Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following events apply to Traceys Restaurant for the Year 1 fiscal year: Started the company when it acquired $23,000 cash from the issue of

The following events apply to Traceys Restaurant for the Year 1 fiscal year:

- Started the company when it acquired $23,000 cash from the issue of common stock.

- Purchased a new cooktop that cost $22,000 cash.

- Earned $36,000 in cash revenue.

- Paid $20,000 cash for salaries expense.

- Paid $7,400 cash for operating expenses.

- Adjusted the records to reflect the use of the cooktop. The cooktop, purchased on January 1, Year 1, has an expected useful life of four years and an estimated salvage value of $3,500. Use straight-line depreciation. The adjusting entry was made as of December 31, Year 1.

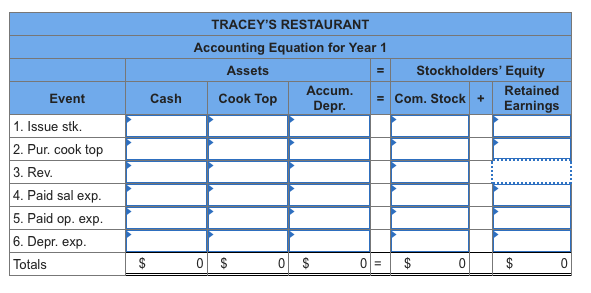

Required a. Record the events in general ledger accounts under an accounting equation. (Negative amounts should be indicated by a minus sign.)

b. What amount of depreciation expense would Traceys report on the Year 2 income statement?

c. What amount of accumulated depreciation would Traceys report on the December 31, Year 2, balance sheet?

TRACEY'S RESTAURANT Accounting Equation for Year 1 Assets Stockholders' Equity Accum. Retained Cook Top = Com. Stock + Depr. Earnings Event Cash 1. Issue stk. 2. Pur. cook top 3. Rev. 4. Paid sal exp. 5. Paid op. exp. 6. Depr. exp. Totals $ 0 $ 0 $ 01 = $ 0 $ 0 Depreciation expense Accumulated depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started