Answered step by step

Verified Expert Solution

Question

1 Approved Answer

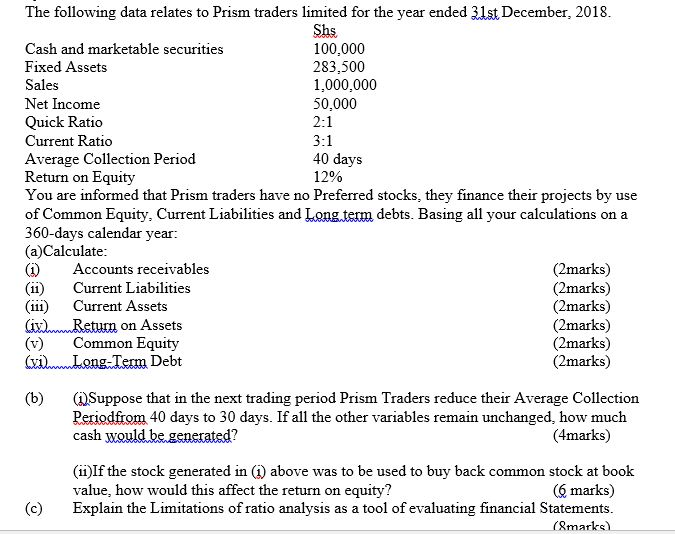

The following data relates to Prism traders limited for the year ended 31st December, 2018. Shs Cash and marketable securities Fixed Assets Sales Net

The following data relates to Prism traders limited for the year ended 31st December, 2018. Shs Cash and marketable securities Fixed Assets Sales Net Income Quick Ratio Current Ratio Average Collection Period Return on Equity You are informed that Prism traders have no Preferred stocks, they finance their projects by use of Common Equity, Current Liabilities and Long term debts. Basing all your calculations on a 360-days calendar year: (a)Calculate: (1) Accounts receivables (11) Current Liabilities (111) Current Assets (iv)Return on Assets Common Equity Long-Term Debt (b) 100,000 283,500 1,000,000 50,000 2:1 3:1 40 days 12% (c) (2marks) (2marks) (2marks) (2marks) (2marks) (2marks) (1)Suppose that in the next trading period Prism Traders reduce their Average Collection Periodfrom 40 days to 30 days. If all the other variables remain unchanged, how much cash would be generated? (4marks) (ii) If the stock generated in (1) above was to be used to buy back common stock at book value, how would this affect the return on equity? (6 marks) Explain the Limitations of ratio analysis as a tool of evaluating financial Statements. (8marks)

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate 1 Accounts Receivables Average Daily Sales Sales 360 days Average Collection Period 40 days Accounts Receivables Average Daily Sales Average Collection Period Accounts Receivables 50000 36...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started