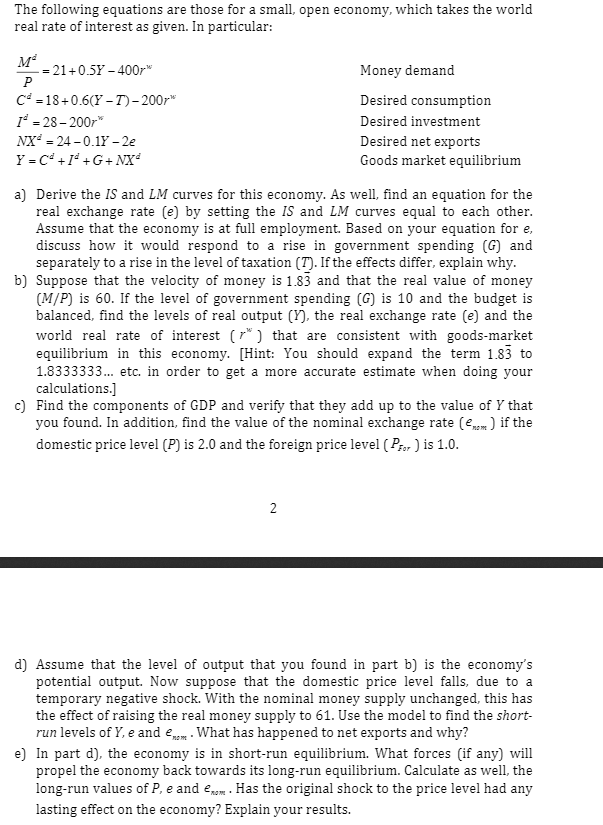

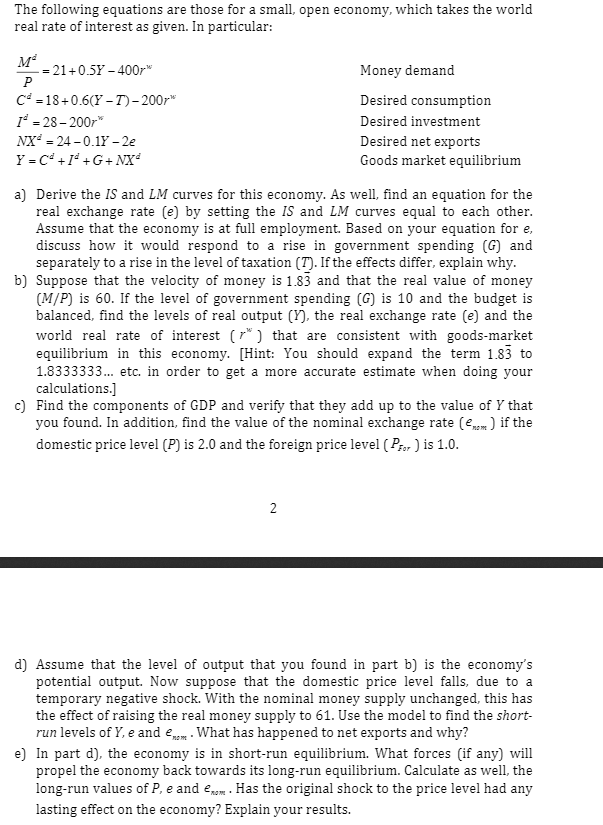

The following equations are those for a small, open economy, which takes the world real rate of interest as given. In particular: M -= 21+0.5Y - 400r P C = 18+0.6(Y-TO-200r* 1 = 28-200r NX = 24 -0.18-22 Y = C +1 +G+NX Money demand Desired consumption Desired investment Desired net exports Goods market equilibrium a) Derive the IS and LM curves for this economy. As well, find an equation for the real exchange rate (e) by setting the IS and LM curves equal to each other. Assume that the economy is at full employment. Based on your equation for e. discuss how it would respond to a rise in government spending (G) and separately to a rise in the level of taxation (T). If the effects differ, explain why. b) Suppose that the velocity of money is 1.83 and that the real value of money (M/P) is 60. If the level of government spending (G) is 10 and the budget is balanced, find the levels of real output (Y), the real exchange rate (e) and the world real rate of interest (**) that are consistent with goods-market equilibrium in this economy. [Hint: You should expand the term 1.83 to 1.8333333... etc. in order to get a more accurate estimate when doing your calculations.) c) Find the components of GDP and verify that they add up to the value of Y that you found. In addition, find the value of the nominal exchange rate (Enem) if the domestic price level (P) is 2.0 and the foreign price level (Por) is 1.0. 2 d) Assume that the level of output that you found in part b) is the economy's potential output. Now suppose that the domestic price level falls, due to a temporary negative shock. With the nominal money supply unchanged, this has the effect of raising the real money supply to 61. Use the model to find the short- run levels of Y, e and mom. What has happened to net exports and why? e) In part d), the economy is in short-run equilibrium. What forces (if any) will propel the economy back towards its long-run equilibrium. Calculate as well, the long-run values of P, e and now. Has the original shock to the price level had any lasting effect on the economy? Explain your results. The following equations are those for a small, open economy, which takes the world real rate of interest as given. In particular: M -= 21+0.5Y - 400r P C = 18+0.6(Y-TO-200r* 1 = 28-200r NX = 24 -0.18-22 Y = C +1 +G+NX Money demand Desired consumption Desired investment Desired net exports Goods market equilibrium a) Derive the IS and LM curves for this economy. As well, find an equation for the real exchange rate (e) by setting the IS and LM curves equal to each other. Assume that the economy is at full employment. Based on your equation for e. discuss how it would respond to a rise in government spending (G) and separately to a rise in the level of taxation (T). If the effects differ, explain why. b) Suppose that the velocity of money is 1.83 and that the real value of money (M/P) is 60. If the level of government spending (G) is 10 and the budget is balanced, find the levels of real output (Y), the real exchange rate (e) and the world real rate of interest (**) that are consistent with goods-market equilibrium in this economy. [Hint: You should expand the term 1.83 to 1.8333333... etc. in order to get a more accurate estimate when doing your calculations.) c) Find the components of GDP and verify that they add up to the value of Y that you found. In addition, find the value of the nominal exchange rate (Enem) if the domestic price level (P) is 2.0 and the foreign price level (Por) is 1.0. 2 d) Assume that the level of output that you found in part b) is the economy's potential output. Now suppose that the domestic price level falls, due to a temporary negative shock. With the nominal money supply unchanged, this has the effect of raising the real money supply to 61. Use the model to find the short- run levels of Y, e and mom. What has happened to net exports and why? e) In part d), the economy is in short-run equilibrium. What forces (if any) will propel the economy back towards its long-run equilibrium. Calculate as well, the long-run values of P, e and now. Has the original shock to the price level had any lasting effect on the economy? Explain your results