Answered step by step

Verified Expert Solution

Question

1 Approved Answer

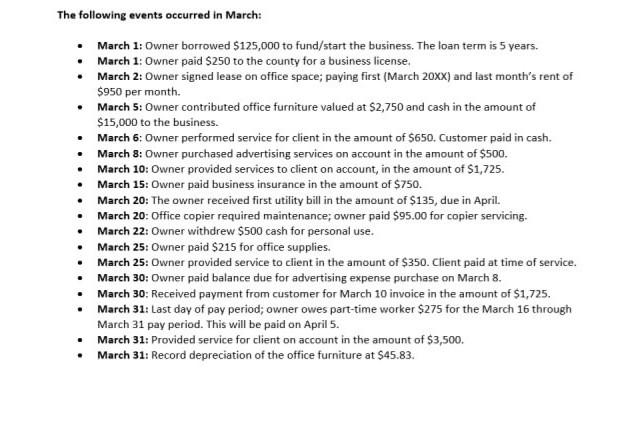

The following events occurred in March: - March 1: Owner borrowed $125,000 to fund/start the business. The loan term is 5 years. - March 1:

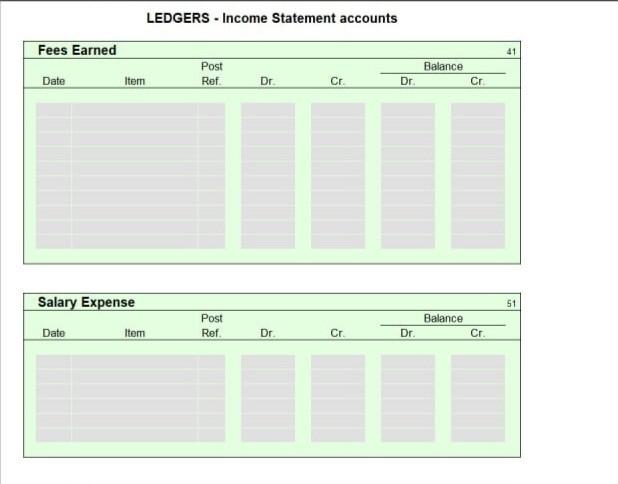

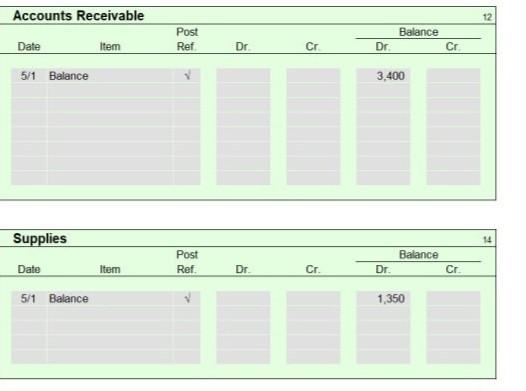

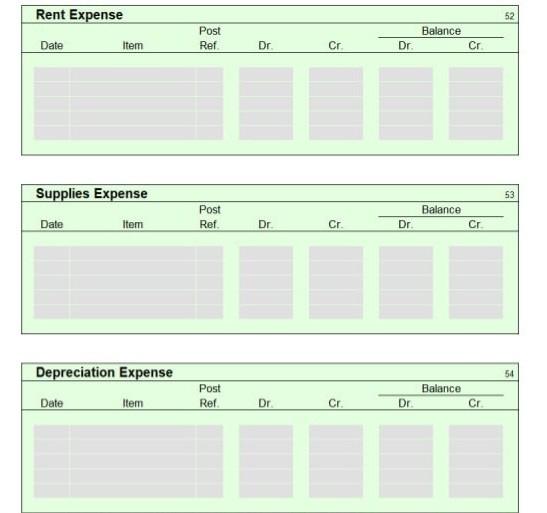

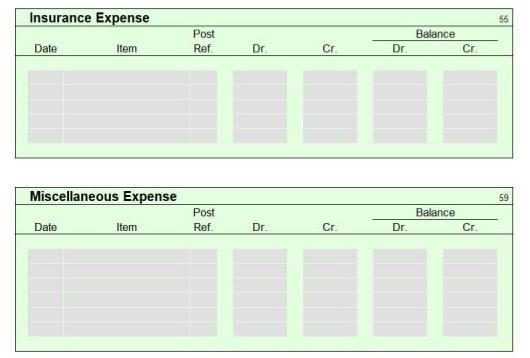

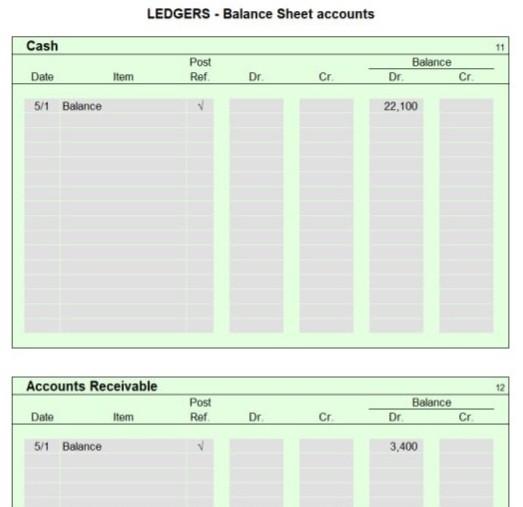

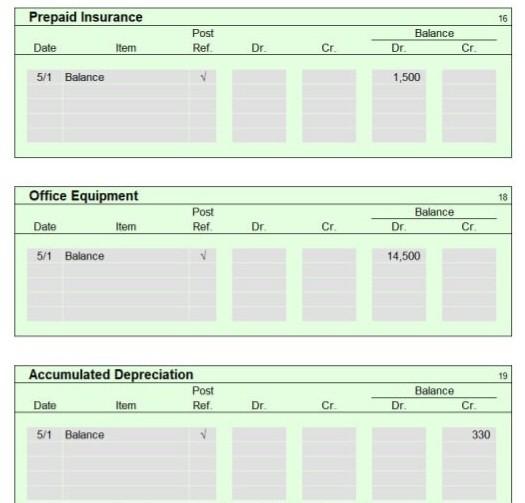

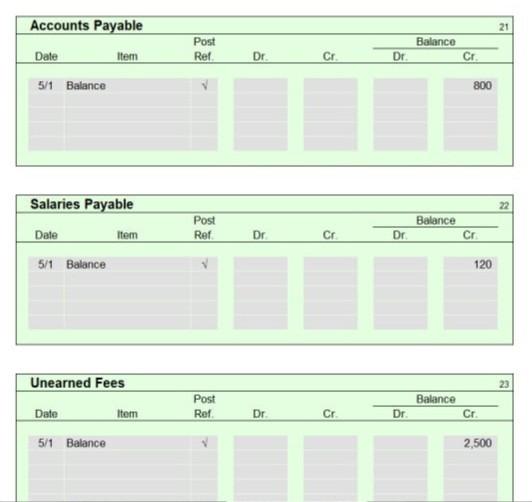

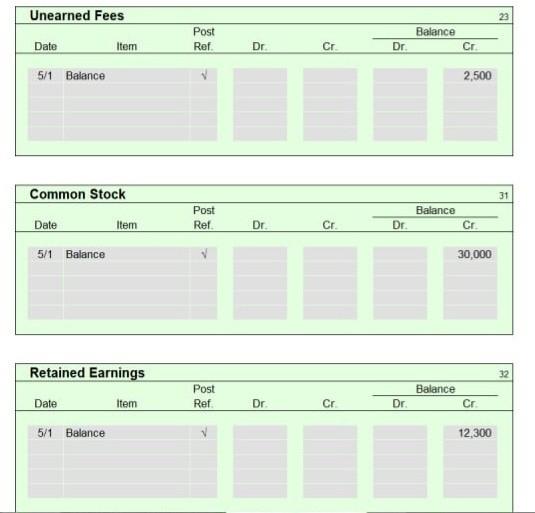

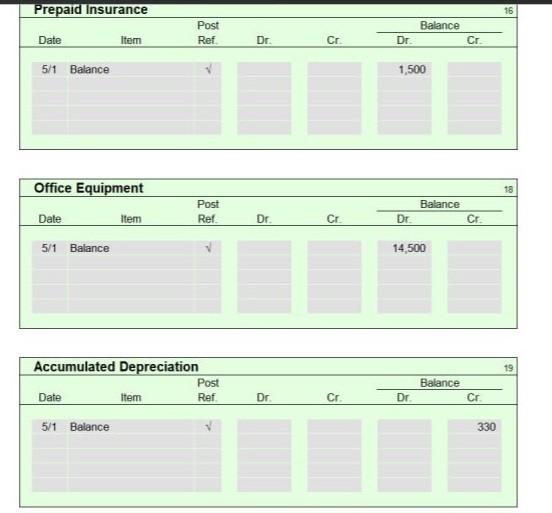

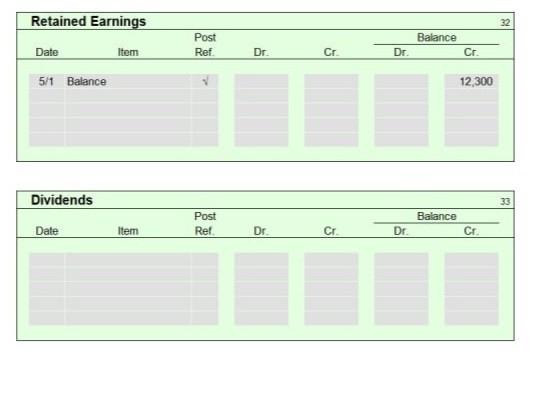

The following events occurred in March: - March 1: Owner borrowed $125,000 to fund/start the business. The loan term is 5 years. - March 1: Owner paid $250 to the county for a business license. - March 2: Owner signed lease on office space; paying first (March 20xX) and last month's rent of $950 per month. - March 5: Owner contributed office furniture valued at $2,750 and cash in the amount of $15,000 to the business. - March 6: Owner performed service for client in the amount of $650. Customer paid in cash. - March 8: Owner purchased advertising services on account in the amount of $500. - March 10: Owner provided services to client on account, in the amount of $1,725. - March 15: Owner paid business insurance in the amount of $750. - March 20: The owner received first utility bill in the amount of $135, due in April. - March 20: Office copier required maintenance; owner paid $95.00 for copier servicing. - March 22: Owner withdrew $500 cash for personal use. - March 25: Owner paid \$215 for office supplies. - March 25: Owner provided service to client in the amount of $350. Client paid at time of service. - March 30: Owner paid balance due for advertising expense purchase on March 8. - March 30: Received payment from customer for March 10 invoice in the amount of \$1,725. - March 31: Last day of pay period; owner owes part-time worker $275 for the March 16 through March 31 pay period. This will be paid on April 5. - March 31: Provided service for client on account in the amount of $3,500. - March 31: Record depreciation of the office furniture at $45.83. LEDGERS - Income Statement accounts \begin{tabular}{|llllll|} \hline Supplies Expense & & & & \\ \hline Date & Post & & \multicolumn{2}{c|}{ Balance } \\ \hline & Ref. & Dr. & & & \\ \hline \end{tabular} \begin{tabular}{|lcccccc|} \hline Insurance Expense & & & & & \multicolumn{2}{c|}{55} \\ \hline Date & Item & Post & Ref. & Dr. & Cr. & Dr. \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|lllllll|} \hline \multicolumn{1}{|l}{ Miscellaneous Expense } & & & & & & \\ \hline \end{tabular} LEDGERS - Balance Sheet accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started