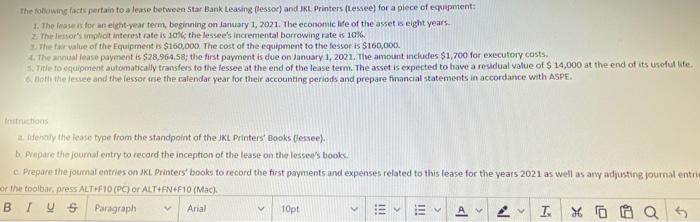

The following facts pertain to a lease between Star Bank Leasing lessor) and KL Printers (Lessee) for a piece of equipment: 1. The lease is for an ethe-year term, beginning on January 1, 2021. The economic We of the asset is eight years. Thresor's most interest rate is 101, the lessee's incremental borrowing rate is 10%. The far value of the Equipment is $160,000. The cost of the equipment to the lessor is $160,000. 4. The annual lease payment is $28,964.58; the first payment is due on January 1, 2021. The amount includes $1,700 for executory costs. 5. Title to equipment automatically transfers to the lessee at the end of the lease term. The asset is expected to have a residual value of $ 14,000 at the end of its useful life. Both the lessee and the lessorite the calendar year for their accounting periods and prepare financial statements in accordance with ASPE. instructions idently the lease type from the standpoint of the KL Printers' Books (lessee). b. Prepare the journal entry to record the inception of the lease on the lessee's books. e. Prepare the journal entries on IKL Printers' books to record the first payments and expenses related to this lease for the years 2021 as well as any adjusting journal entre or the toolbar.press ALT+F10(PC) or ALTHEN F10 (Mac). BTU Paragraph Anal 10pt 2 I !!! !!! V T x to o as The following facts pertain to a lease between Star Bank Leasing lessor) and KL Printers (Lessee) for a piece of equipment: 1. The lease is for an ethe-year term, beginning on January 1, 2021. The economic We of the asset is eight years. Thresor's most interest rate is 101, the lessee's incremental borrowing rate is 10%. The far value of the Equipment is $160,000. The cost of the equipment to the lessor is $160,000. 4. The annual lease payment is $28,964.58; the first payment is due on January 1, 2021. The amount includes $1,700 for executory costs. 5. Title to equipment automatically transfers to the lessee at the end of the lease term. The asset is expected to have a residual value of $ 14,000 at the end of its useful life. Both the lessee and the lessorite the calendar year for their accounting periods and prepare financial statements in accordance with ASPE. instructions idently the lease type from the standpoint of the KL Printers' Books (lessee). b. Prepare the journal entry to record the inception of the lease on the lessee's books. e. Prepare the journal entries on IKL Printers' books to record the first payments and expenses related to this lease for the years 2021 as well as any adjusting journal entre or the toolbar.press ALT+F10(PC) or ALTHEN F10 (Mac). BTU Paragraph Anal 10pt 2 I !!! !!! V T x to o as