Answered step by step

Verified Expert Solution

Question

1 Approved Answer

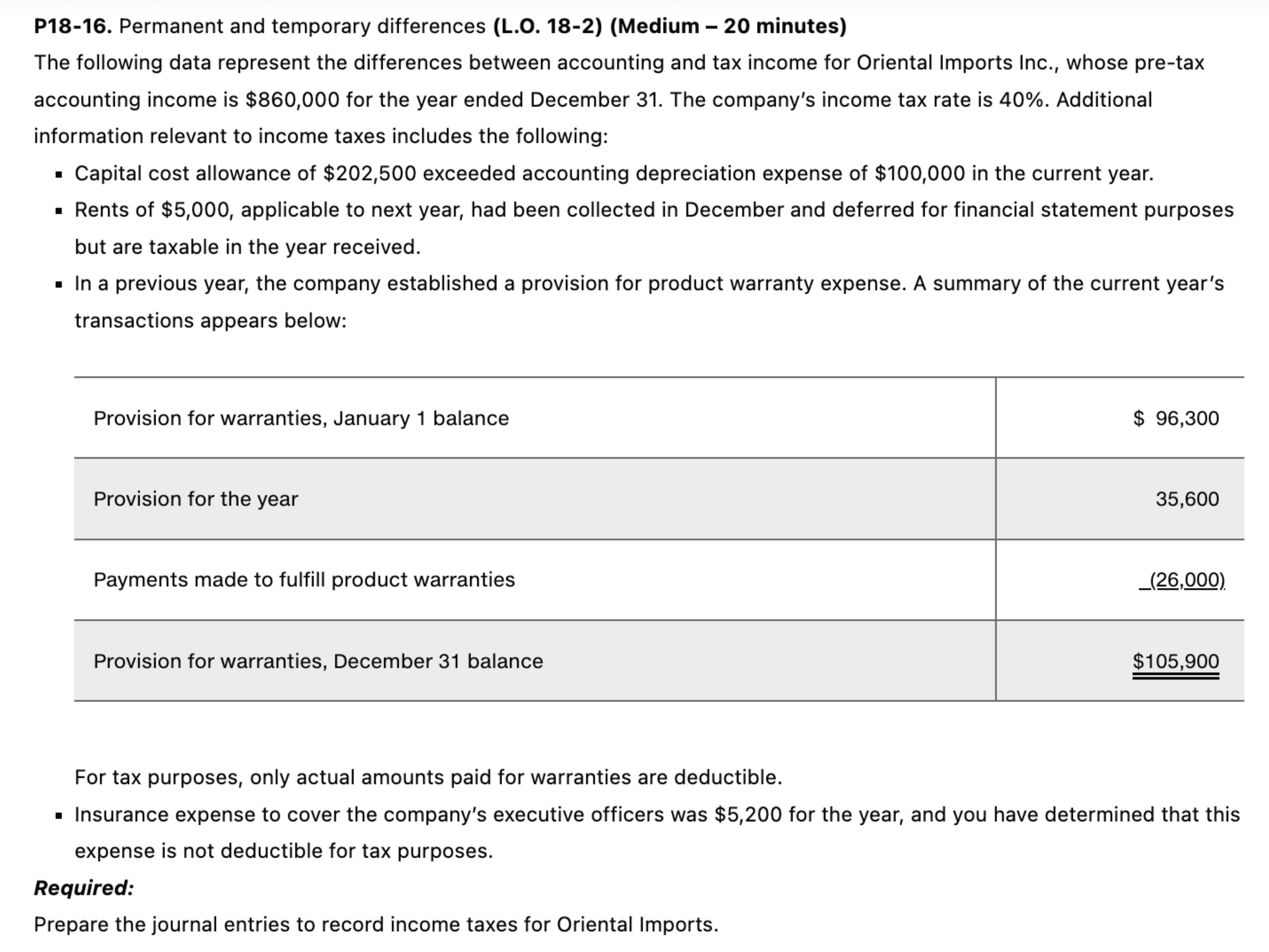

The following data represent the differences between accounting and tax income for Oriental Imports Inc., whose pre - tax accounting income is $ 8 6

The following data represent the differences between accounting and tax income for Oriental Imports Inc., whose pretax accounting income is $ for the year ended December The company's income tax rate is Additional information relevant to income taxes includes the following: Capital cost allowance of $ exceeded accounting depreciation expense of $ in the current year.

Rents of $ applicable to next year, had been collected in December and deferred for financial statement purposes but are taxable in the year received. In a previous year, the company established a provision for product warranty expense. A summary of the current year's

transactions appears below: For tax purposes, only actual amounts paid for warranties are deductible. Insurance expense to cover the company's executive officers was $ for the year, and you have determined that this expense is not deductible for tax purposes.

Required:

Prepare the journal entries to record income taxes for Oriental Imports.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started