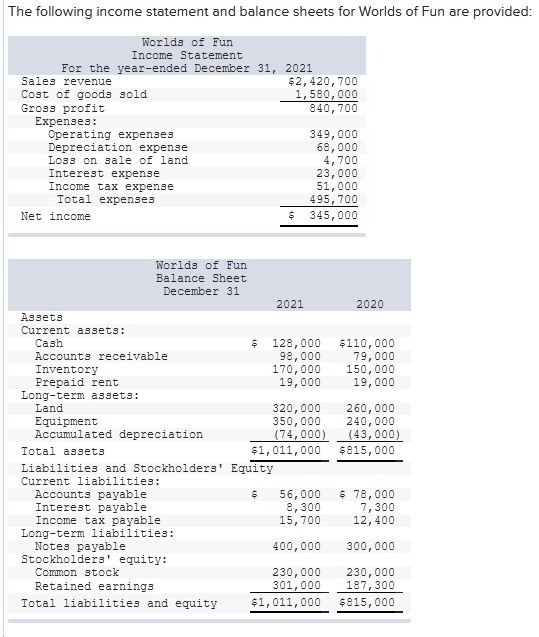

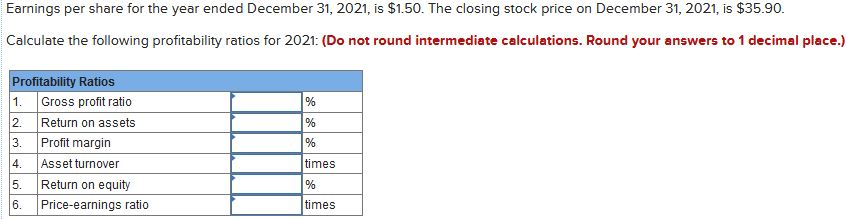

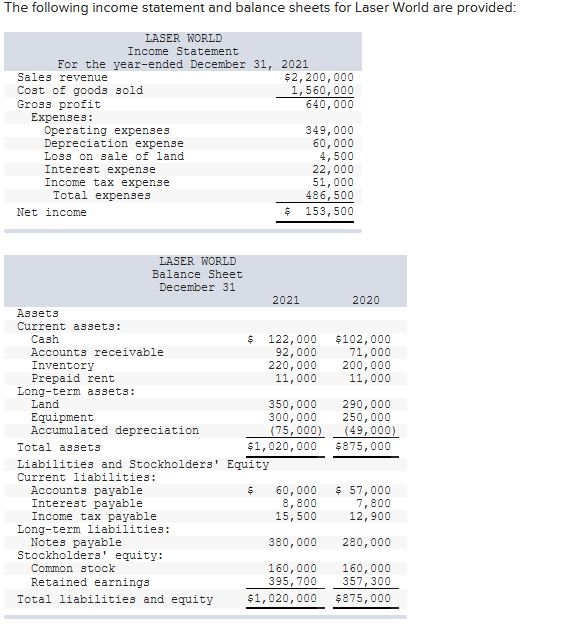

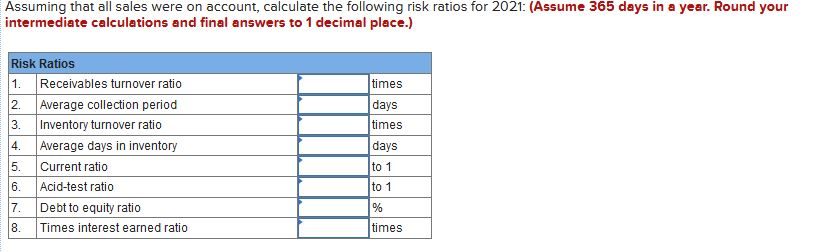

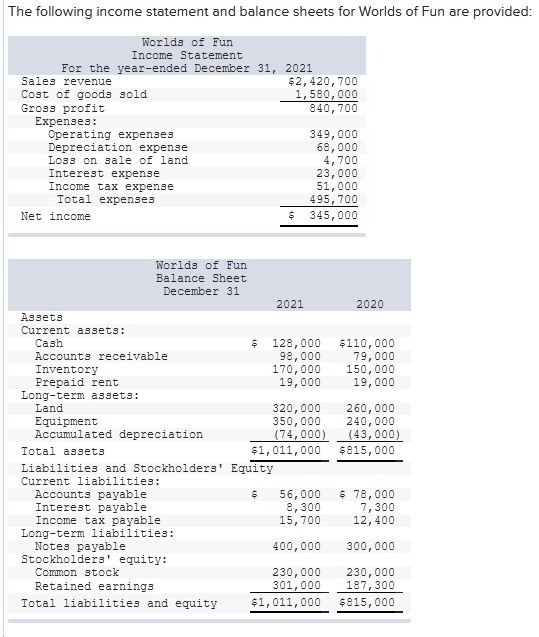

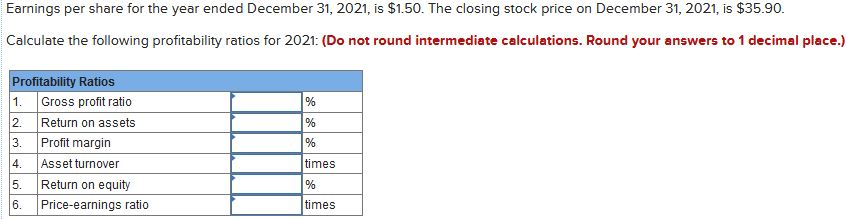

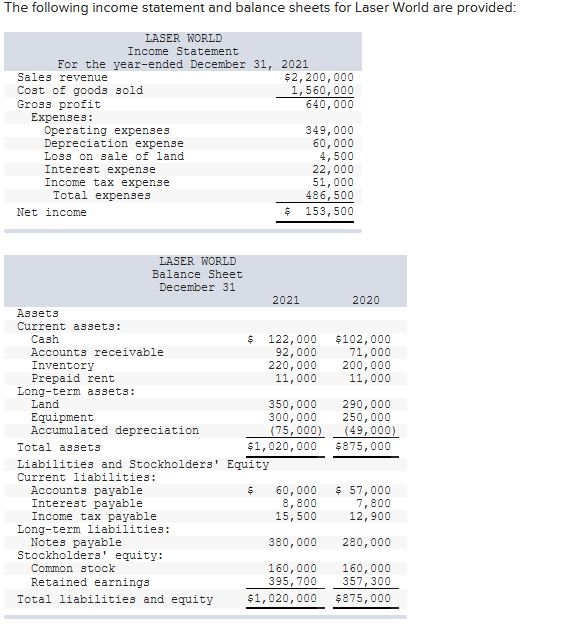

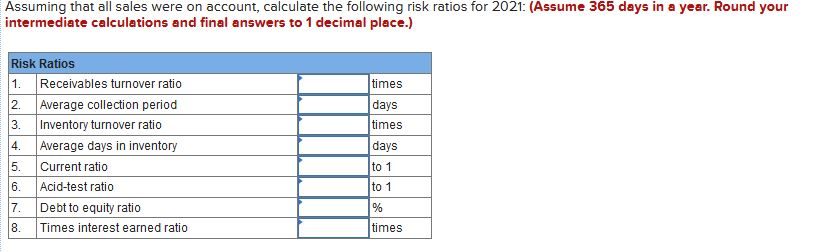

The following income statement and balance sheets for Worlds of Fun are provided: Worlds of Fun Income Statement For the year-ended December 31, 2021 Sales revenue $2,420,700 Cost of goods 3old 1,580,000 Gross profit 840,700 Expenses: Operating expenses 349,000 Depreciation expense 68,000 Lo33 on sale of land 4,700 Interest expense 23,000 Income tax expense 51,000 Total expenses 495,700 Net income 345,000 2020 $110,000 79,000 150,000 19,000 Worlds of Fun Balance Sheet December 31 2021 Assets Current assets: Cash 128,000 Accounts receivable 98,000 Inventory 170,000 Prepaid rent 19,000 Long-term assets: Land 320,000 Equipment 350,000 Accumulated depreciation (74,000) Total assets $1,011,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 56,000 Interest payable 8,300 Income tax payable 15,700 Long-term liabilities: Notes payable 400,000 Stockholders' equity: Common stock 230,000 Retained earnings 301,000 Total liabilities and equity $1,011,000 260,000 240,000 (43,000) $815,000 $ 78,000 7,300 12,400 300,000 230,000 187,300 $815,000 Earnings per share for the year ended December 31, 2021, is $1.50. The closing stock price on December 31, 2021, is $35.90. Calculate the following profitability ratios for 2021: (Do not round intermediate calculations. Round your answers to 1 decimal place.) Profitability Ratios 1. Gross profit ratio 2. Return on assets 3. Profit margin Asset turnover Return on equity Price-earnings ratio times times The following income statement and balance sheets for Laser World are provided: LASER WORLD Income Statement For the year-ended December 31, 2021 Sales revenue $2,200,000 Cost of goods sold 1,560,000 Gross profit 640,000 Expenses: Operating expenses 349,000 Depreciation expense 60,000 Logs on sale of land 4,500 Interest expense 22,000 Income tax expense 51,000 Total expenses 486,500 Net income $ 153,500 2020 $102,000 71,000 200,000 11,000 LASER WORLD Balance Sheet December 31 2021 Assets Current assets: Cash 122,000 Accounts receivable 92,000 Inventory 220,000 Prepaid rent 11,000 Long-term assets: Land 350,000 Equipment 300,000 Accumulated depreciation (75,000) Total assets $1,020,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable 60,000 Interest payable 8,800 Income tax payable 15,500 Long-term liabilities: Notes payable 380,000 Stockholders' equity: Common stock 160,000 Retained earnings 395,700 Total liabilities and equity $1,020,000 290,000 250,000 (49,000) $875,000 $ 57,000 7,800 12,900 280,000 160,000 357, 300 $875,000 Assuming that all sales were on account, calculate the following risk ratios for 2021: (Assume 365 days in a year. Round your intermediate calculations and final answers to 1 decimal place.) times days times Risk Ratios 1. Receivables turnover ratio 2. Average collection period 3. Inventory turnover ratio Average days in inventory Current ratio 6. Acid-test ratio Debt to equity ratio 8. Times interest earned ratio days 5. to 1 to 1 times