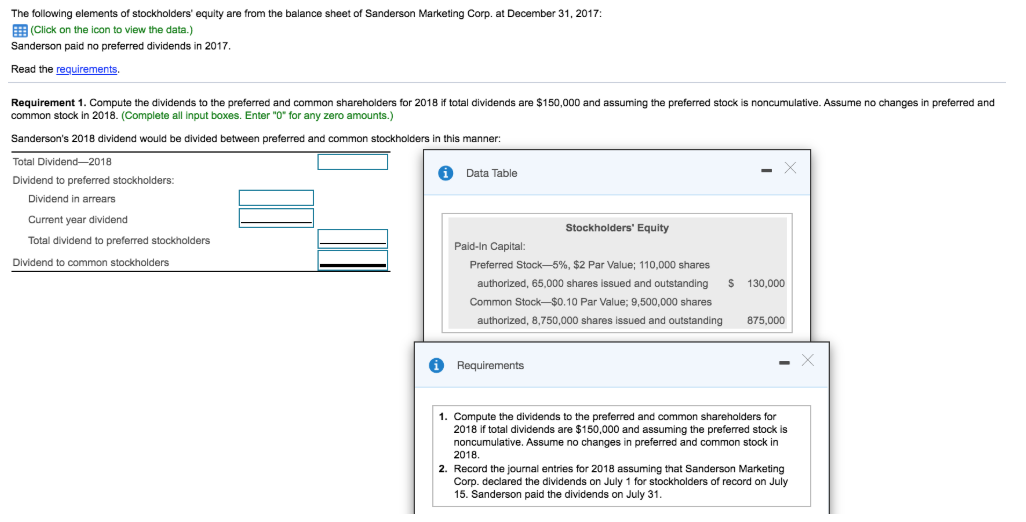

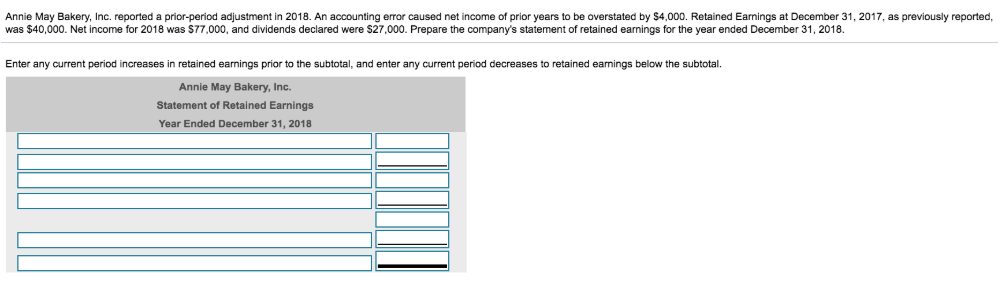

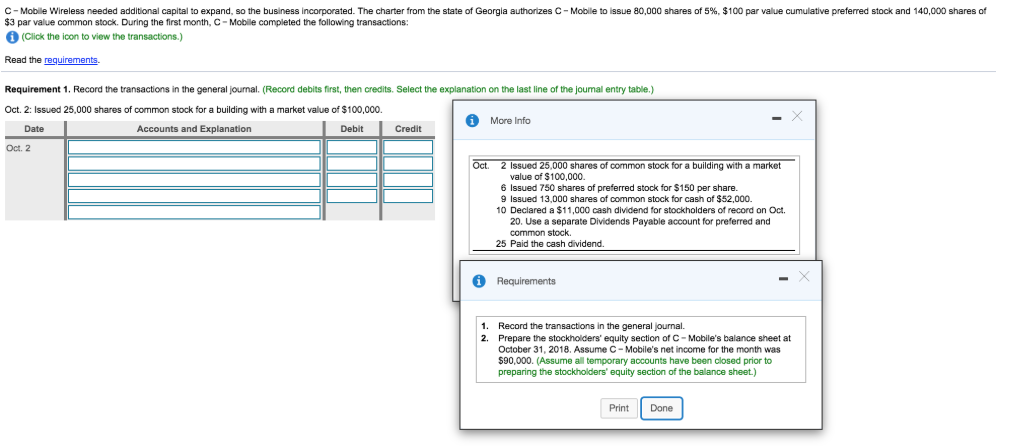

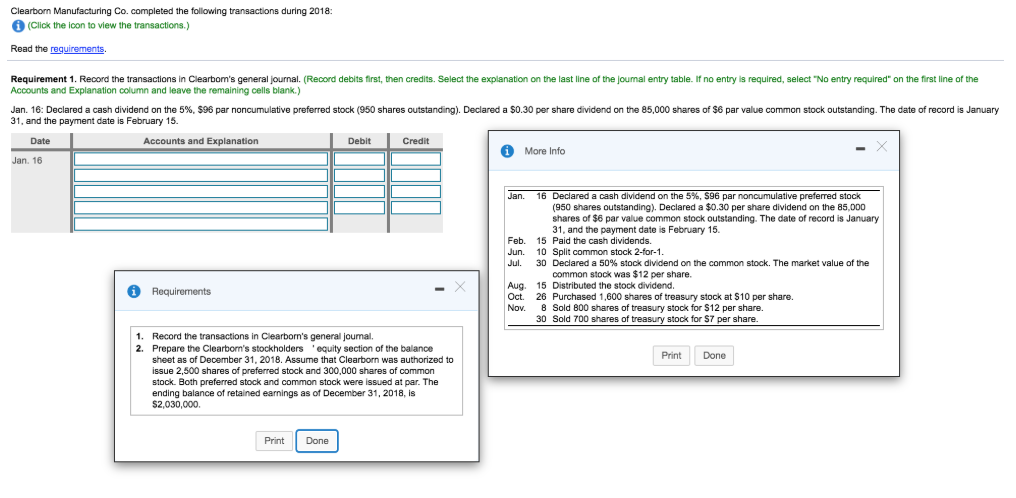

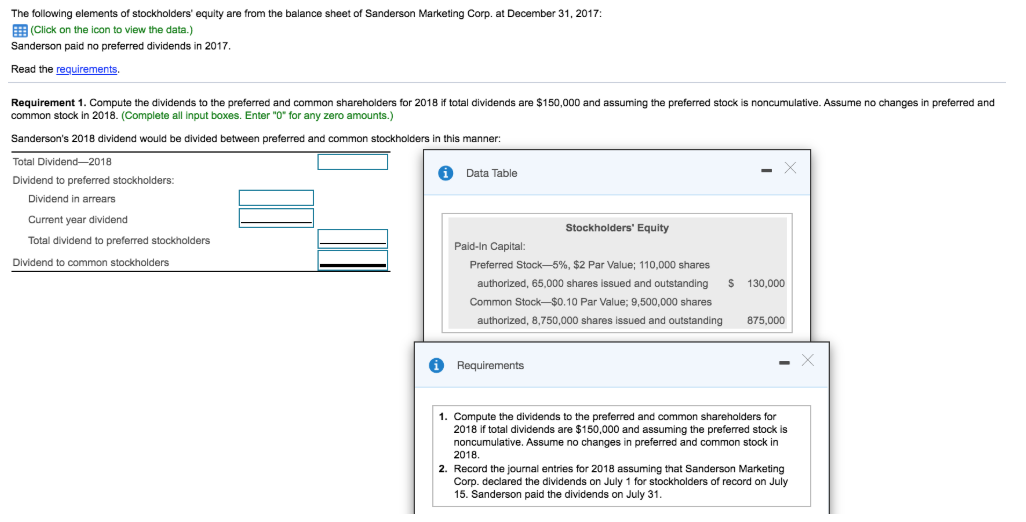

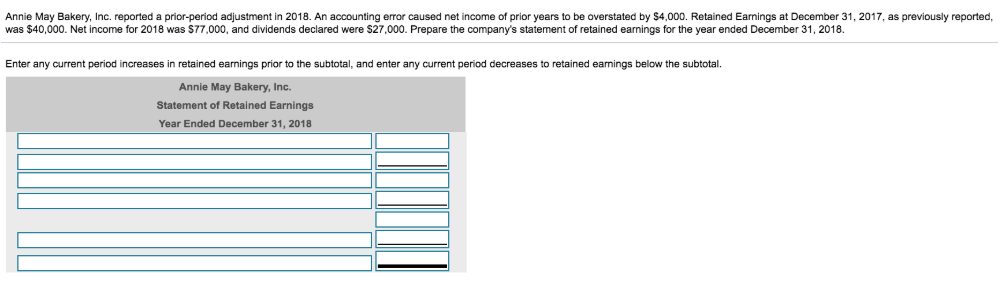

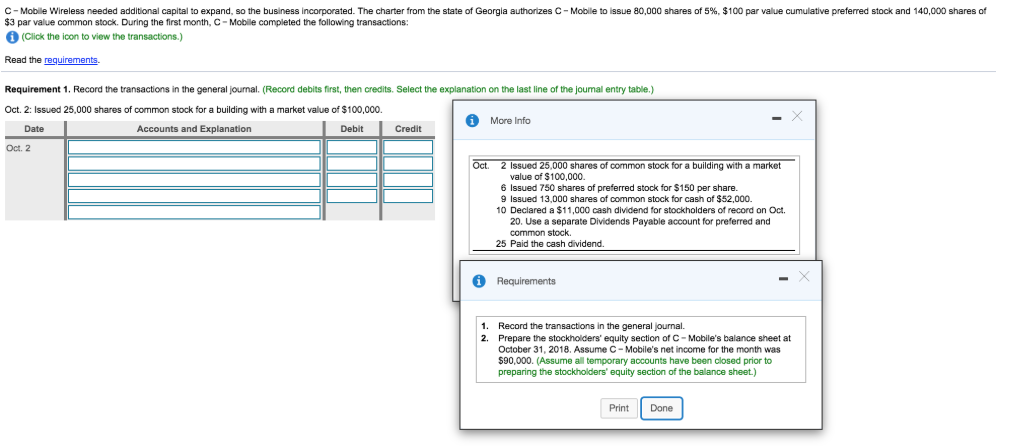

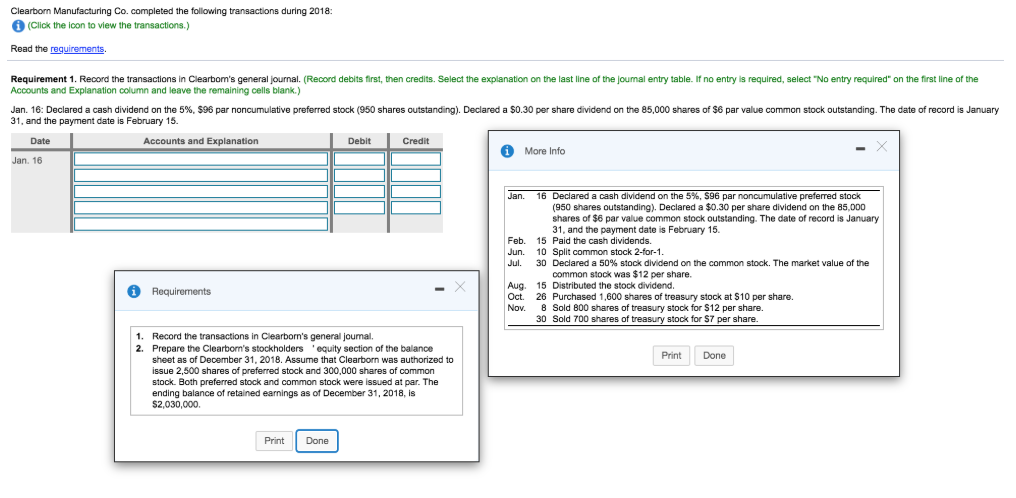

The following elements of stockholders' equity are from the balance sheet of Sanderson Marketing Corp. at December 31, 2017: (Click on the icon to view the data.) Sanderson paid no preferred dividends in 2017. Read the requirements Requirement 1. Compute the dividends to the preferred and common shareholders for 2018 if total dividends are $150,000 and assuming the preferred stock is noncumulative. Assume no changes in preferred and common stock in 2018. (Complete all input boxes. Enter "0" for any zero amounts.) Sanderson's 2018 dividend would be divided between preferred and common stockholders in this manner: 0 Data Table Total Dividend-2018 Dividend to preferred stockholders: Dividend in arrears Current year dividend Total dividend to preferred stockholders Dividend to common stockholders Stockholders' Equity Paid-In Capital: Preferred Stock-5%, $2 Par Value; 110,000 shares authorized, 65,000 shares issued and outstanding Common Stock-$0.10 Par Value; 9,500,000 shares authorized, 8,750,000 shares issued and outstanding $ 130,000 875,000 i Requirements 1. Compute the dividends to the preferred and common shareholders for 2018 if total dividends are $150,000 and assuming the preferred stock is noncumulative. Assume no changes in preferred and common stock in 2018. 2. Record the journal entries for 2018 assuming that Sanderson Marketing Corp. declared the dividends on July 1 for stockholders of record on July 15. Sanderson paid the dividends on July 31. Annie May Bakery, Inc. reported a prior-period adjustment in 2018. An accounting error caused net income of prior years to be overstated by $4,000. Retained Earnings at December 31, 2017, as previously reported, was $40,000. Net income for 2018 was $77,000, and dividends declared were $27,000. Prepare the company's statement of retained earnings for the year ended December 31, 2018. Enter any current period increases in retained earnings prior to the subtotal, and enter any current period decreases to retained earnings below the subtotal. Annie May Bakery, Inc. Statement of Retained Earnings Year Ended December 31, 2018 C-Mobile Wireless needed additional capital to expand, so the business incorporated. The charter from the state of Georgia authorizes C-Mobile to issue 80,000 shares of 5%, $100 par value cumulative preferred stock and 140,000 shares of $3 par value common stock. During the first month, C-Mobile completed the following transactions: (Click the icon to view the transactions.) Read the requirements. Requirement 1. Record the transactions in the general Journal (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Oct. 2: Issued 25,000 shares of common stock for a building with a market value of $100,000 * More Info Date Accounts and Explanation Debit Credit Oct. 2 Oct. 2 Issued 25,000 shares of common stock for a building with a market value of $100.000 6 Issued 750 shares of preferred stock for $150 per share. 9 Issued 13,000 shares of common stock for cash of $52,000. 10 Declared a $11,000 cash dividend for stockholders of record on Oct. 20. Use a separate Dividends Payable account for preferred and common stock 25 Paid the cash dividend. Requirements 1. Record the transactions in the general Journal 2. Prepare the stockholders' equity section of C-Mobile's balance sheet at October 31, 2018. Assume C-Mobile's net income for the month was $90,000. (Assume all temporary accounts have been closed prior to preparing the stockholders' equity section of the balance sheet.) Print Done Clearborn Manufacturing Co. completed the following transactions during 2018: (Click the icon to view the transactions.) Read the requirements. Requirement 1. Record the transactions in Clearbom's general journal. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. If no entry is required, select "No entry required" on the first line of the Accounts and Explanation column and leave the remaining cells blank.) Jan. 16: Declared a cash dividend on the 5%, 596 par noncumulative preferred stock (950 shares outstanding). Declared a $0.30 per share dividend on the 85,000 shares of $6 par value common stock outstanding. The date of record is January 31, and the payment date is February 15. Date Accounts and Explanation Debit Credit More Info Jan. 16 Jan. Feb. Jun. Jul. 16 Declared a cash dividend on the 5%, 596 par noncumulative preferred stock (950 shares outstanding). Declared a $0.30 per share dividend on the 85,000 shares of $6 par value common stock outstanding. The date of record is January 31. and the payment date is February 15. 15 Paid the cash dividends. 10 Split common stock 2-for-1. 30 Declared a 50% stock dividend on the common stock. The market value of the common stock was $12 per share. 15 Distributed the stock dividend. 26 Purchased 1,600 shares of treasury stock at $10 per share. Sold 800 shares of treasury stock for $12 per share. 30 Sold 700 shares of treasury stock for S7 per share. Requirements Aug Oct. Nov. Print Done 1. Record the transactions in Clearborn's general joumal 2. Prepare the Clearborn's stockholders fequity section of the balance sheet as of December 31, 2018. Assume that Clearborn was authorized to issue 2,500 shares of preferred stock and 300,000 shares of common stock. Both preferred stock and common stock were issued at par. The ending balance of retained earnings as of December 31, 2018, is $2,030,000. Print Done