Question

The following events occurred for Favata Company: a. Received $13,000 cash from owners and issued stock to them. b. Borrowed $10,000 cash from a

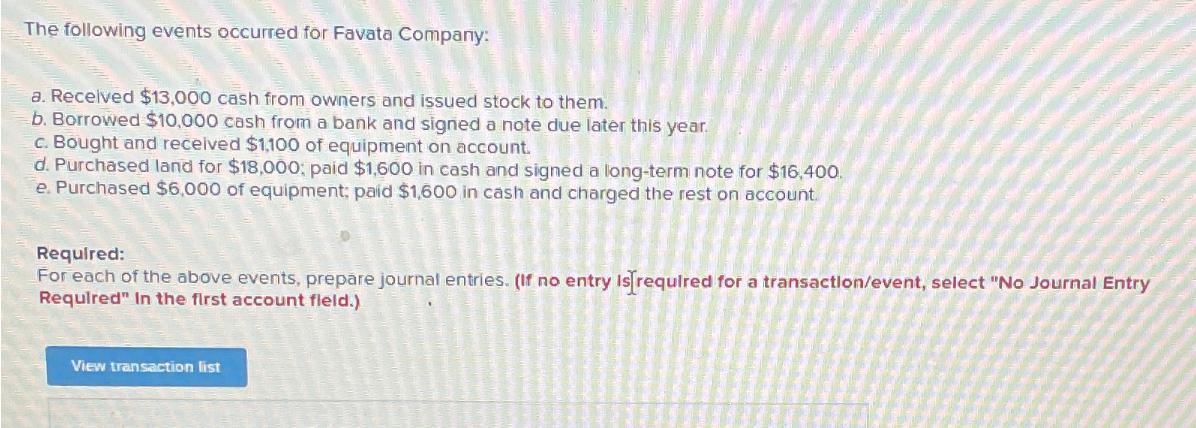

The following events occurred for Favata Company: a. Received $13,000 cash from owners and issued stock to them. b. Borrowed $10,000 cash from a bank and signed a note due later this year. c. Bought and received $1,100 of equipment on account. d. Purchased land for $18,000; paid $1,600 in cash and signed a long-term note for $16,400. e. Purchased $6,000 of equipment; paid $1,600 in cash and charged the rest on account. Required: For each of the above events, prepare journal entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answera Cash 13000 Common Stock 13000 b ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Accounting

Authors: Fred Phillips, Robert Libby, Patricia Libby

5th edition

78025915, 978-1259115400, 1259115402, 978-0078025914

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App