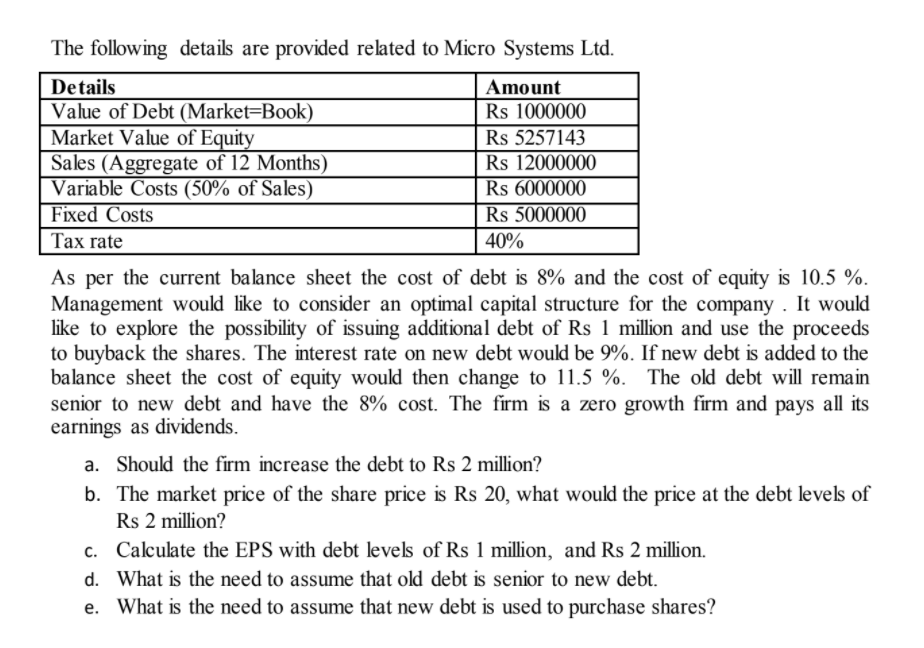

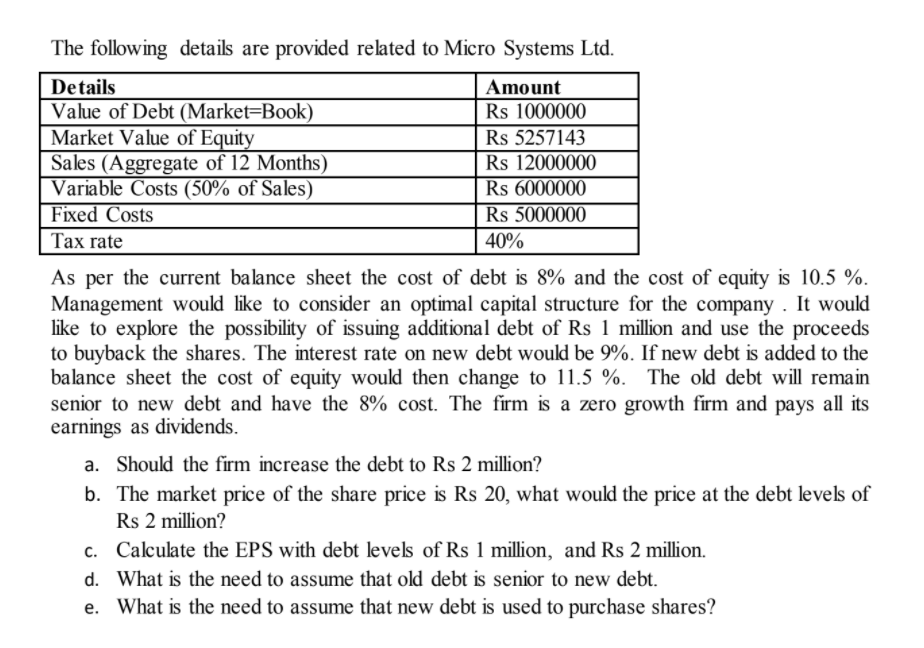

The following details are provided related to Micro Systems Ltd. Details Amount Value of Debt (Market=Book) Rs 1000000 Market Value of Equity Rs 5257143 Sales (Aggregate of 12 Months) Rs 12000000 Variable Costs (50% of Sales) Rs 6000000 Fixed Costs Rs 5000000 Tax rate 40% As per the current balance sheet the cost of debt is 8% and the cost of equity is 10.5 %. Management would like to consider an optimal capital structure for the company. It would like to explore the possibility of issuing additional debt of Rs 1 million and use the proceeds to buyback the shares. The interest rate on new debt would be 9%. If new debt is added to the balance sheet the cost of equity would then change to 11.5 %. The old debt will remain senior to new debt and have the 8% cost. The firm is a zero growth firm and pays all its earnings as dividends. a. Should the firm increase the debt to Rs 2 million? b. The market price of the share price is Rs 20, what would the price at the debt levels of Rs 2 million? C. Calculate the EPS with debt levels of Rs 1 million, and Rs 2 million. d. What is the need to assume that old debt is senior to new debt. e. What is the need to assume that new debt is used to purchase shares? The following details are provided related to Micro Systems Ltd. Details Amount Value of Debt (Market=Book) Rs 1000000 Market Value of Equity Rs 5257143 Sales (Aggregate of 12 Months) Rs 12000000 Variable Costs (50% of Sales) Rs 6000000 Fixed Costs Rs 5000000 Tax rate 40% As per the current balance sheet the cost of debt is 8% and the cost of equity is 10.5 %. Management would like to consider an optimal capital structure for the company. It would like to explore the possibility of issuing additional debt of Rs 1 million and use the proceeds to buyback the shares. The interest rate on new debt would be 9%. If new debt is added to the balance sheet the cost of equity would then change to 11.5 %. The old debt will remain senior to new debt and have the 8% cost. The firm is a zero growth firm and pays all its earnings as dividends. a. Should the firm increase the debt to Rs 2 million? b. The market price of the share price is Rs 20, what would the price at the debt levels of Rs 2 million? C. Calculate the EPS with debt levels of Rs 1 million, and Rs 2 million. d. What is the need to assume that old debt is senior to new debt. e. What is the need to assume that new debt is used to purchase shares