Answered step by step

Verified Expert Solution

Question

1 Approved Answer

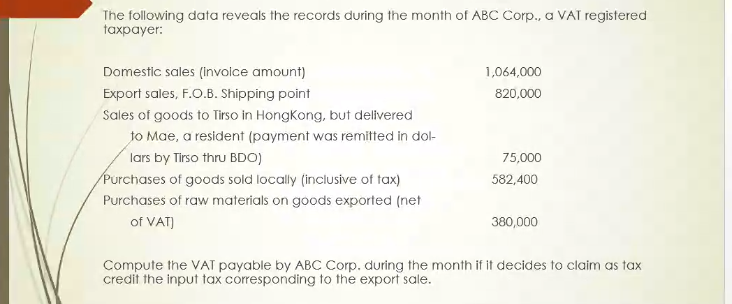

The following data reveals the records during the month of ABC Corp., a VAT registered taxpayer: 1,064,000 820,000 Domestic sales (Involce amount) Export sales, F.O.B.

The following data reveals the records during the month of ABC Corp., a VAT registered taxpayer: 1,064,000 820,000 Domestic sales (Involce amount) Export sales, F.O.B. Shipping point Sales of goods to Tirso in Hongkong, but delivered to Mae, a resident (payment was remitted in dol- lars by Tirso thru BDO) Purchases of goods sold locally (inclusive of tax) Purchases of raw materials on goods exported (net of VAT) 75,000 582,400 380,000 Compute the VAT payable by ABC Corp. during the month if it decides to claim as tax credit the input tax corresponding to the export sale. The following data reveals the records during the month of ABC Corp., a VAT registered taxpayer: 1,064,000 820,000 Domestic sales (Involce amount) Export sales, F.O.B. Shipping point Sales of goods to Tirso in Hongkong, but delivered to Mae, a resident (payment was remitted in dol- lars by Tirso thru BDO) Purchases of goods sold locally (inclusive of tax) Purchases of raw materials on goods exported (net of VAT) 75,000 582,400 380,000 Compute the VAT payable by ABC Corp. during the month if it decides to claim as tax credit the input tax corresponding to the export sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started