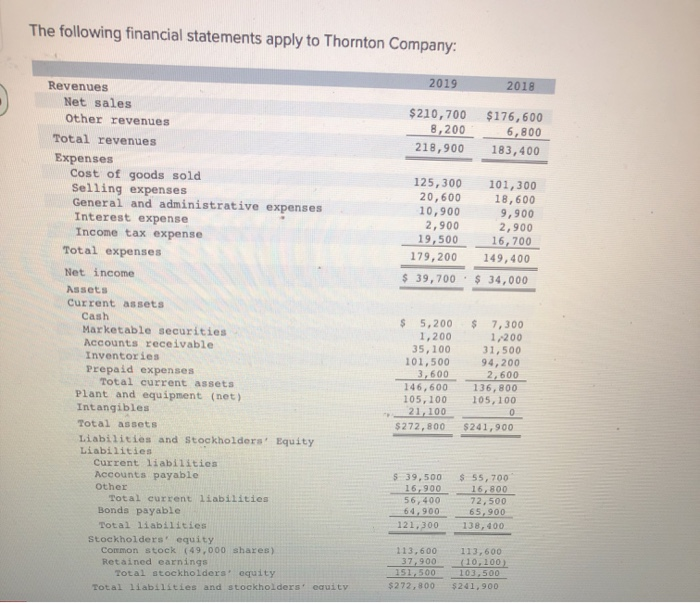

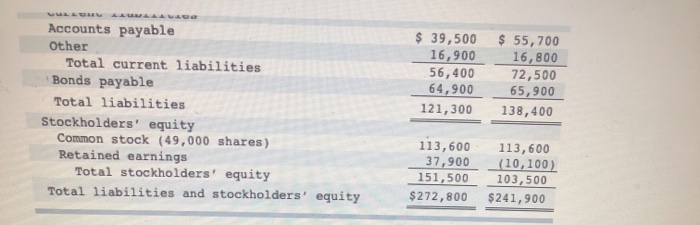

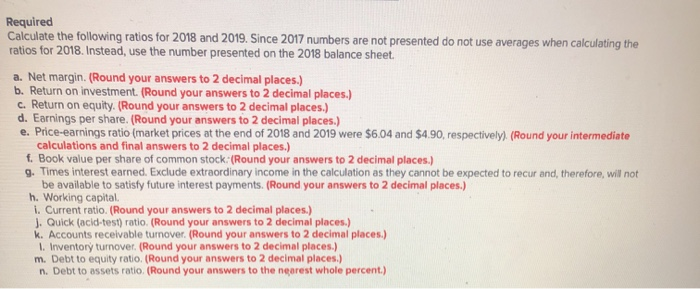

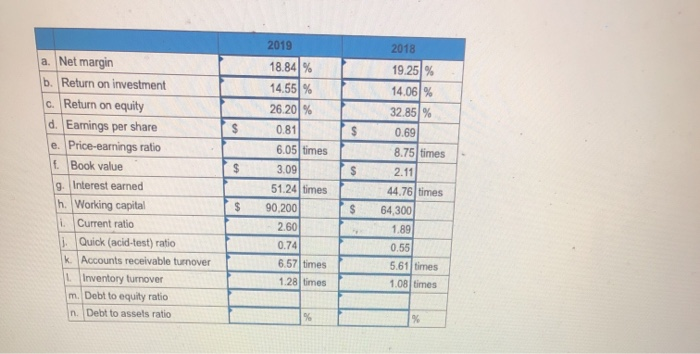

The following financial statements apply to Thomton Company: 201 2019 evenes $210, 70 IN, 1,200 21,900 Net ales 6,00 other reveen Total reveues 11,4 Expenses Cost of goode eld Selling penes General and diniatrative penes Taterest espense Tee ta epense 125,0 10, 2,s00 19,50 2,00 Tetal aspenae 179,200 14,4 Set ineom Aaseta Currest aeta Cash aketle seurities Accousta receiveble tevetories Prepeid epenas Tetal erent aet Pan nd gigent en) Ttangiles I7,300 35,1 31,50 144, 10s, Ttal ta abiities and ockelders it Lia ies Curt inies Aeco payabe Ttal eren i nds p ie 14,400 12,500 Total lbili t . share TOTAL Stockholders equity Comnon stock (49,000 shares) Retained arnings Total stockholdere equity 113, 600 37,100 IS1,50 (10,100 103, S00 Tutal liabilities and stockholdera quity 1272,e00 241,900 Ca es the ing tios for 20 and 20 Se 2ouben t pr 20te theunber presetedenhe 20 elence sheet ingthe Net margin. nd your te decial plecn A Return on imentund y de ec Betum on equty tnd yur t ial ) Earings per shee nd your sd s Priceeminga o maet pricesthendof 20nd 20 0nd calltennd en2decimalacm Times ieretemed udeerdy income inthe caton be valbie ly uureert pnymer nd yuran AWorking capt Cree nd your erst deciml Quic cidt ndya tdl Accounts cevaleme nd your e Lertryuove nd yr d Deto ty t d m t rand he wll they cannat e 2de cimal OAnawer is not complete 2018 Net margn 14 OS 24.2OS Retum aninveent Raum on ey ld. Eaming per har Priengo terest med 4300 Working cop TAcooumts e Invertery umever De pls be understandable and specific The following financial statements apply to Thornton Company: 2019 Revenues 2018 Net sales $210,700 8,200 $176,600 Other revenues 6,800 Total revenues 218,900 183,400 Expenses Cost of goods sold Selling expenses General and administrative expenses Interest expense 125,300 20,600 10,900 2,900 19,500 101,300 18,600 9,900 2,900 16,700 Income tax expense Total expenses 179,200 149,400 Net income $ 39,700 $ 34,000 Assets Current assets Cash Marketable securities 2$ 5,200 1,200 35,100 101,500 3,600 146,600 105,100 21,100 2$ 7,300 1,200 31,500 94,200 2,600 Accounts receivable Inventories Prepaid expenses Total current assets Plant and equipment (net) Intangibles 136,800 105,100 Total assets $272,800 $241,900 Liabilities and Stockholders' Equity Liabilities Current liabilitien Accounts payable $ 39,500 16,900 56,400 64,900 $ 55,700 16,800 72,500 65,900 Other Total current liabilities Bonds payable Total liabilities 121,300 138,400 Stockholders' equity Common stock (49,000 shares) Retained earnings Total stockholders equity 113,600 37,900 151,500 113,600 (10,100) 103,500 Total liabilities and stockholders eauity $272,800 $241,900 Accounts payable Other $ 39,500 16,900 56,400 64,900 $ 55,700 16,800 72,500 65,900 Total current liabilities Bonds payable Total liabilities 121,300 138,400 Stockholders' equity Common stock (49,000 shares) Retained earnings Total stockholders' equity 113,600 37,900 151,500 113,600 (10,100) 103,500 Total liabilities and stockholders' equity $272,800 $241,900 Required Calculate the following ratios for 2018 and 2019. Since 2017 numbers are not presented do not use averages when calculating the ratios for 2018. Instead, use the number presented on the 2018 balance sheet. a. Net margin. (Round your answers to 2 decimal places.) b. Return on investment. (Round your answers to 2 decimal places.) c. Return on equity. (Round your answers to 2 decimal places.) d. Earnings per share. (Round your answers to 2 decimal places.) e. Price-earnings ratio (market prices at the end of 2018 and 2019 were $6.04 and $4.90, respectively). (Round your intermediate calculations and final answers to 2 decimal places.) f. Book value per share of common stock: (Round your answers to 2 decimal places.) g. Times interest earned. Exclude extraordinary income in the calculation as they cannot be expected to recur and, therefore, will not be available to satisfy future interest payments. (Round your answers to 2 decimal places.) h. Working capital. i. Current ratio. (Round your answers to 2 decimal places.) J. Quick (acid-test) ratio. (Round your answers to 2 decimal places.) k. Accounts receivable turnover. (Round your answers to 2 decimal places.) 1. Inventor turnover. (Round your answers to 2 decimal places.) m. Debt to equity ratio. (Round your answers to 2 decimal places.) n. Debt to assets ratio. (Round your answers to the nearest whole percent.) 2019 2018 a. Net margin 18.84 % 19.25 % b. Return on investment 14.55 % 26.20 % 14.06 % c. Return on equity d. Eamings per share e. Price-earnings ratio 32.85 % 0.81 0.69 2$ 6.05 times 8.75 times fBook value 3.09 2.11 g. Interest earned 51.24 times 44.76 times h. Working capital iCurrent ratio %24 90,200 64,300 2$ 2.60 1.89 i. Quick (acid-test) ratio 0.74 0.55 k. Accounts receivable turnover 6.57 times 5.61 times LInventory turnover 1.28 times 1.08 times m. Debt to equity ratio n. Debt to assets ratio