Question

The following has yet to be adjusted. Adjustment is required, if necessary: 1) The company revised one of the motor vehicle useful life from 10

The following has yet to be adjusted. Adjustment is required, if necessary:

The following has yet to be adjusted. Adjustment is required, if necessary:

1) The company revised one of the motor vehicle useful life from 10 years to 8 years on 1 January 2020. The motor vehicle was acquired on 1 January 2017 at RM 320,000 and depreciated using straight line basis. The depreciation of this motor vehicle for the current year was not included in the above trial balance. (Depreciation for other assets has been computed and no adjustment should be made).

2) Dividend paid and dividend received for the year amounting RM 210,000 and RM 1,750,000 respectively.

3) The company intends to sell one of its building with the carrying amount of RM 400,000. The fair value of the building is RM 500,000 and the cost to sell it is RM 80,000. It meets the criteria to classify the asset as Non-Current Asset Held for Sale.

4) The external auditor detected an error whereby the legal fee provided in year 2015 was understated by RM 40,000. Tax rate is assumed at 25%.

5) Taxation charge for the current years taxable profit is calculated to be RM 260,000 and deferred tax liability is to be reduced by RM 20,000.

6) During the year, the company incurred development cost amounting RM 60,000 and this development cost meet the criteria for capitalisation. The future economic benefit and future development cost associated to it is RM 70,000 and RM 20,000 respectively.

7) As at 31 December 2020, there is indication that one of the machineries need to be impaired. The carrying amount of the machinery is RM 200,000 and the current market price is RM 260,000. The cost related for selling the machinery is RM 120,000. If the machinery continuously uses, the value in use is expected to be RM 160,000.

8) On 1 December 2020, the companys research team incurred RM 40,000 to gain knowledge for new development project. The amount has been recorded in intangible assets.

9) At the end of the year, the closing inventories were RM 2,100,000 which comprise of raw material amounting RM 1,018,000; finish goods amounting RM 600,000 and work in progress amounting RM 482,000.

In accordance with the approved accounting standards, prepare the following components of financial statements for the HIL Bhd:

(a) Statement of Profit or Loss (expenses classified by nature) for the financial year ended 31 December 2020. (16 marks)

(b) Statement of Changes in Equity for the financial year ended 31 December 2020. (5 marks)

(c) Statement of Financial Position as at 31 December 2020. (16 marks)

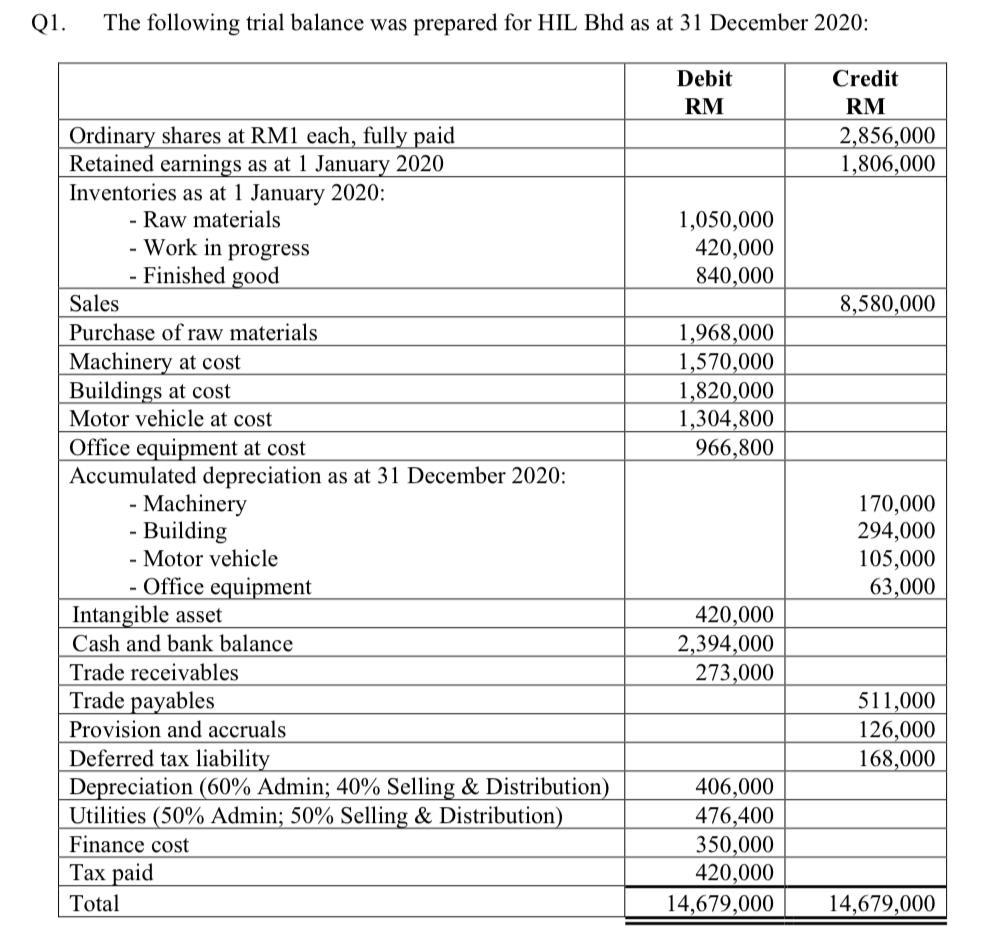

Q1. The following trial balance was prepared for HIL Bhd as at 31 December 2020: Debit RM Credit RM 2,856,000 1,806,000 1,050,000 420,000 840,000 8,580,000 1,968,000 1,570,000 1,820,000 1,304,800 966,800 Ordinary shares at RM1 each, fully paid Retained earnings as at 1 January 2020 Inventories as at 1 January 2020: - Raw materials - Work in progress - Finished good Sales Purchase of raw materials Machinery at cost Buildings at cost Motor vehicle at cost Office equipment at cost Accumulated depreciation as at 31 December 2020: - Machinery - Building - Motor vehicle - Office equipment Intangible asset Cash and bank balance Trade receivables Trade payables Provision and accruals Deferred tax liability Depreciation (60% Admin; 40% Selling & Distribution) Utilities (50% Admin; 50% Selling & Distribution) Finance cost Tax paid Total 170,000 294,000 105,000 63,000 420,000 2,394,000 273,000 511,000 126,000 168,000 406,000 476,400 350,000 420,000 14,679,000 14,679,000 Q1. The following trial balance was prepared for HIL Bhd as at 31 December 2020: Debit RM Credit RM 2,856,000 1,806,000 1,050,000 420,000 840,000 8,580,000 1,968,000 1,570,000 1,820,000 1,304,800 966,800 Ordinary shares at RM1 each, fully paid Retained earnings as at 1 January 2020 Inventories as at 1 January 2020: - Raw materials - Work in progress - Finished good Sales Purchase of raw materials Machinery at cost Buildings at cost Motor vehicle at cost Office equipment at cost Accumulated depreciation as at 31 December 2020: - Machinery - Building - Motor vehicle - Office equipment Intangible asset Cash and bank balance Trade receivables Trade payables Provision and accruals Deferred tax liability Depreciation (60% Admin; 40% Selling & Distribution) Utilities (50% Admin; 50% Selling & Distribution) Finance cost Tax paid Total 170,000 294,000 105,000 63,000 420,000 2,394,000 273,000 511,000 126,000 168,000 406,000 476,400 350,000 420,000 14,679,000 14,679,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started