Question: The following example shows a bizarre swap transaction that was entered into between Bankers Trust (BT) and Procter & Gamble (P&G). The swap was

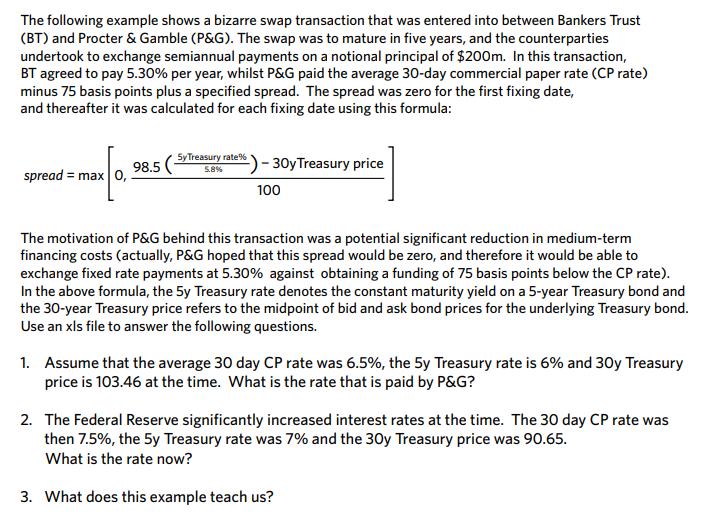

The following example shows a bizarre swap transaction that was entered into between Bankers Trust (BT) and Procter & Gamble (P&G). The swap was to mature in five years, and the counterparties undertook to exchange semiannual payments on a notional principal of $200m. In this transaction, BT agreed to pay 5.30% per year, whilst P&G paid the average 30-day commercial paper rate (CP rate) minus 75 basis points plus a specified spread. The spread was zero for the first fixing date, and thereafter it was calculated for each fixing date using this formula: spread = max 0, x|0 98.5 Sy Treasury rate% 5.8% -)- 30y Treasury price 100 The motivation of P&G behind this transaction was a potential significant reduction in medium-term financing costs (actually, P&G hoped that this spread would be zero, and therefore it would be able to exchange fixed rate payments at 5.30% against obtaining a funding of 75 basis points below the CP rate). In the above formula, the 5y Treasury rate denotes the constant maturity yield on a 5-year Treasury bond and the 30-year Treasury price refers to the midpoint of bid and ask bond prices for the underlying Treasury bond. Use an xls file to answer the following questions. 1. Assume that the average 30 day CP rate was 6.5%, the 5y Treasury rate is 6% and 30y Treasury price is 103.46 at the time. What is the rate that is paid by P&G? 2. The Federal Reserve significantly increased interest rates at the time. The 30 day CP rate was then 7.5%, the 5y Treasury rate was 7% and the 30y Treasury price was 90.65. What is the rate now? 3. What does this example teach us?

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

1To calculate the rate paid by PG we first need to calculate the spread using the given formula We s... View full answer

Get step-by-step solutions from verified subject matter experts