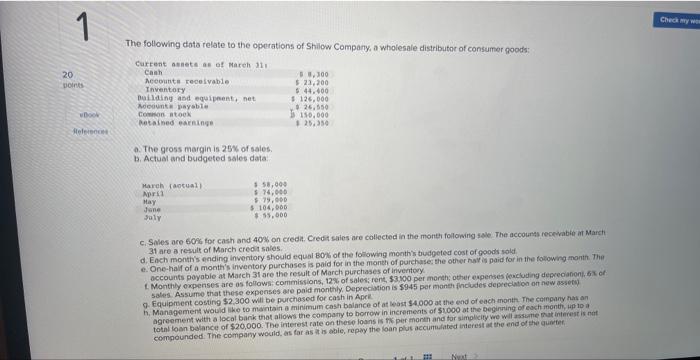

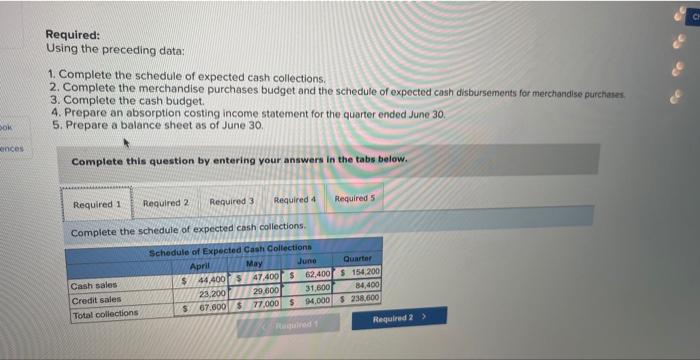

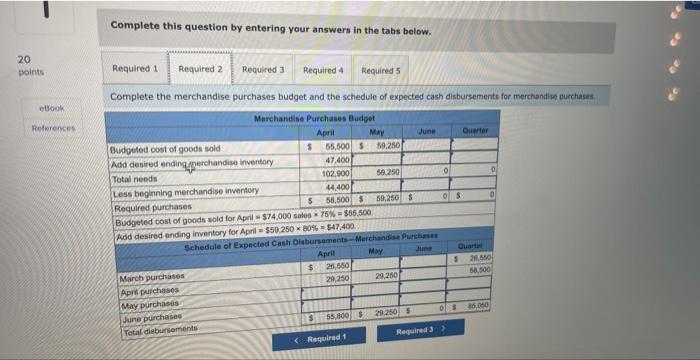

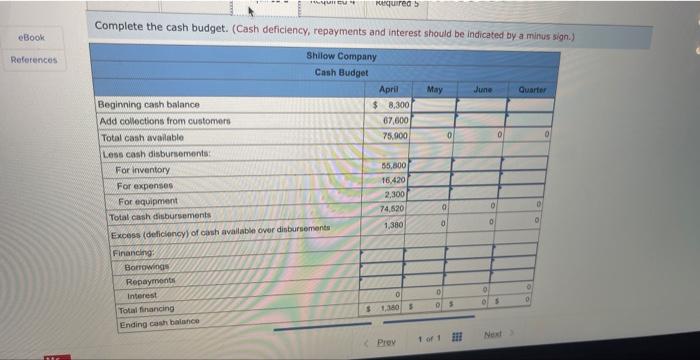

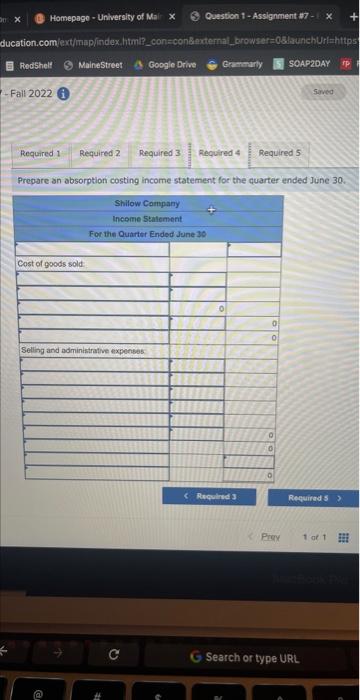

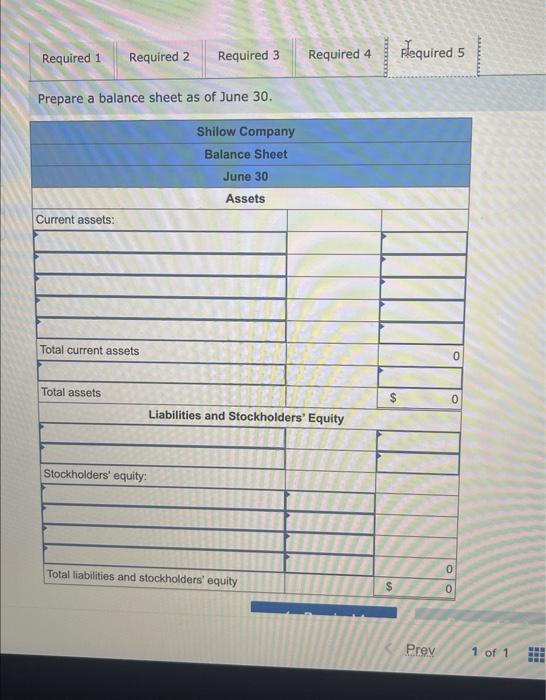

The following dota relate to the operations of Shilow Company, a wholesale distributot of consumer poods: a. The gross margin is 2Bx of sales. B. Actual and budgeted sales data. c. SNles are 6004 for cash and 40% on creda, Creditsaies are callected in the monte followitig save. The accouns recrenabie in March 31 are a result of March credit sales. d) Ench month's eading inventory should equal BOil of the following month's budgetedt cost of goods soly e. One-half of a month's inventory purchases is paid for in the month of purchases the other hav is paid for in the following manth. The accounts poyabie at Match 31 are the rewit of March purchases of invertory. sates. Assume that these expenses are paid monthly. Deperchiation is 5945 per manth fhcludes depreclation ort new assets) 7. Equipment costing $2.300 will be porchasod for cash in Apel. 6. Management would like to mantain a minimum casi baiance of at wast 54.000 at the end of each montin. The ceingany nas an agreement with a local bark that aliows the comparyy to borrow in inerements of $1.000 at the begirring of eoch month, up 10 al totnl loon bsiance of $20,000. The interest rate on these loans is fic per month and tor simplicity wo will assume that interest is net compounded. The compainy would, as fat as it is apile, repay the loan plus accumalated interest at the end of the queter. Required: Using the preceding data: 1. Complete the schedule of expected cash collections. 2. Complete the merchandise purchases budget and the schedule of expected cash disbursements for merchandise purchates 3. Complete the cash budget. 4. Prepare an absorption costing income statement for the quarter ended June 30. 5. Prepare a balance sheet as of June 30 . Complete this question by entering your answers in the tabs below. Complete the schedule of expected cash collections. Complete this question by entering your answers in the tabs below. Complete the merchandise purchases budget and the schedule of expected cash distursements for merchantite purchases. Complete the cash budget. (Cash deficiency, repayments and interest should be indicated by a minus sion.) Prepare an absorption costing income statement for the quarter ended June 30 . Prepare a balance sheet as of June 30