Answered step by step

Verified Expert Solution

Question

1 Approved Answer

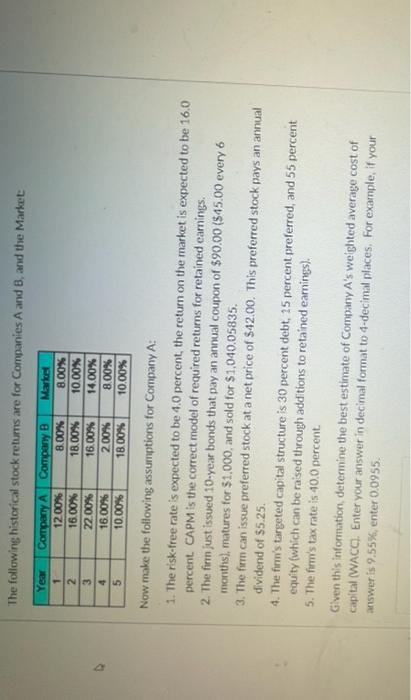

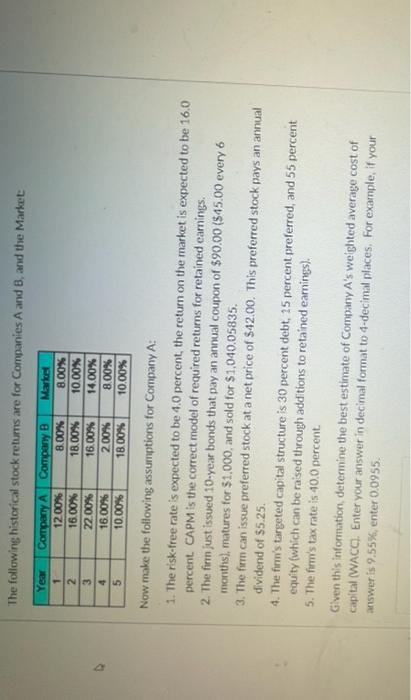

The following historical stock returns are for Companies A and B, and the Market Year Company B Market Company A 12.00% 1 8.00% 8.00% 2

The following historical stock returns are for Companies A and B, and the Market Year Company B Market Company A 12.00% 1 8.00% 8.00% 2 16.00% 18.00% 10.00% 3 22.00% 16.00% 14.00% 4 16.00% 2.00% 8.00% 5 10.00% 18.00% 10.00% Now make the following assumptions for Company A: 1. The risk-free rate is expected to be 4.0 percent, the return on the market is expected to be 16.0 percent. CAPM is the correct model of required returns for retained earnings. 2. The firm just issued 10-year bonds that pay an annual coupon of $90.00 ($45.00 every 6 months), matures for $1,000, and sold for $1,040.05835. dividend of $5.25. 3. The firm can issue preferred stock at a net price of $42.00. This preferred stock pays an annual 4. The firm's targeted capital structure is 30 percent debt, 15 percent preferred, and 55 percent equity (which can be raised through additions to retained earnings). 5. The firm's tax rate is 40.0 percent. Given this information, determine the best estimate of Company A's weighted average cost of answer is 9.55%, enter 0.0955. capital (WACC). Enter your answer in decimal format to 4-decimal places. For example, if your

The following historical stock returns are for Companies A and B, and the Market Year Company B Market Company A 12.00% 1 8.00% 8.00% 2 16.00% 18.00% 10.00% 3 22.00% 16.00% 14.00% 4 16.00% 2.00% 8.00% 5 10.00% 18.00% 10.00% Now make the following assumptions for Company A: 1. The risk-free rate is expected to be 4.0 percent, the return on the market is expected to be 16.0 percent. CAPM is the correct model of required returns for retained earnings. 2. The firm just issued 10-year bonds that pay an annual coupon of $90.00 ($45.00 every 6 months), matures for $1,000, and sold for $1,040.05835. dividend of $5.25. 3. The firm can issue preferred stock at a net price of $42.00. This preferred stock pays an annual 4. The firm's targeted capital structure is 30 percent debt, 15 percent preferred, and 55 percent equity (which can be raised through additions to retained earnings). 5. The firm's tax rate is 40.0 percent. Given this information, determine the best estimate of Company A's weighted average cost of answer is 9.55%, enter 0.0955. capital (WACC). Enter your answer in decimal format to 4-decimal places. For example, if your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started