Answered step by step

Verified Expert Solution

Question

1 Approved Answer

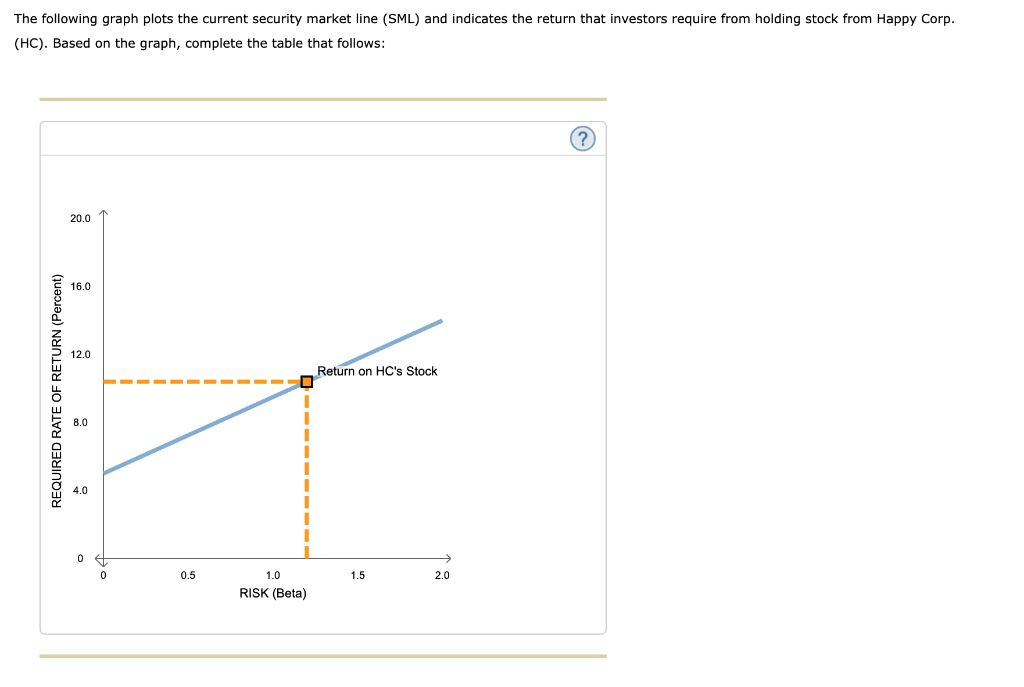

The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC).

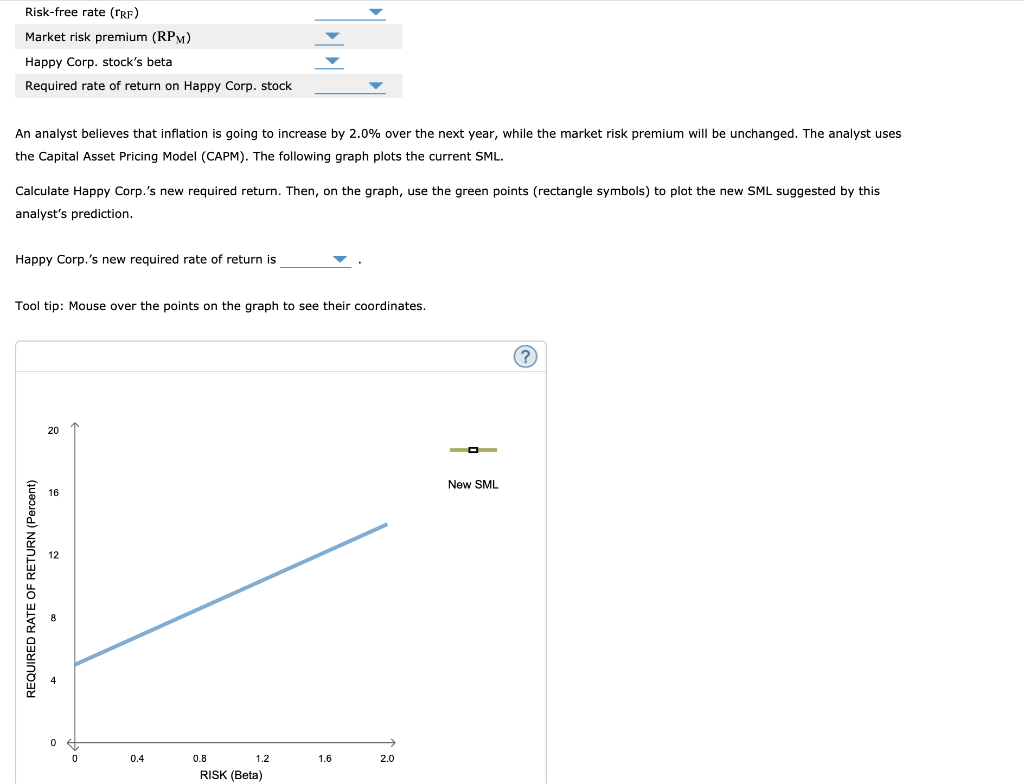

The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC). Based on the graph, complete the table that follows: REQUIRED RATE OF RETURN (Percent) 20.0 16.0 12.0 Return on HC's Stock 8.0 4.0 0.5 1.0 1.5 2.0 RISK (Beta) (?) Risk-free rate (TRF) Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on Happy Corp. stock An analyst believes that inflation is going to increase by 2.0% over the next year, while the market risk premium will be unchanged. The analyst uses the Capital Asset Pricing Model (CAPM). The following graph plots the current SML. Calculate Happy Corp.'s new required return. Then, on the graph, use the green points (rectangle symbols) to plot the new SML suggested by this analyst's prediction. Happy Corp.'s new required rate of return is Tool tip: Mouse over the points on the graph to see their coordinates. REQUIRED RATE OF RETURN (Percent) 16 12 20 0 0 0.4 0.8 1.2 1.6 2.0 RISK (Beta) New SML ? The SML helps determine the risk-aversion level among investors. The steeper the slope of the SML, the the level of risk aversion. Which of the following statements best describes the shape of the SML if investors were not at all risk averse? The SML would have a positive slope, but the slope would be flatter than it would be if investors were risk averse. The SML would have a negative slope. The SML would have a positive slope, but the slope would be steeper than it would be if investors were risk averse. The SML would be a horizontal line.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve the question lets break it down into steps using the Capital Asset Pricing Model CAPM Step ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started