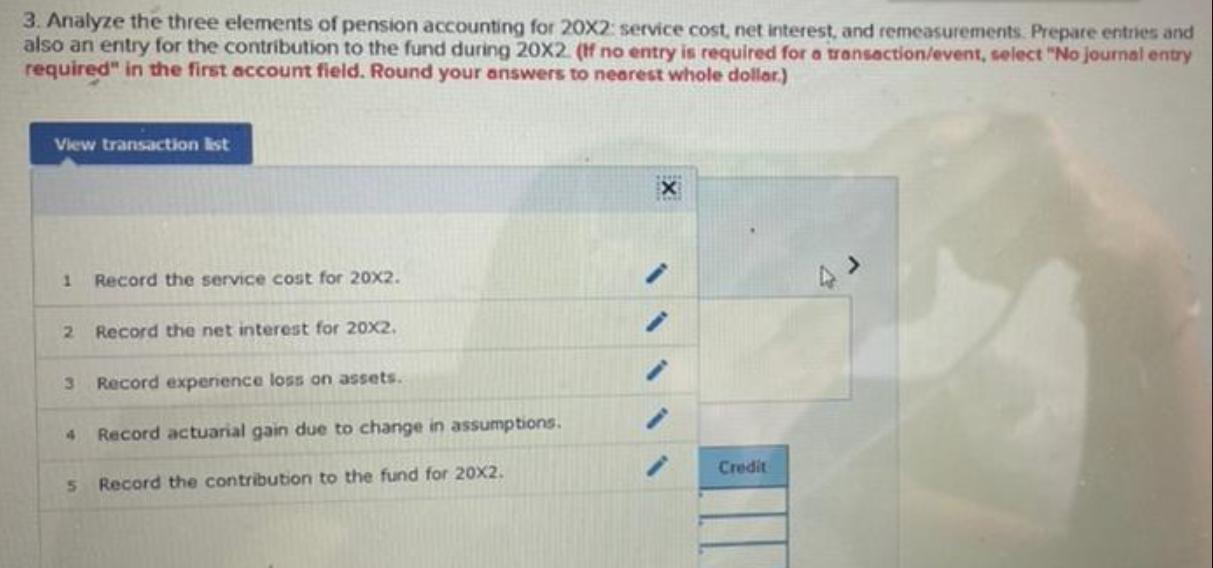

The following data relate to a defined benefit pension plan: Defined benefit obligation, 31 December 20x1 Benefits paid to retirees in 20x2 during the year Current service cost for 20X2 Actual return on plan assets for 20X2 Fair value of plan assets, 31 December 20X1 Funding payment 1, December 20X2 Past service cost from amendment dated 31 December 20X2; liability is increased because benefits were increased on a retrospective basis Actuarial revaluation dated 31 December 20X2; decrease to liability because of changed mortality assumptions Long-term interest rate on corporate bonds Net defined benefit pension liability, 31 December 20X1 $154,000 30,000 8,300 3,600 $ 60,000 94,000 8,600 5,300 Required: 1. Calculate the SFP net defined benefit pension liability as of 31 December 20X1. (4,100) 6% 2. Compute the defined benefit obligation at 31 December 20X2 and the fair value of plan assets on the same date. Defined benefit obligation, 31 December 20X2 Fair value of plan assets, 31 December 20X2 $ 142,740 $ 76,200 3. Analyze the three elements of pension accounting for 20X2: service cost, net interest, and remeasurements. Prepare entries and also an entry for the contribution to the fund during 20X2. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to nearest whole dollar) View transaction list 1 Record the service cost for 20x2. 2 3 Record experience loss on assets. 4 Record actuarial gain due to change in assumptions. Record the contribution to the fund for 20x2. Record the net interest for 20x2. 5 Credit

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

SFP net defined benefit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started