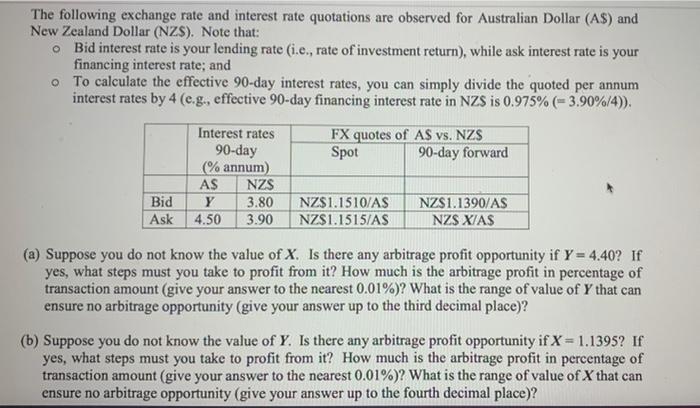

The following exchange rate and interest rate quotations are observed for Australian Dollar (A$) and New Zealand Dollar (NZS). Note that: Bid interest rate is your lending rate (1.e., rate of investment return), while ask interest rate is your financing interest rate; and o To calculate the effective 90-day interest rates, you can simply divide the quoted per annum interest rates by 4 (e.g., effective 90-day financing interest rate in NZS is 0.975% (3.90%/4)). FX quotes of AS vs. NZS Spot 90-day forward Interest rates 90-day (% annum) NZS Y 3.80 4.50 3.90 AS Bid Ask NZ$1.1510/AS NZS1.1515/AS NZ$1.1390/AS NZS XIAS (a) Suppose you do not know the value of X. Is there any arbitrage profit opportunity if Y = 4.40? If yes, what steps must you take to profit from it? How much is the arbitrage profit in percentage of transaction amount (give your answer to the nearest 0.01%)? What is the range of value of Y that can ensure no arbitrage opportunity (give your answer up to the third decimal place)? (b) Suppose you do not know the value of Y. Is there any arbitrage profit opportunity if X= 1.1395? If yes, what steps must you take to profit from it? How much is the arbitrage profit in percentage of transaction amount (give your answer to the nearest 0.01%)? What is the range of value of X that can ensure no arbitrage opportunity (give your answer up to the fourth decimal place)? The following exchange rate and interest rate quotations are observed for Australian Dollar (A$) and New Zealand Dollar (NZS). Note that: Bid interest rate is your lending rate (1.e., rate of investment return), while ask interest rate is your financing interest rate; and o To calculate the effective 90-day interest rates, you can simply divide the quoted per annum interest rates by 4 (e.g., effective 90-day financing interest rate in NZS is 0.975% (3.90%/4)). FX quotes of AS vs. NZS Spot 90-day forward Interest rates 90-day (% annum) NZS Y 3.80 4.50 3.90 AS Bid Ask NZ$1.1510/AS NZS1.1515/AS NZ$1.1390/AS NZS XIAS (a) Suppose you do not know the value of X. Is there any arbitrage profit opportunity if Y = 4.40? If yes, what steps must you take to profit from it? How much is the arbitrage profit in percentage of transaction amount (give your answer to the nearest 0.01%)? What is the range of value of Y that can ensure no arbitrage opportunity (give your answer up to the third decimal place)? (b) Suppose you do not know the value of Y. Is there any arbitrage profit opportunity if X= 1.1395? If yes, what steps must you take to profit from it? How much is the arbitrage profit in percentage of transaction amount (give your answer to the nearest 0.01%)? What is the range of value of X that can ensure no arbitrage opportunity (give your answer up to the fourth decimal place)