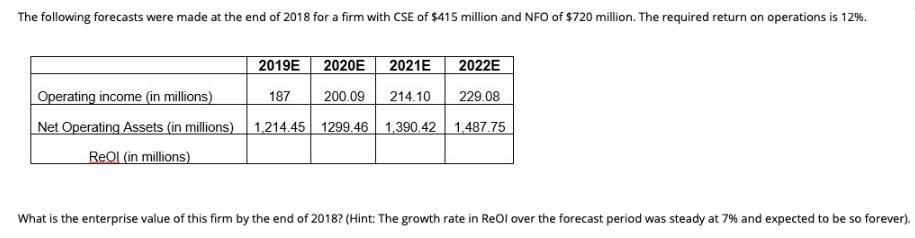

The following forecasts were made at the end of 2018 for a firm with CSE of $415 million and NFO of $720 million. The

The following forecasts were made at the end of 2018 for a firm with CSE of $415 million and NFO of $720 million. The required return on operations is 12%. 2019E Operating income (in millions) 187 Net Operating Assets (in millions) 1.214.45 Reol (in millions) 2020E 2021E 200.09 214.10 1299.46 1,390.42 2022E 229.08 1,487.75 What is the enterprise value of this firm by the end of 2018? (Hint: The growth rate in ReOl over the forecast period was steady at 7% and expected to be so forever).

Step by Step Solution

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Terminal value Reol at the end of 2022 required return on operations growth rate 148775 012 00...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started