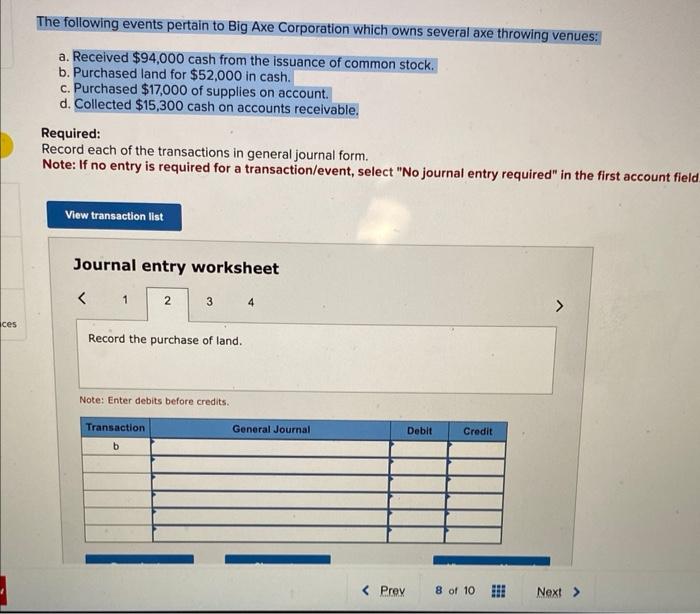

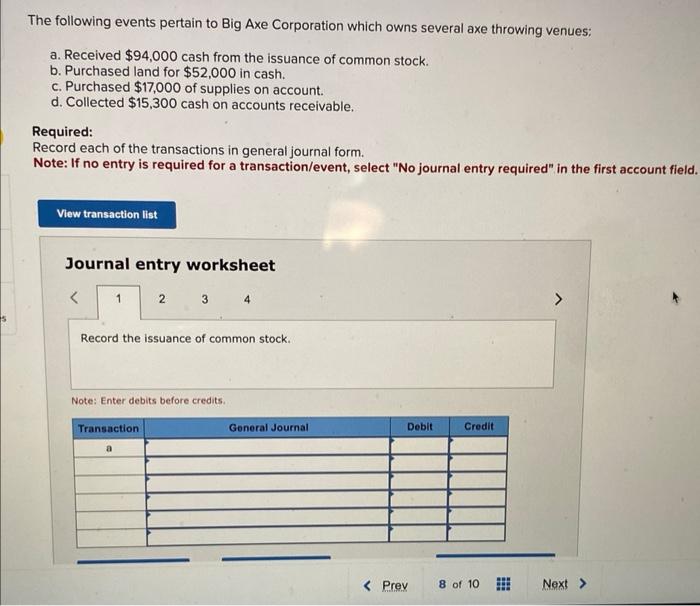

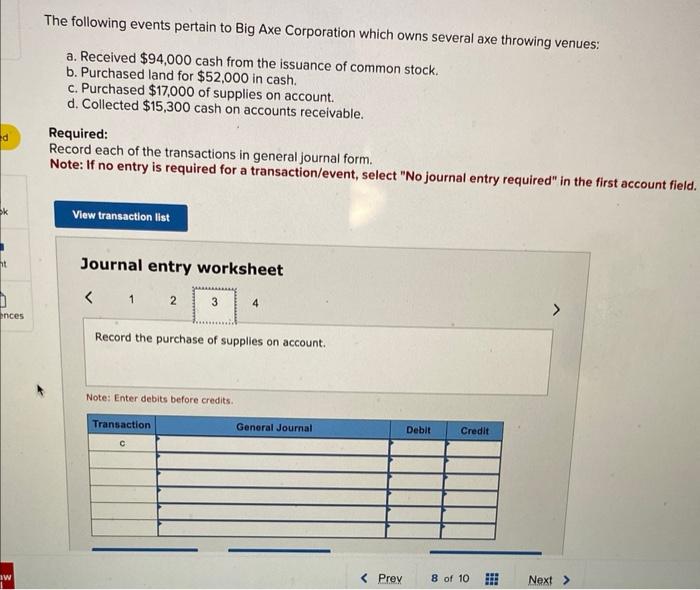

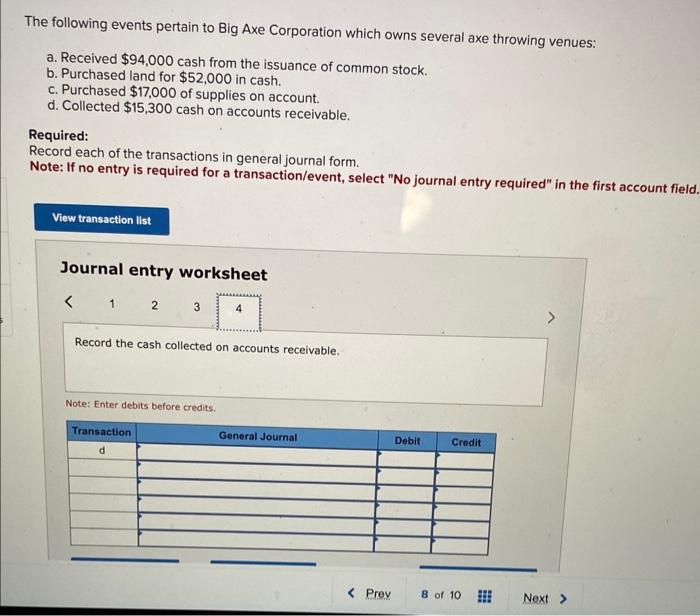

The following events pertain to Big Axe Corporation which owns several axe throwing venues: a. Received $94,000 cash from the issuance of common stock. b. Purchased land for $52,000 in cash. c. Purchased $17,000 of supplies on account. d. Collected $15,300 cash on accounts receivable. Required: Record each of the transactions in general journal form. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account fielc Journal entry worksheet The following events pertain to Big Axe Corporation which owns several axe throwing venues: a. Received $94,000 cash from the issuance of common stock. b. Purchased land for $52,000 in cash. c. Purchased $17,000 of supplies on account. d. Collected $15,300 cash on accounts receivable. Required: Record each of the transactions in general journal form. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. The following events pertain to Big Axe Corporation which owns several axe throwing venues: a. Received $94,000 cash from the issuance of common stock. b. Purchased land for $52,000 in cash. c. Purchased $17,000 of supplies on account. d. Collected $15,300 cash on accounts receivable. Required: Record each of the transactions in general journal form. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the purchase of supplies on account. Note: Enter debits before credits. The following events pertain to Big Axe Corporation which owns several axe throwing venues: a. Received $94,000 cash from the issuance of common stock. b. Purchased land for $52,000 in cash. c. Purchased $17,000 of supplies on account. d. Collected $15,300 cash on accounts receivable. Required: Record each of the transactions in general journal form. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field Journal entry worksheet Record the cash collected on accounts receivable. Note: Enter debits before credits