Question

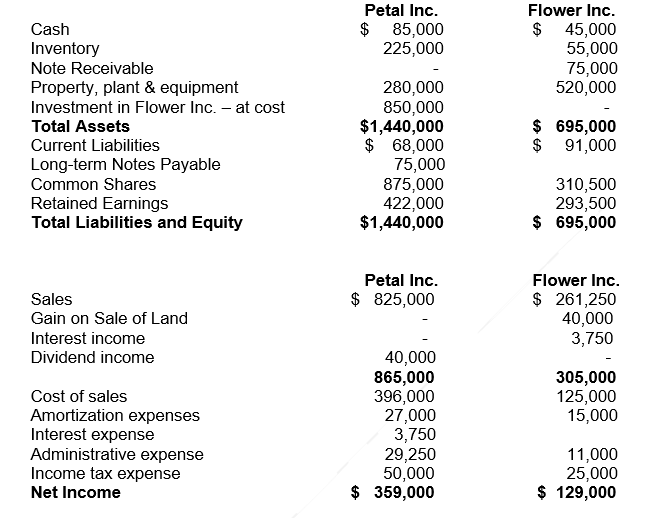

The following financial statements were prepared on December 31, 2020: Additional Information: Petal purchased 80% of the outstanding voting shares of Flower for $850,000 on

The following financial statements were prepared on December 31, 2020:

Additional Information:

Petal purchased 80% of the outstanding voting shares of Flower for $850,000 on July 1, 2017, at which time Flowers retained earnings were $45,500, and common shares were $310,500. The fair values of Flowers net asset were equal to their fair value, except for the following: o Inventory = fair value was $5,500 greater than book value o Equipment = fair value was $420,000 greater than book value - equipment had a remaining useful life five years o Land = fair value $250,000 greater than book value. Half of this land was sold to an outside third party in 2020. o Flower also had a patent that was not recorded on their balance sheet. The fair value of this patent was $20,000 and its remaining useful life was 10 years.

During 2018, a goodwill impairment loss of $5,000 was recognized. A further impairment loss of $4,000 was recognized in 2020. Impairments are grouped with amortization expense.

During 2020, inventory sales from Petal to Flower were $25,000. At the beginning of the year, Flowers inventories contained merchandise purchased from Petal for $10,000. At the end of the year, Flowers inventories contained merchandise purchased from Petal for $8,000. A gross margin of 30% is recognized on its intercompany sales.

At the beginning of 2019, Flower sold a piece of equipment that had a remaining useful life of 5 years to Petal for $155,000. Flower recorded a gain of $20,000 before taxes.

January 1 2020, Flower sold a piece of land to Petal for $75,000. Flower gave a note payable, the entire amount is due on December 31, 2023, to Petal for the purchase of the land. Petal pays 5% interest on the note which is payable on December 31 of each year. Petal has always paid the interest on time. Petal recorded a gain of $40,000 before taxes.

Flower paid out $50,000 in dividends and Petal recorded $40,000 ($50,000 * 80%) of dividend revenue in 2020. Any impairment losses are grouped with administrative expenses.

Assume a 40% tax rate

REQUIRED:

All necessary calculation details must be provided to support your answer, in order to obtain marks. A. Calculate the amount of the acquisition differential and the amount of goodwill arising from this combination. Also, state any intercompany items/transactions.

B. Prepare a consolidated statement of income for the year ended December 31, 2020.

C. Prepare the consolidated statement of financial position as of December 31, 2020.

Petal Inc. $ 85,000 225,000 Flower Inc. $ 45,000 55,000 75,000 520,000 Cash Inventory Note Receivable Property, plant & equipment Investment in Flower Inc. - at cost Total Assets Current Liabilities Long-term Notes Payable Common Shares Retained Earnings Total Liabilities and Equity $ 695,000 $ 91,000 280,000 850,000 $1,440,000 $ 68,000 75,000 875,000 422,000 $1,440,000 310,500 293,500 $ 695,000 Petal Inc. $ 825,000 Sales Gain on Sale of Land Interest income Dividend income Flower Inc. $ 261,250 40,000 3,750 305,000 125,000 15,000 Cost of sales Amortization expenses Interest expense Administrative expense Income tax expense Net Income 40,000 865,000 396,000 27,000 3,750 29,250 50,000 $ 359,000 11,000 25,000 $ 129,000 Petal Inc. $ 85,000 225,000 Flower Inc. $ 45,000 55,000 75,000 520,000 Cash Inventory Note Receivable Property, plant & equipment Investment in Flower Inc. - at cost Total Assets Current Liabilities Long-term Notes Payable Common Shares Retained Earnings Total Liabilities and Equity $ 695,000 $ 91,000 280,000 850,000 $1,440,000 $ 68,000 75,000 875,000 422,000 $1,440,000 310,500 293,500 $ 695,000 Petal Inc. $ 825,000 Sales Gain on Sale of Land Interest income Dividend income Flower Inc. $ 261,250 40,000 3,750 305,000 125,000 15,000 Cost of sales Amortization expenses Interest expense Administrative expense Income tax expense Net Income 40,000 865,000 396,000 27,000 3,750 29,250 50,000 $ 359,000 11,000 25,000 $ 129,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started