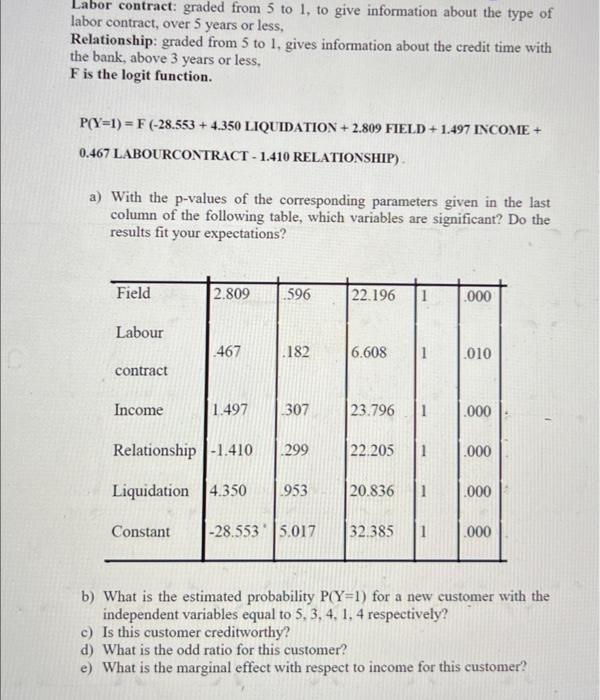

The following equation gives the results of the Logit model when the dependent variable Y measures the creditworthiness of a specific bank's customers, against the independent variables defined as follows: Y=1 when the customer is creditworthy, Y=0 when the customer is not creditworthy, Liquidation: graded from 5 to 1, to give information about the repayment of principal and interest with the bank over the past 12 months up to the time of assessment, to be good or not, Field: graded from 5 to 1, to give information about the development prospect of the industry in which the borrower is working, to be very developed in the near future or not, Income: graded from 5 to 1 , to give information about monthly income, very high or not, Labor contract: graded from 5 to 1 , to give information about the type of labor contract, over 5 years or less, Relationship: graded from 5 to 1 , gives information about the credit time with the bank, above 3 years or less, F is the logit function. P(Y=1)=F(28.553+4.350 LIQUIDATION +2.809 FIELD +1.497 INCOME + 0.467 LABOURCONTRACT - 1.410 RELATIONSHIP) a) With the p-values of the corresponding parameters given in the last column of the following table, which variables are significant? Do the results fit your expectations? b) What is the estimated probability P(Y=1) for a new customer with the independent variables equal to 5,3,4,1,4 respectively? c) Is this customer creditworthy? d) What is the odd ratio for this customer? e) What is the marginal effect with respect to income for this customer? The following equation gives the results of the Logit model when the dependent variable Y measures the creditworthiness of a specific bank's customers, against the independent variables defined as follows: Y=1 when the customer is creditworthy, Y=0 when the customer is not creditworthy, Liquidation: graded from 5 to 1, to give information about the repayment of principal and interest with the bank over the past 12 months up to the time of assessment, to be good or not, Field: graded from 5 to 1, to give information about the development prospect of the industry in which the borrower is working, to be very developed in the near future or not, Income: graded from 5 to 1 , to give information about monthly income, very high or not, Labor contract: graded from 5 to 1 , to give information about the type of labor contract, over 5 years or less, Relationship: graded from 5 to 1 , gives information about the credit time with the bank, above 3 years or less, F is the logit function. P(Y=1)=F(28.553+4.350 LIQUIDATION +2.809 FIELD +1.497 INCOME + 0.467 LABOURCONTRACT - 1.410 RELATIONSHIP) a) With the p-values of the corresponding parameters given in the last column of the following table, which variables are significant? Do the results fit your expectations? b) What is the estimated probability P(Y=1) for a new customer with the independent variables equal to 5,3,4,1,4 respectively? c) Is this customer creditworthy? d) What is the odd ratio for this customer? e) What is the marginal effect with respect to income for this customer