Question

The following Figure shows the adjustment of the dollar/euro exchange rate following a permanent increase in the U.S. money supply. It shows both the short-run

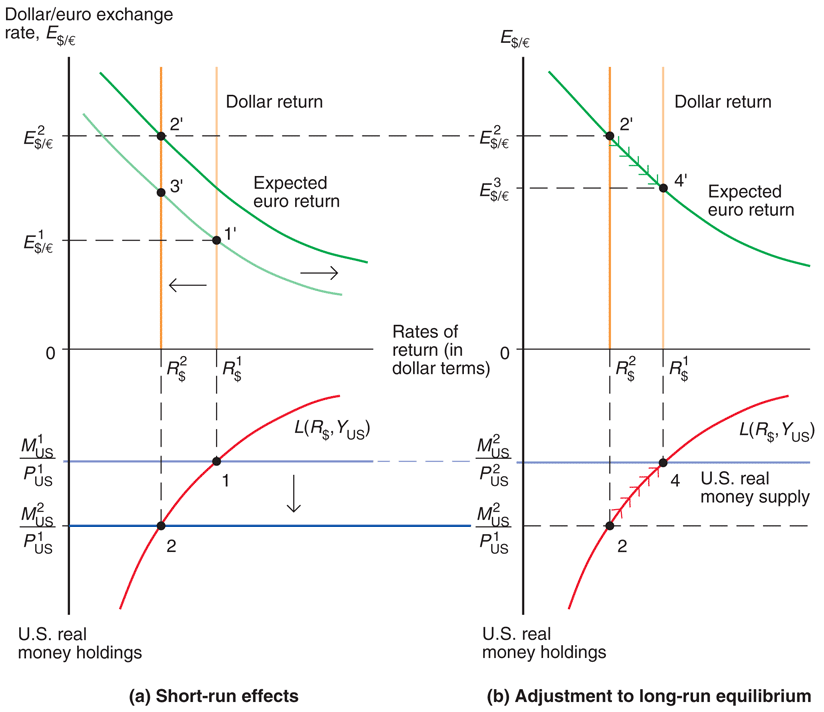

The following Figure shows the adjustment of the dollar/euro exchange rate following a permanent increase in the U.S. money supply. It shows both the short-run and long-run effects of this increase in the U.S. money supply.

Please draw the time paths of the following variables after a permanent increase in the U.S. money supply: (a) U.S. money supply; (b) Dollar interest rate; (c) U.S. price level; (d) Dollar/Euro exchange rate.

Which time path describes the phenomenon of Exchange Rate Overshooting?

Why there is overshooting in the short-run? Is it related to the short-run rigidity of the price level?

Dollar/euro exchange rate, Este Este Dollar return Dollar return 2' 2 a - ESE 3' 3 4' Expected euro return Este Expected euro return Egle 1' 1 0 Rates of return (in dollar terms) 0 R in the R L(RS, YUS) L(R, Yus) Mus P1 Mis US 1 P2 US 1 4 U.S. real money supply ME PUS "US 'US Pus 2 2 U.S. real money holdings U.S. real money holdings (a) Short-run effects (b) Adjustment to long-run equilibrium Dollar/euro exchange rate, Este Este Dollar return Dollar return 2' 2 a - ESE 3' 3 4' Expected euro return Este Expected euro return Egle 1' 1 0 Rates of return (in dollar terms) 0 R in the R L(RS, YUS) L(R, Yus) Mus P1 Mis US 1 P2 US 1 4 U.S. real money supply ME PUS "US 'US Pus 2 2 U.S. real money holdings U.S. real money holdings (a) Short-run effects (b) Adjustment to long-run equilibriumStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started