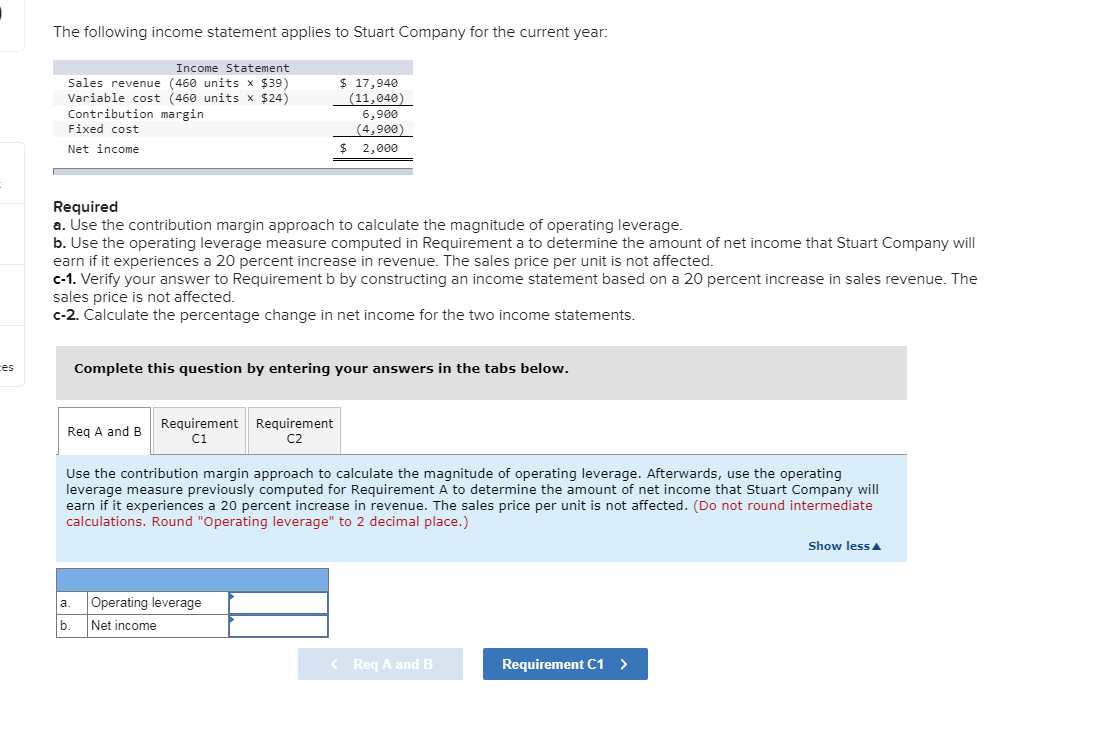

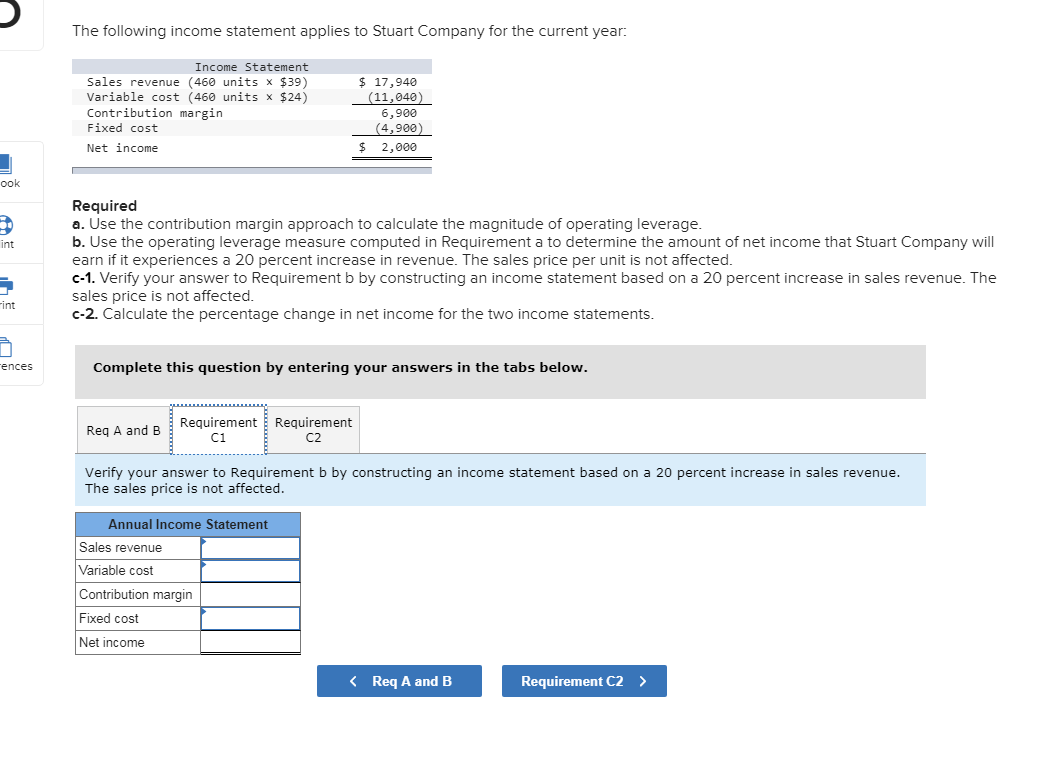

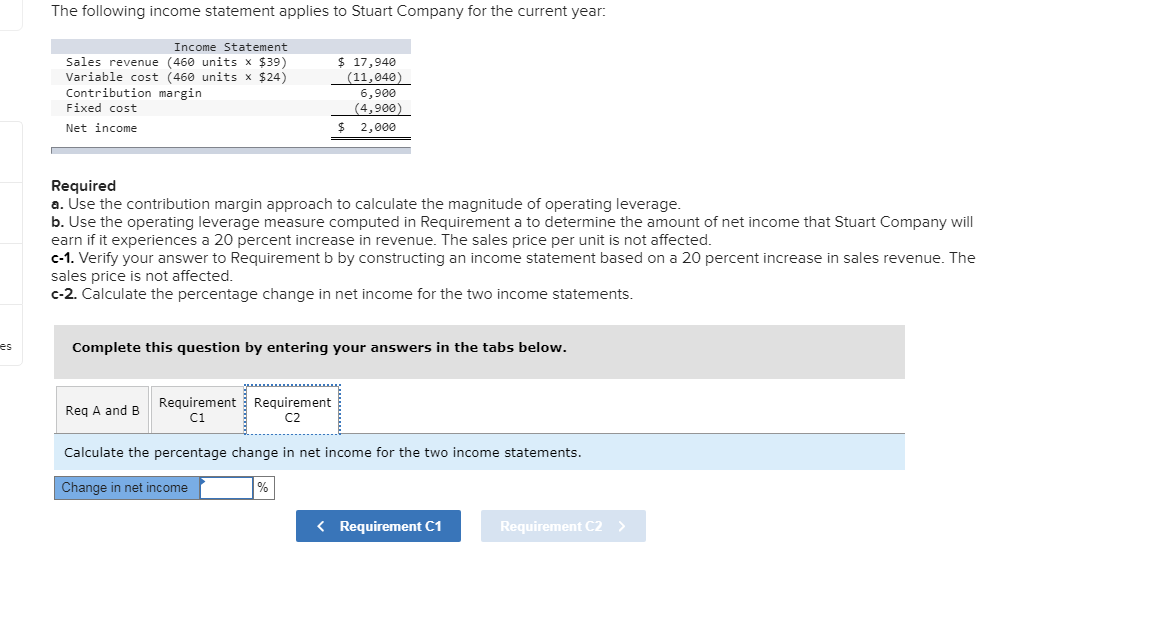

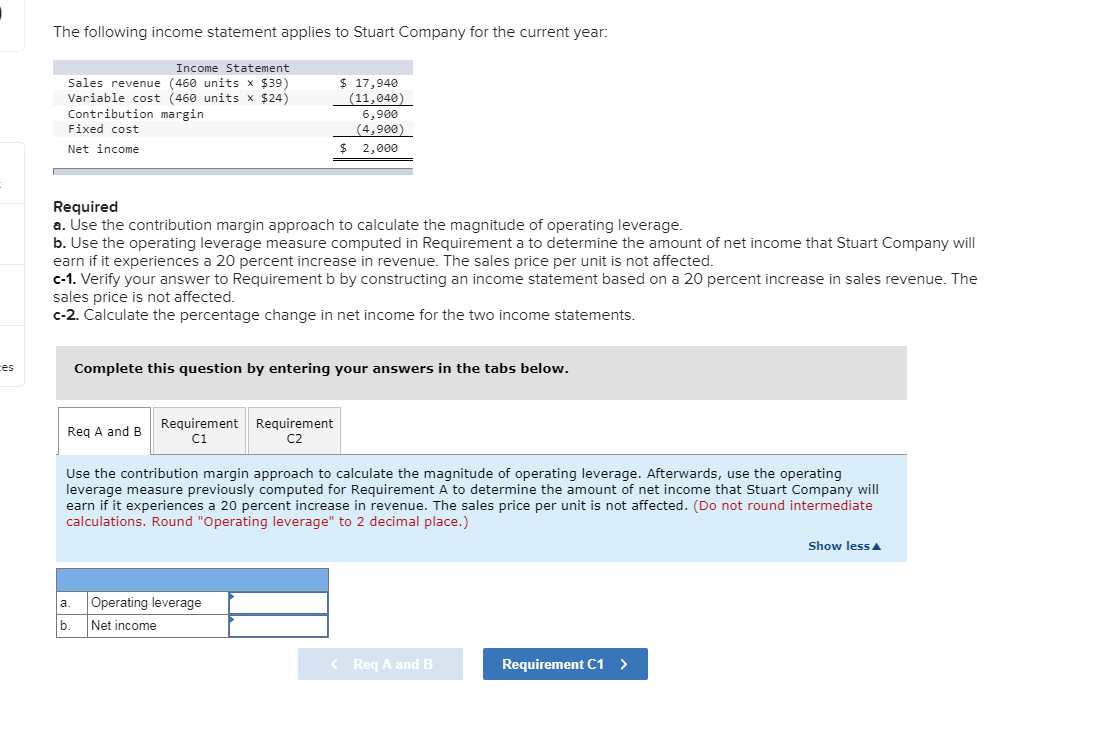

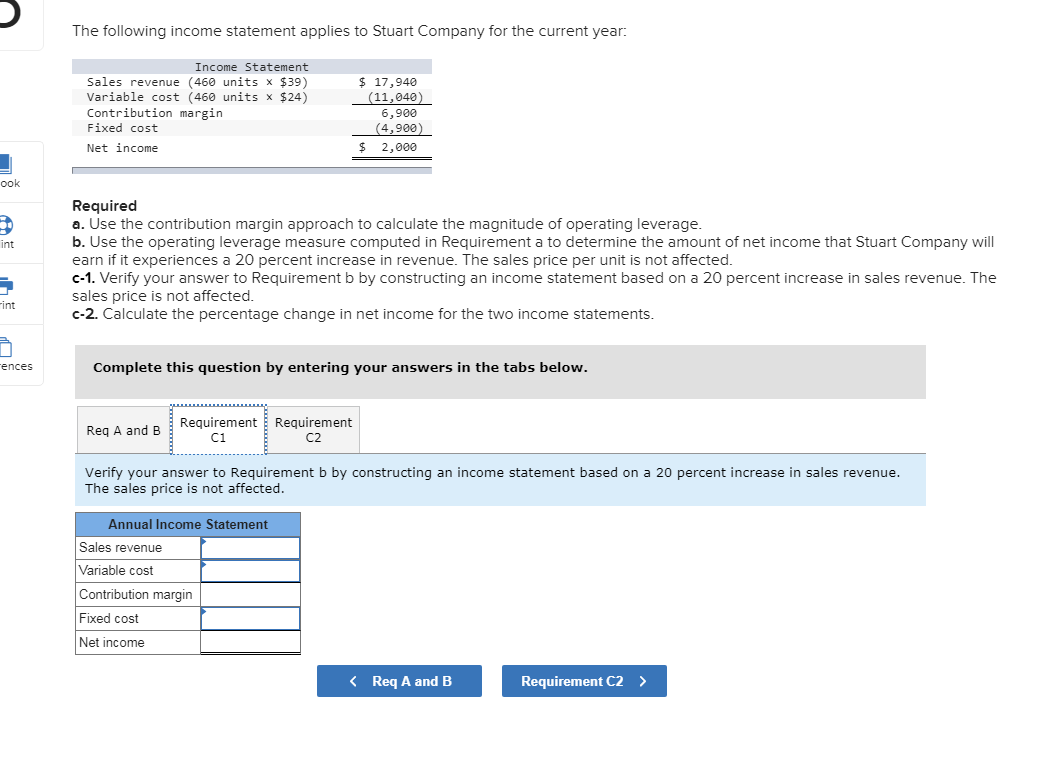

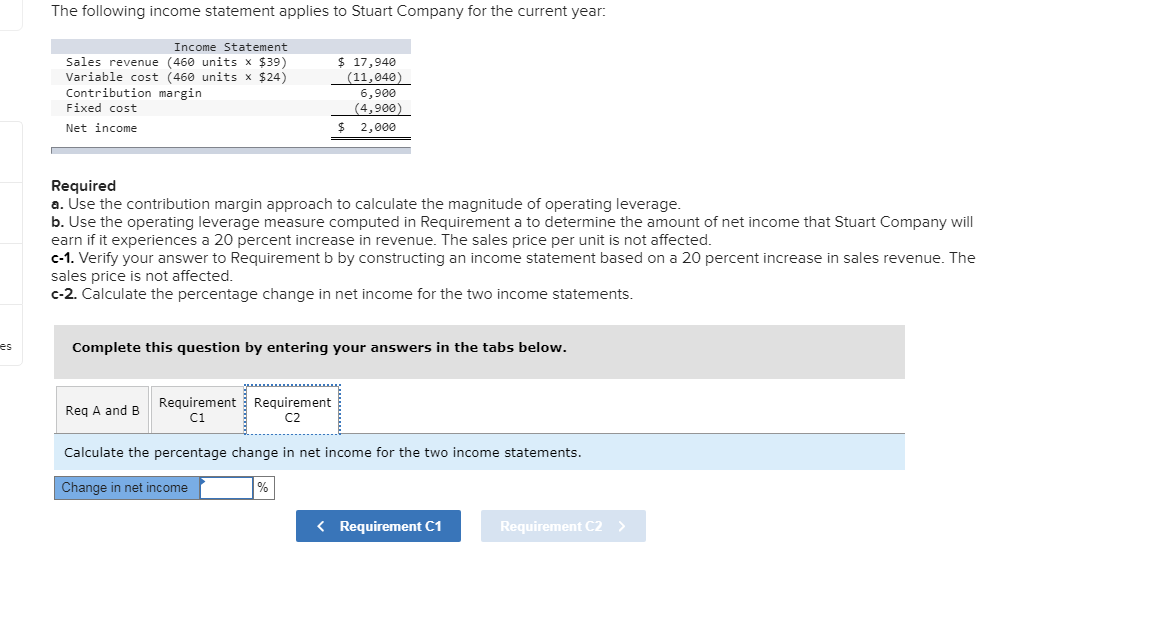

The following income statement applies to Stuart Company for the current year: Income Statement Sales revenue (460 units x $39) Variable cost (460 units x $24) Contribution margin Fixed cost 17,940 (11,040) 6,900 (4,900) Net income 2,000 Required a. Use the contribution margin approach to calculate the magnitude of operating leverage. b. Use the operating leverage measure computed in Requirement a to determine the amount of net income that Stuart Company will earn if it experiences a 20 percent increase in revenue. The sales price per unit is not affected. c-1. Verify your answer to Requirement b by constructing an income statement based on a 20 percent increase in sales revenue. The sales price is not affected. c-2. Calculate the percentage change in net income for the two income statements. es Complete this question by entering your answers in the tabs below. Requirement Requirement Req A and B C1 C2 Use the contribution margin approach to calculate the magnitude of operating leverage. Afterwards, use the operating leverage measure previously computed for Requirement A to determine the amount of net income that Stuart Company will earn if it experiences a 20 percent increase in revenue. The sales price per unit is not affected. (Do not round intermediate calculations. Round "Operating leverage" to 2 decimal place.) Show less Operating leverage a. Net income Req A and B Requirement C1 > The following income statement applies to Stuart Company for the current year Income Statement Sales revenue (460 units x $39) Variable cost (460 units x $24) Contribution margin 17,940 (11,040) 6,900 Fixed cost (4,900) $2,000 Net income ook Required a. Use the contribution margin approach to calculate the magnitude of operating leverage. b. Use the operating leveragee measure computed in Requirement a to determine the amount of net income that Stuart Company will earn if it experiences a 20 percent increase in revenue. The sales price per unit is not affected. c-1. Verify your answer to Requirement b by constructing an income statement based on a 20 percent increase in sales revenue. The sales price is not affected. c-2. Calculate the percentage change in net income for the two income statements. int int ences Complete this question by entering your answers in the tabs below. Requirement Requirement Req A and B C1 C2 Verify your answer to Requirement b by constructing an income statement based on a 20 percent increase in sales revenue. The sales price is not affected. Annual Income Statement Sales revenue Variable cost Contribution margin Fixed cost Net income Req A and B Requirement C2 > The following income statement applies to Stuart Company for the current year: Income Statement Sales revenue (460 units x $39) Variable cost (460 units x $24) Contribution margin Fixed cost 17,940 (11,040) 6,900 (4,900) Net income 2,000 Required a. Use the contribution margin approach to calculate the magnitude of operating leverage. b. Use the operating leveragee measure computed in Requirement a to determine the amount of net income that Stuart Company will earn if it experiences a 20 percent increase in revenue. The sales price per unit is not affected. c-1. Verify your answer to Requirement b by constructing an income statement based on a 20 percent increase in sales revenue. The sales price is not affected. c-2. Calculate the percentage change in net income for the two income statements. Complete this question by entering your answers in the tabs below. es Requirement Requirement Req A and B C1 C2 Calculate the percentage change in net income for the two income statements. Change in net income % Requirement C1 Requirement C2 >