Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q3. If the market size is 100 millions in 2008 and is growing at 10% per year and the labor cost is 25% of

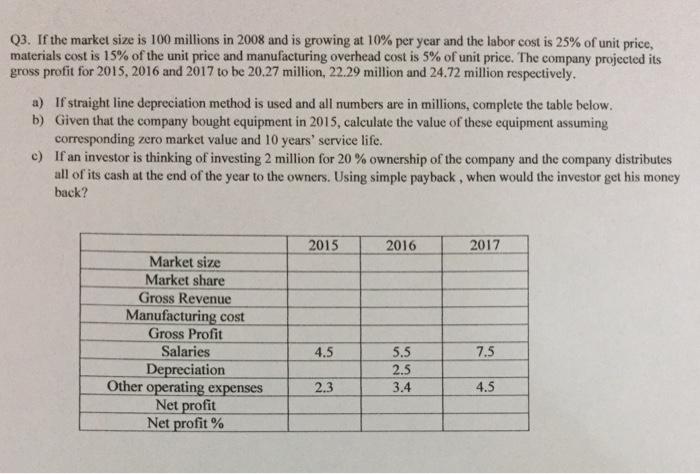

Q3. If the market size is 100 millions in 2008 and is growing at 10% per year and the labor cost is 25% of unit price, materials cost is 15% of the unit price and manufacturing overhead cost is 5% of unit price. The company projected its gross profit for 2015, 2016 and 2017 to be 20.27 million, 22.29 million and 24.72 million respectively. a) If straight line depreciation method is used and all numbers are in millions, complete the table below. Given that the company bought equipment in 2015, calculate the value of these equipment assuming corresponding zero market value and 10 years' service life. b) c) If an investor is thinking of investing 2 million for 20% ownership of the company and the company distributes all of its cash at the end of the year to the owners. Using simple payback, when would the investor get his money back? Market size Market share Gross Revenue Manufacturing cost Gross Profit Salaries Depreciation Other operating expenses Net profit Net profit % 2015 4.5 2.3 2016 5.5 2.5 3.4 2017 7.5 4.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a in million 2015 2016 2017 Market size 100 110 121 Market share Gross Revenue 100 3685 4053 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started