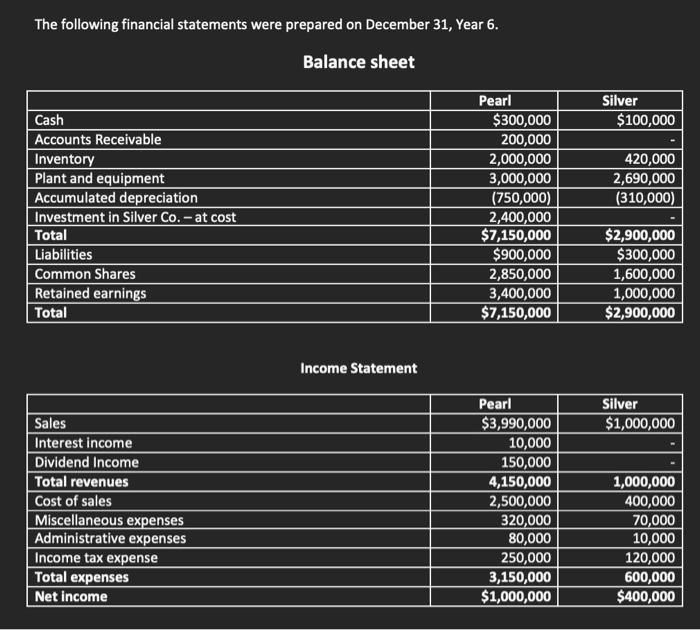

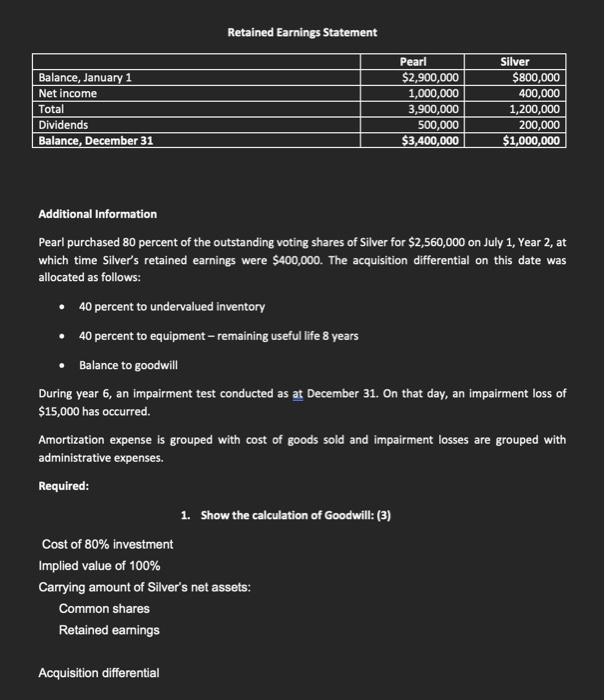

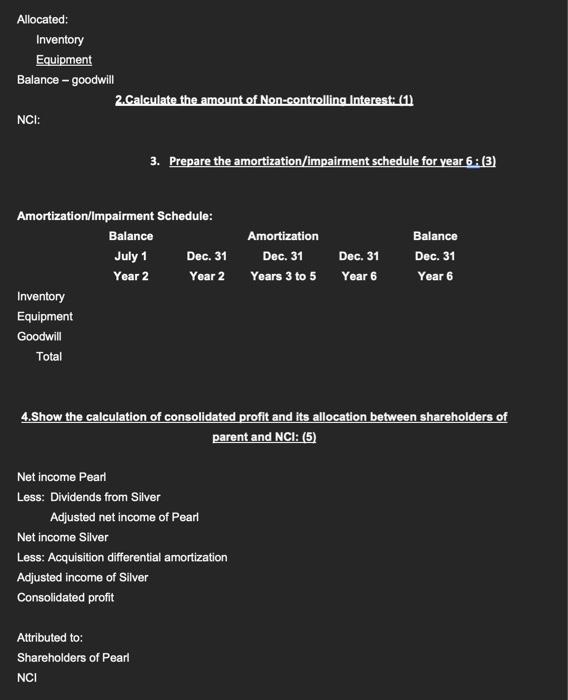

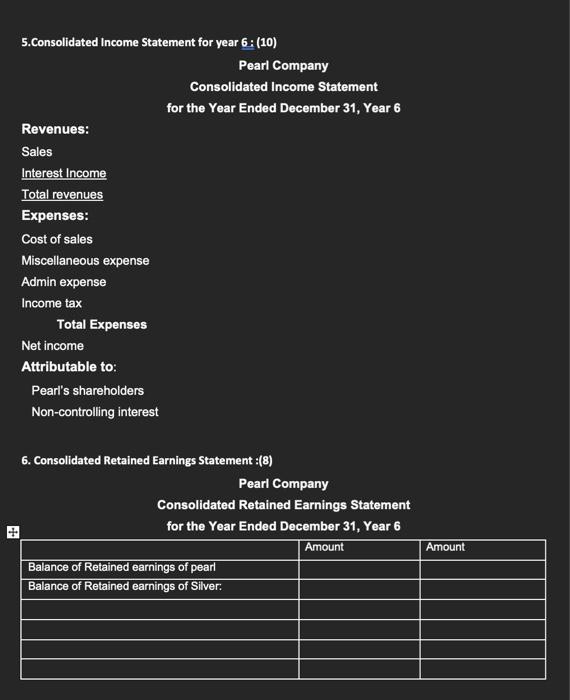

The following financial statements were prepared on December 31 , Year 6. Balance sheet \begin{tabular}{|l|r|r|} \hline & \multicolumn{1}{|c|}{ Pearl } & \multicolumn{1}{c|}{ Silver } \\ \hline Cash & $300,000 & $100,000 \\ \hline Accounts Receivable & 200,000 & \\ \hline Inventory & 2,000,000 & 420,000 \\ \hline Plant and equipment & 3,000,000 & 2,690,000 \\ \hline Accumulated depreciation & (750,000) & (310,000) \\ \hline Investment in Silver Co. - at cost & 2,400,000 & \\ \hline Total & $7,150,000 & $2,900,000 \\ \hline Liabilities & $900,000 & $300,000 \\ \hline Common Shares & 2,850,000 & 1,600,000 \\ \hline Retained earnings & 3,400,000 & 1,000,000 \\ \hline Total & $7,150,000 & $2,900,000 \\ \hline \end{tabular} Income Statement \begin{tabular}{|l|r|r|} \hline & \multicolumn{1}{|c|}{ Pearl } & \multicolumn{1}{c|}{ Silver } \\ \hline Sales & $3,990,000 & $1,000,000 \\ \hline Interest income & 10,000 & \\ \hline Dividend Income & 150,000 & \\ \hline Total revenues & 4,150,000 & 1,000,000 \\ \hline Cost of sales & 2,500,000 & 400,000 \\ \hline Miscellaneous expenses & 320,000 & 70,000 \\ \hline Administrative expenses & 80,000 & 10,000 \\ \hline Income tax expense & 250,000 & 120,000 \\ \hline Total expenses & 3,150,000 & 600,000 \\ \hline Net income & $1,000,000 & $400,000 \\ \hline \end{tabular} Retained Earnings Statement Additional Information Pearl purchased 80 percent of the outstanding voting shares of Silver for $2,560,000 on July 1, Year 2 , at which time Silver's retained earnings were $400,000. The acquisition differential on this date was allocated as follows: - 40 percent to undervalued inventory - 40 percent to equipment - remaining useful life 8 years - Balance to goodwill During year 6, an impairment test conducted as at December 31 . On that day, an impairment loss of $15,000 has occurred. Amortization expense is grouped with cost of goods sold and impairment losses are grouped with administrative expenses. Required: 1. Show the calculation of Goodwill: (3) Cost of 80% investment Implied value of 100% Carrying amount of Silver's net assets: Common shares Retained earnings Acquisition differential Amortization/lmpairment Schedule: 5. Consolidated Income Statement for year 6:(10) Pearl Company Consolidated Income Statement for the Year Ended December 31, Year 6 Revenues: Sales Interest Income Total revenues Expenses: Cost of sales Miscellaneous expense Admin expense Income tax Total Expenses Net income Attributable to: Pearl's shareholders Non-controlling interest 6. Consolidated Retained Earnings Statement :(8) Pearl Company Consolidated Retained Earnings Statement for the Year Ended December 31, Year 6 \begin{tabular}{|l|l|l|} \hline & Amount & Amount \\ \hline Balance of Retained earnings of pearl & & \\ \hline Balance of Retained earnings of Silver: & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} The following financial statements were prepared on December 31 , Year 6. Balance sheet \begin{tabular}{|l|r|r|} \hline & \multicolumn{1}{|c|}{ Pearl } & \multicolumn{1}{c|}{ Silver } \\ \hline Cash & $300,000 & $100,000 \\ \hline Accounts Receivable & 200,000 & \\ \hline Inventory & 2,000,000 & 420,000 \\ \hline Plant and equipment & 3,000,000 & 2,690,000 \\ \hline Accumulated depreciation & (750,000) & (310,000) \\ \hline Investment in Silver Co. - at cost & 2,400,000 & \\ \hline Total & $7,150,000 & $2,900,000 \\ \hline Liabilities & $900,000 & $300,000 \\ \hline Common Shares & 2,850,000 & 1,600,000 \\ \hline Retained earnings & 3,400,000 & 1,000,000 \\ \hline Total & $7,150,000 & $2,900,000 \\ \hline \end{tabular} Income Statement \begin{tabular}{|l|r|r|} \hline & \multicolumn{1}{|c|}{ Pearl } & \multicolumn{1}{c|}{ Silver } \\ \hline Sales & $3,990,000 & $1,000,000 \\ \hline Interest income & 10,000 & \\ \hline Dividend Income & 150,000 & \\ \hline Total revenues & 4,150,000 & 1,000,000 \\ \hline Cost of sales & 2,500,000 & 400,000 \\ \hline Miscellaneous expenses & 320,000 & 70,000 \\ \hline Administrative expenses & 80,000 & 10,000 \\ \hline Income tax expense & 250,000 & 120,000 \\ \hline Total expenses & 3,150,000 & 600,000 \\ \hline Net income & $1,000,000 & $400,000 \\ \hline \end{tabular} Retained Earnings Statement Additional Information Pearl purchased 80 percent of the outstanding voting shares of Silver for $2,560,000 on July 1, Year 2 , at which time Silver's retained earnings were $400,000. The acquisition differential on this date was allocated as follows: - 40 percent to undervalued inventory - 40 percent to equipment - remaining useful life 8 years - Balance to goodwill During year 6, an impairment test conducted as at December 31 . On that day, an impairment loss of $15,000 has occurred. Amortization expense is grouped with cost of goods sold and impairment losses are grouped with administrative expenses. Required: 1. Show the calculation of Goodwill: (3) Cost of 80% investment Implied value of 100% Carrying amount of Silver's net assets: Common shares Retained earnings Acquisition differential Amortization/lmpairment Schedule: 5. Consolidated Income Statement for year 6:(10) Pearl Company Consolidated Income Statement for the Year Ended December 31, Year 6 Revenues: Sales Interest Income Total revenues Expenses: Cost of sales Miscellaneous expense Admin expense Income tax Total Expenses Net income Attributable to: Pearl's shareholders Non-controlling interest 6. Consolidated Retained Earnings Statement :(8) Pearl Company Consolidated Retained Earnings Statement for the Year Ended December 31, Year 6 \begin{tabular}{|l|l|l|} \hline & Amount & Amount \\ \hline Balance of Retained earnings of pearl & & \\ \hline Balance of Retained earnings of Silver: & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular}