Answered step by step

Verified Expert Solution

Question

1 Approved Answer

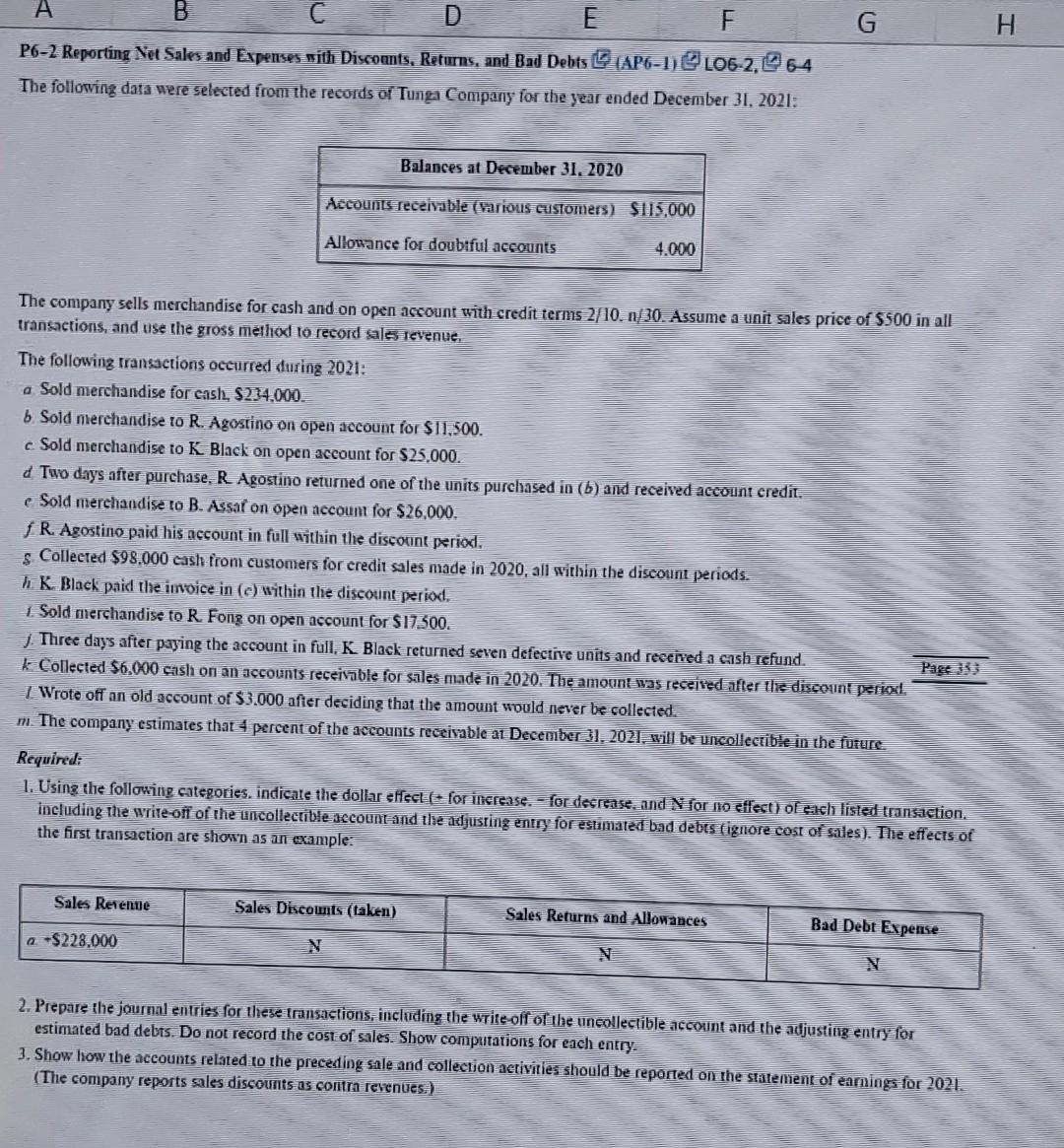

The following data were selected from the records of Tunga Company for the year ended December 31. 2021: The company sells merchandise for cash and

The following data were selected from the records of Tunga Company for the year ended December 31. 2021: The company sells merchandise for cash and on open account with credit terms 2/10.n/30. Assume a unit sales price of 5500 in all transactions, and use the gross method to record sales revenue. The following transactions oceurred during 2021: a Sold merchandise for cash, $234,000. b. Sold merchandise to R. Agostino on open account for $11.500. c. Sold merchandise to K. Black on open account for $25.000. d. Two days after purchase, R. Agostino returned one of the units purchased in (b) and received account credit. e Sold merchandise to B. Assat on open accoumt for $26,000. fR. Agostino paid his account in full within the disconnt periad. \&. Collected $98,000 eash from customers for credit sales made in 2020, all within the discount periods. hK. Black paid the imoice in (c) within the discount period. 1. Sold merchandise to R. Fong on open account for $17.500. 1. Three days after paying the account in full, K. Black returned seven defective units and recelred a cish refund. k Collected 56,000 cish on an accounts receivable for sales made in 2020. The amount was recelied after the discomnt period. Page 353 1 Wrote off an old account of $3.000 after deciding that the amount would never be collected, m. The company estimates that 4 percent of the accounts receivable at December 31, 2021, will be uncollectible in the future. Required: 1. Using the following categories, indicate the dollar effect (+ for ilicrease. - for decrease, and N for no effect) of each listed transaction. including the write-ofi of the uncollectible account and the adjusting entry for estimated bad debis (ignore cost of sales). The effects of the first transaction are shown as an example: 2. Prepare the journal entries for these transactions, inclining the write-off of the tineollectible accoint and the adjusting entry for estimated bad debts. Do not record the cost of sales. Show computations for each entry. 3. Show how the accounts related to the preceding sale and collection aetivities should be reported on the statement of earnings for 2021. (The company reports sales discounts as contra revenues.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started