Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Super Furniture Mart received an offer in October 2021 to sell 25,000 'work from home' chairs to Easy Life Corporations. Easy Life Corporation requires

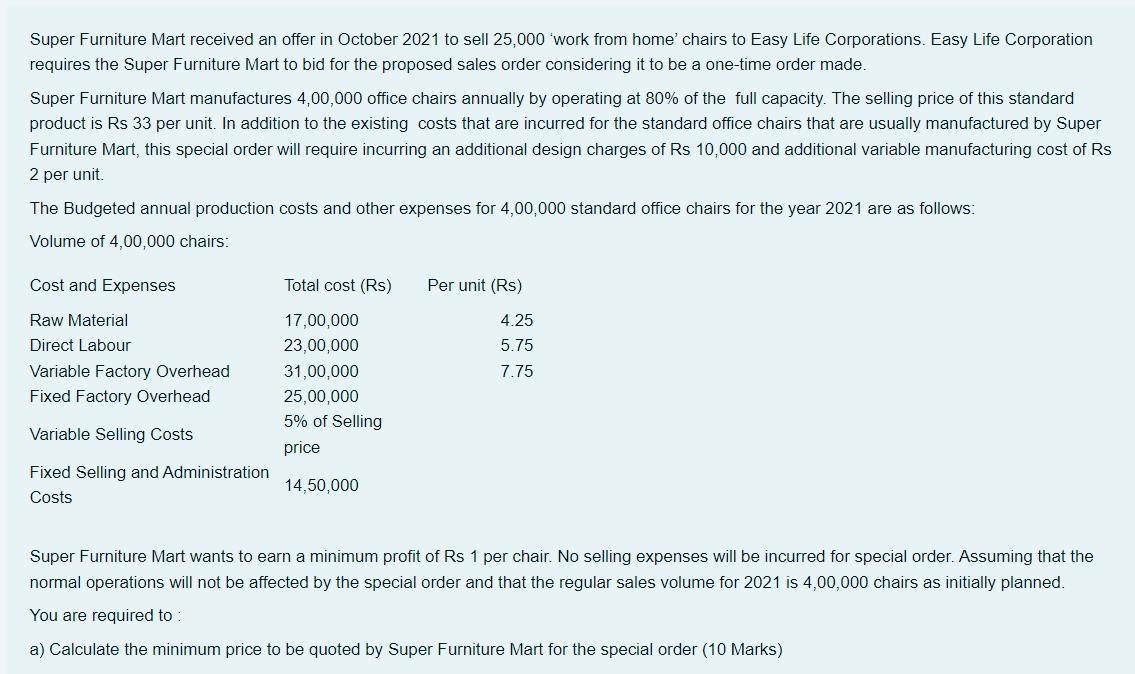

Super Furniture Mart received an offer in October 2021 to sell 25,000 'work from home' chairs to Easy Life Corporations. Easy Life Corporation requires the Super Furniture Mart to bid for the proposed sales order considering it to be a one-time order made. Super Furniture Mart manufactures 4,00,000 office chairs annually by operating at 80% of the full capacity. The selling price of this standard product is Rs 33 per unit. In addition to the existing costs that are incurred for the standard office chairs that are usually manufactured by Super Furniture Mart, this special order will require incurring an additional design charges of Rs 10,000 and additional variable manufacturing cost of Rs 2 per unit. The Budgeted annual production costs and other expenses for 4,00,000 standard office chairs for the year 2021 are as follows: Volume of 4,00,000 chairs: Cost and Expenses Raw Material Direct Labour Variable Factory Overhead Fixed Factory Overhead Variable Selling Costs Fixed Selling and Administration Costs Total cost (Rs) 17,00,000 23,00,000 31,00,000 25,00,000 5% of Selling price 14,50,000 Per unit (Rs) 4.25 5.75 7.75 Super Furniture Mart wants to earn a minimum profit of Rs 1 per chair. No selling expenses will be incurred for special order. Assuming that the normal operations will not be affected by the special order and that the regular sales volume for 2021 is 4,00,000 chairs as initially planned. You are required to : a) Calculate the minimum price to be quoted by Super Furniture Mart for the special order (10 Marks)

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the minimum price to be quoted by Super Furniture Mart for the special ord...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started