Answered step by step

Verified Expert Solution

Question

1 Approved Answer

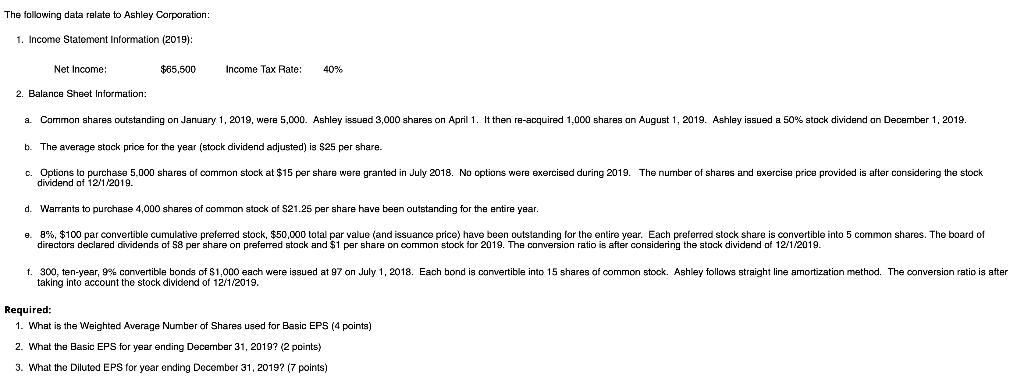

The following data relate to Ashley Corporation: 1. Income Statement Information (2019): Net Income: $65,500 Income Tax Rate: 40% 2. Balance Sheet Information: a.

The following data relate to Ashley Corporation: 1. Income Statement Information (2019): Net Income: $65,500 Income Tax Rate: 40% 2. Balance Sheet Information: a. Common shares outstanding on January 1, 2019, were 5,000. Ashley issued 3,000 shares on April 1. It then re-acquired 1,000 shares on August 1, 2019. Ashley issued a 50% stock dividend on December 1, 2019. b. The average stock price for the year (stock dividend adjusted) is $25 per share. c. Options purchase 5,000 shares of common stock at $15 per share were granted in July 2018. No options were exercised during 2019. The number of shares and exercise price provided is after considering the stock dividend of 12/1/2019. d. Warrants to purchase 4,000 shares of common stock of $21.25 per share have been outstanding for the entire year. e. 8%, $100 par convertible cumulative preferred stock, $50,000 total par value (and issuance price) have been outstanding for the entire year. Each preferred stock share is convertible into 5 common shares. The board of directors declared dividends of S8 per share on preferred stock and $1 per share on common stock for 2019. The conversion ratio is after considering the stock dividend of 12/1/2019. after 1. 300, ten-year, 9% convertible bonds of $1,000 each were issued at 97 on July 1, 2018. Each bond is convertible into 15 shares of common stock. Ashley follows straight line amortization method. The conversion ratio is aft taking into account the stock dividend of 12/1/2019. Required: 1. What is the Weighted Average Number of Shares used for Basic EPS (4 points) 2. What the Basic EPS for year ending December 31, 2019? (2 points) 3. What the Diluted EPS for year ending December 31, 2019? (7 points)

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Weighted Average Number of Shares u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started