Question

The following details were obtained from the accounting records of Condensed Computer Ltd for the financial year. The firm uses the net credit sales method

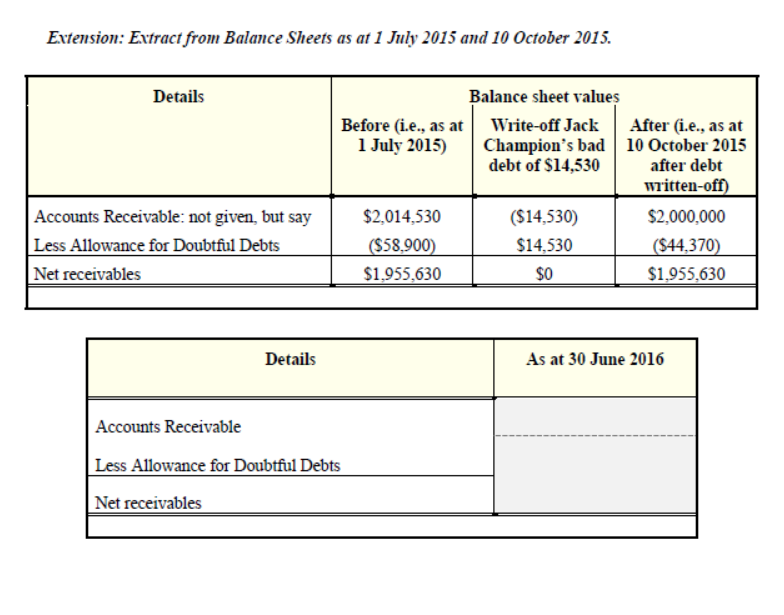

The following details were obtained from the accounting records of Condensed Computer Ltd for the financial year. The firm uses the net credit sales method for estimating doubtful debts and has observed that on average approximately 3% of all credit sales will be not be collected. On 1 July, 2015 the Balance in the Allowance for Doubtful Debts ledger account was $58,900. On 10 October, 2015 a Bankruptcy notice in the financial press revealed that the business of Jack Champion (currently an Account Receivable) had gone into Liquidation and would not be able to pay any of their outstanding debts. It was decided that the $14,530 owed to our business by Jack Champion would be written off as a Bad Debt. On 22 January, 2016 the remaining assets of Jack Champion were sold and realised more than was originally expected and he decided to pay $6,250 of the debt that he originally owed us. On 30 June, 2016 it was decided that an adjusting entry would be required in the books to account for the estimated Allowance for Doubtful Debts. Total Sales for the year ending 30 June, 2016 were $2,500,000, of which 30% had been made on a Cash Sales basis. Required (a) Prepare the General Journal entries to record the above information for Condensed Computer Ltd. Narrations are required. (6 marks) (b) Prepare and balance the Allowance for Doubtful Debts account at 30 June, 2016. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started