Answered step by step

Verified Expert Solution

Question

1 Approved Answer

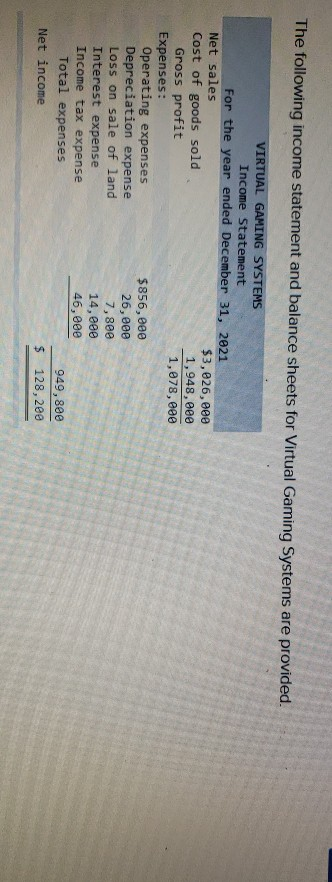

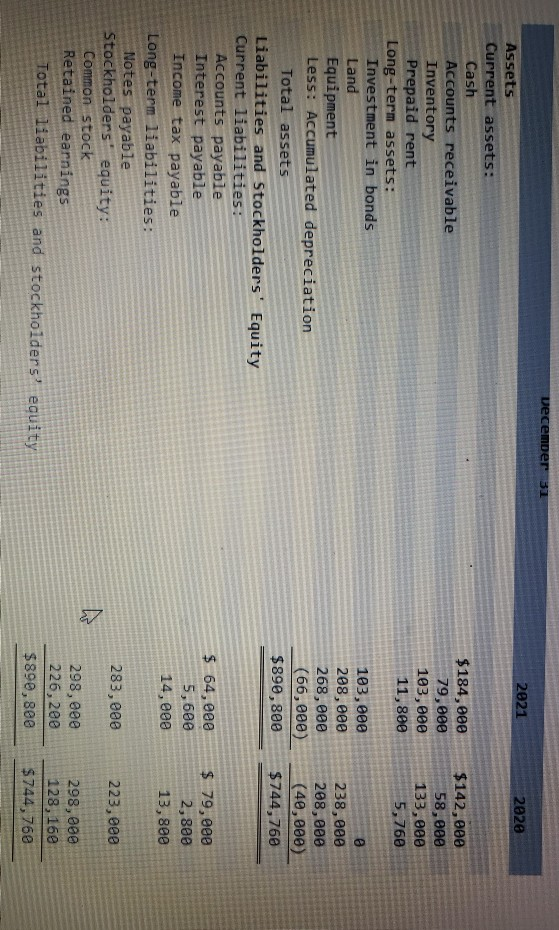

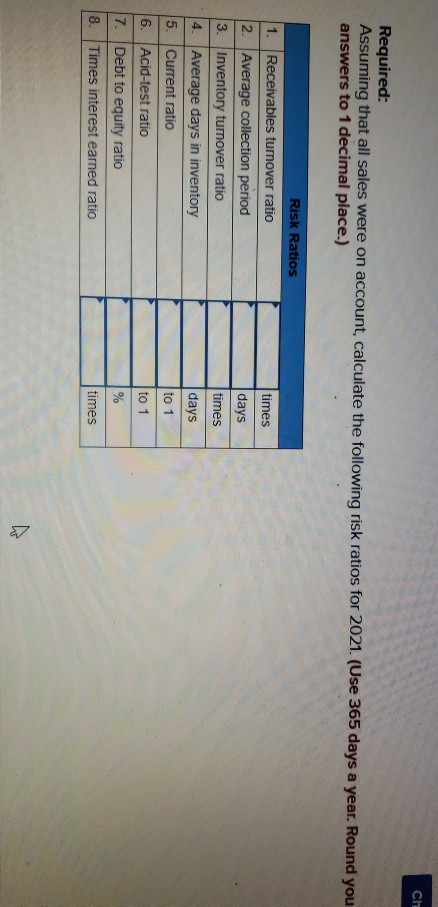

The following income statement and balance sheets for Virtual Gaming Systems are provided. VIRTUAL GAMING SYSTEMS Income Statement For the year ended December 31, 2021

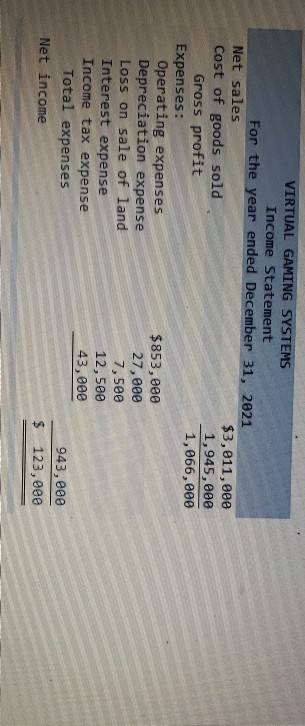

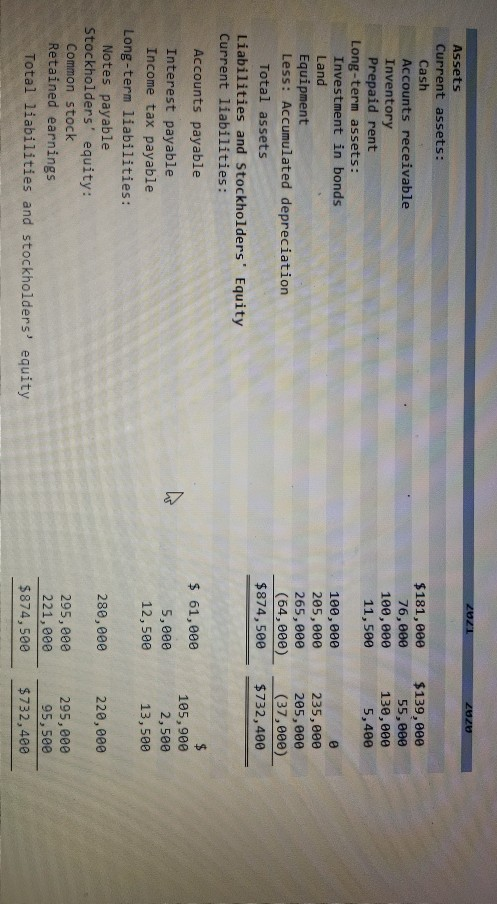

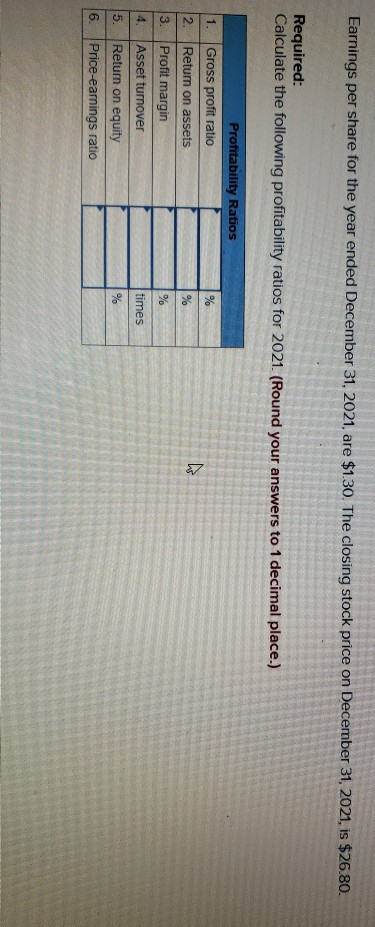

The following income statement and balance sheets for Virtual Gaming Systems are provided. VIRTUAL GAMING SYSTEMS Income Statement For the year ended December 31, 2021 Net sales $3,026,000 Cost of goods sold 1,948,000 Gross profit 1,078,000 Expenses: Operating expenses $856,000 Depreciation expense 26,000 Loss on sale of land 7,800 Interest expense 14,000 Income tax expense 46, eee Total expenses 949,800 Net income $ 128,200 December 31 2021 2020 $184,000 79,000 103,000 11,800 $142,000 58,000 133,000 5,768 Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders equity: Common stock Retained earnings Total liabilities and stockholders' equity 103,000 208,000 268,000 (66,000) $890,800 238,000 208,000 (40,000) $744,760 64, eee 5,600 14, eee $ 79,00 2,800 13,800 283,000 223, eee 298,eee 226,200 $899,800 298,000 128, 160 $744,760 Ch Required: Assuming that all sales were on account, calculate the following risk ratios for 2021. (Use 365 days a year. Round you answers to 1 decimal place.) times Risk Ratios Receivables turnover ratio Average collection period 3. Inventory turnover ratio 4. Average days in inventory 5. Current ratio Acid-test ratio Debt to equity ratio 8. Times interest earned ratio days times days to 1 to 1 times VIRTUAL GAMING SYSTEMS Income Statement For the year ended December 31, 2021 Net sales $3,011,000 Cost of goods sold 1,945,000 Gross profit 1,066,000 Expenses: Operating expenses $853,000 Depreciation expense 27,000 Loss on sale of land 7,500 Interest expense 12,500 Income tax expense 43,000 Total expenses 943,000 Net income $ 123,000 ZUZU $181,000 76,000 100,000 $139,000 55,000 130,000 5,400 11,500 100,000 205,000 265,000 (64,000) $874,500 235,000 205,000 (37,000) $732,400 Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity $ 61,000 5,000 12,500 105,900 2,500 13,500 280,000 220,000 295,000 221,000 $874,500 295,000 95,500 $732,400 Earnings per share for the year ended December 31, 2021, are $1.30. The closing stock price on December 31, 2021, is $26.80. Required: Calculate the following profitability ratios for 2021. (Round your answers to 1 decimal place.) Profitability Ratios 1. Gross profit ratio Return on assets Profit margin Asset turnover Return on equity 6. Price-earnings ratio times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started