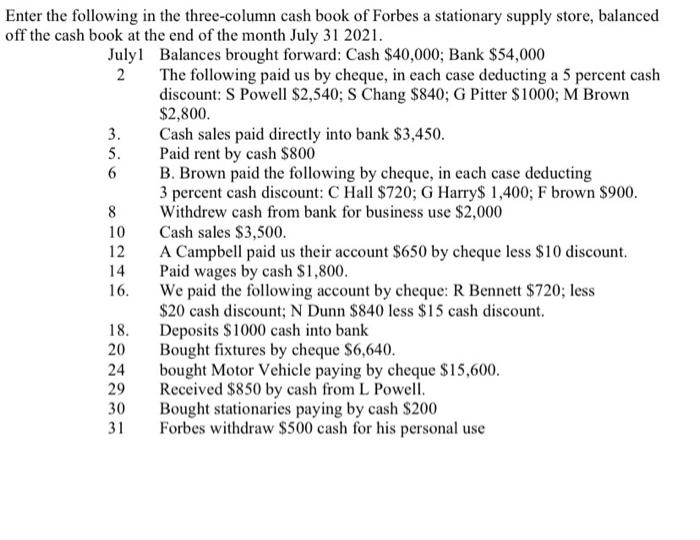

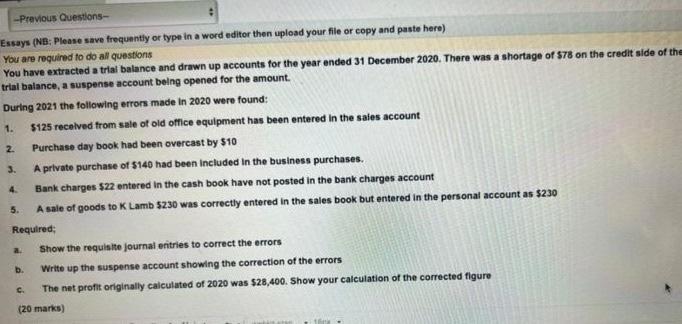

the following in the three-column cash book of Forbes a stationary supply store, balanced the cash book at the end of the month July 312021. July1 Balances brought forward: Cash $40,000; Bank $54,000 2 The following paid us by cheque, in each case deducting a 5 percent cash discount: S Powell \$2,540; S Chang $840; G Pitter $1000; M Brown $2,800. 3. Cash sales paid directly into bank $3,450. 5. Paid rent by cash $800 6 B. Brown paid the following by cheque, in each case deducting 3 percent cash discount: C Hall $720; G Harry $1,400; F brown $900. 8 Withdrew cash from bank for business use $2,000 10 Cash sales $3,500. 12 A Campbell paid us their account $650 by cheque less $10 discount. 14 Paid wages by cash $1,800. 16. We paid the following account by cheque: R Bennett $720; less $20 cash discount; N Dunn $840 less $15 cash discount. 18. Deposits $1000 cash into bank 20 Bought fixtures by cheque $6,640. bought Motor Vehicle paying by cheque $15,600. Received $850 by cash from L Powell. Bought stationaries paying by cash $200 Forbes withdraw $500 cash for his personal use Steve introduces in-house thchnical training programs for employees, as well as a provision to reimburse the tultion fees for employees who take coliege courses that bennfit both the employee and the organization. Steve is using to motivate and retain employees. performance appraisal methods hight-performance work practices mentoring laffirmative action Essays (NE: Please save frequantly or type in a word editor then upload your file or copy and paste here) You are required to do all questions You have extracted a trial balance and drawn up accounts for the year ended 31 December 2020. There was a shortage of $78 on the credit side of th trial balance, a suspense account belng opened for the amount. During 202.1 the following errors made in 2020 were found: 1. 5125 recelved from sale of old office equipment has been entered in the safes account: 2. Purchase day book had been overcast by $10 3. A private purchase of $140 had been included in the business purchases. 4. Bank charges $22 entered in the cash book have not posted in the bank charges account 5. A sale of goods to K Lamb $230 was correctly entered in the sales book but entered in the personal account as $230 Requilred; a. Show the requisite journal enitries to correct the errors b. Write up the suspense account showing the correction of the errors c. The net profit originally calculated of 2020 was $28,400. Show your calculation of the corrected figure (20 marks)