Answered step by step

Verified Expert Solution

Question

1 Approved Answer

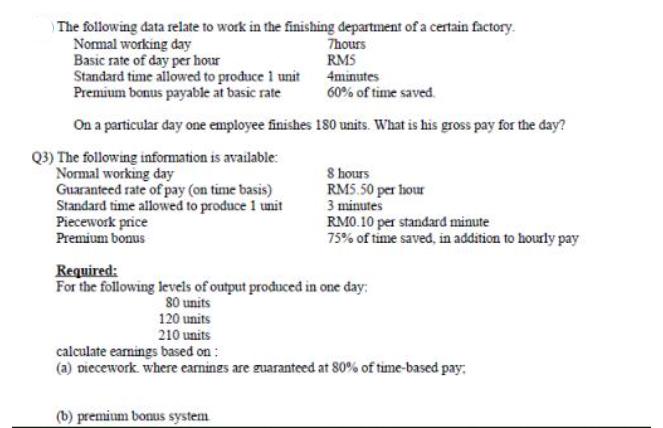

The following data relate to work in the finishing department of a certain factory. Normal working day Basic rate of day per hour Standard

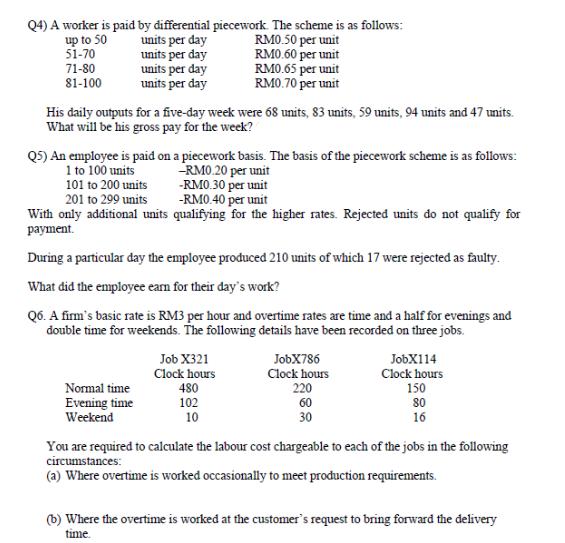

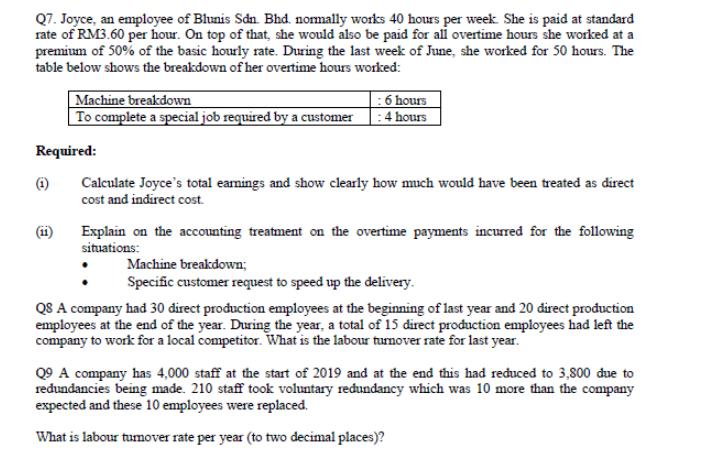

The following data relate to work in the finishing department of a certain factory. Normal working day Basic rate of day per hour Standard time allowed to produce 1 unit Premium bonus payable at basic rate On a particular day one employee finishes Q3) The following information is available: Normal working day Guaranteed rate of pay (on time basis) Standard time allowed to produce 1 unit Piecework price Premium bonus Thours RMS (b) premium bonus system 4minutes 60% of time saved. 180 units. What is his gross pay for the day? 8 hours RM5.50 per hour 3 minutes RM0.10 per standard minute 75% of time saved, in addition to hourly pay Required: For the following levels of output produced in one day: 80 units 120 units 210 units calculate earnings based on: (a) Diecework where earnings are guaranteed at 80% of time-based pay. Q4) A worker is paid by differential piecework. The scheme is as follows: up to 50 RM0.50 per unit 51-70 RM0.60 per unit 71-80 RM0.65 per unit 81-100 RM0.70 per unit units per day units per day units per day units per day His daily outputs for a five-day week were 68 units, 83 units, 59 units, 94 units and 47 units. What will be his gross pay for the week? Q5) An employee is paid on a piecework basis. The basis of the piecework scheme is as follows: 1 to 100 units 101 to 200 units 201 to 299 units -RM0.20 per unit -RM0.30 per unit -RM0.40 per unit With only additional units qualifying for the higher rates. Rejected units do not qualify for payment. During a particular day the employee produced 210 units of which 17 were rejected as faulty. What did the employee earn for their day's work? Q6. A firm's basic rate is RM3 per hour and overtime rates are time and a half for evenings and double time for weekends. The following details have been recorded on three jobs. Normal time Evening time Weekend Job X321 Clock hours 480 102 10 JobX786 Clock hours 220 60 30 JobX114 Clock hours 150 80 16 You are required to calculate the labour cost chargeable to each of the jobs in the following circumstances: (a) Where overtime is worked occasionally to meet production requirements. (b) Where the overtime is worked at the customer's request to bring forward the delivery time. Q7. Joyce, an employee of Blunis Sdn. Bhd. normally works 40 hours per week. She is paid at standard rate of RM3.60 per hour. On top of that, she would also be paid for all overtime hours she worked at a premium of 50% of the basic hourly rate. During the last week of June, she worked for 50 hours. The table below shows the breakdown of her overtime hours worked: Required: (1) Machine breakdown : 6 hours To complete a special job required by a customer : 4 hours (11) Calculate Joyce's total earnings and show clearly how much would have been treated as direct cost and indirect cost. Explain on the accounting treatment on the overtime payments incurred for the following situations: Machine breakdown; Specific customer request to speed up the delivery. Q8 A company had 30 direct production employees at the beginning of last year and 20 direct production employees at the end of the year. During the year, a total of 15 direct production employees had left the company to work for a local competitor. What is the labour turnover rate for last year. Q9 A company has 4,000 staff at the start of 2019 and at the end this had reduced to 3,800 due to redundancies being made. 210 staff took voluntary redundancy which was 10 more than the company expected and these 10 employees were replaced. What is labour tumover rate per year (to two decimal places)?

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Q3 To calculate the gross pay for the day well need to calculate the earnings under both the piecework and premium bonus systems for the given levels ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started