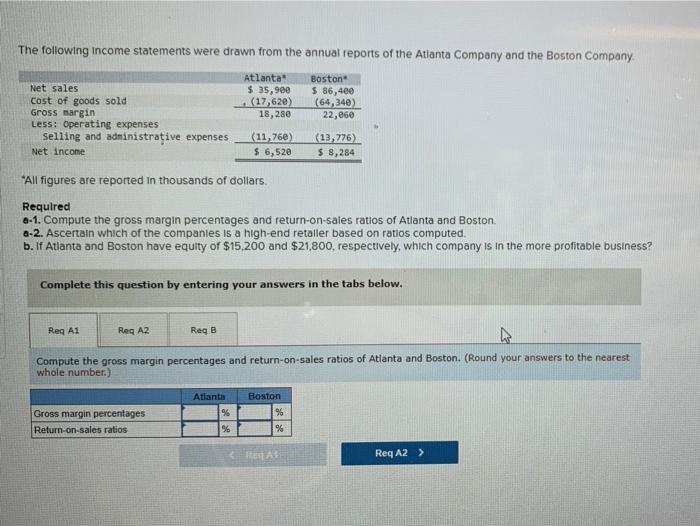

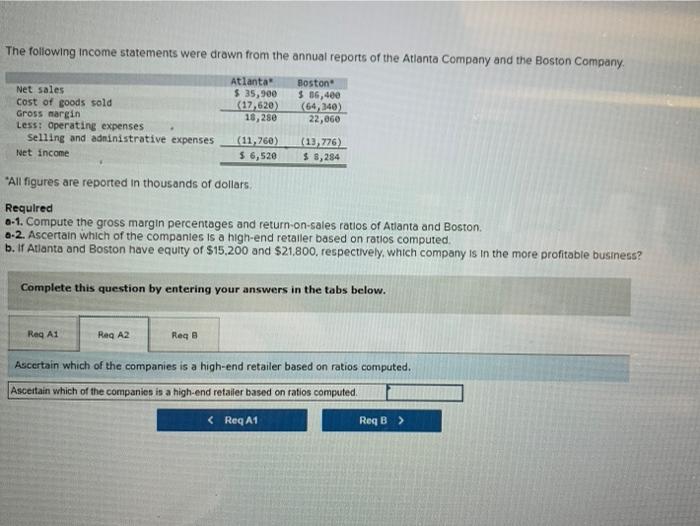

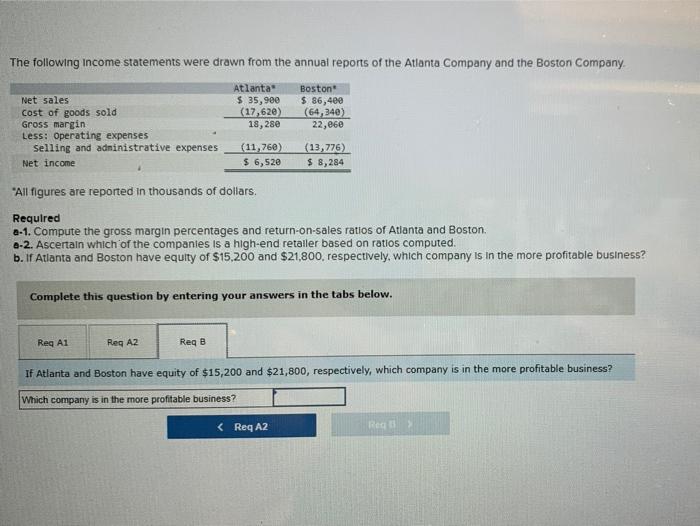

The following income statements were drawn from the annual reports of the Atlanta Company and the Boston Company Atlanta $ 35,900 (17,620) 18,280 Boston $ 86,400 (64,340) 22,060 Net sales Cost of goods sold Gross margin Less: Operating expenses Selling and administrative expenses Net Income (11,760) $ 6,520 (13,776) $ 8,284 *All figures are reported in thousands of dollars. Required 6-1. Compute the gross margin percentages and return-on-sales ratios of Atlanta and Boston. a-2. Ascertain which of the companies is a high-end retailer based on ratlos computed. b. If Atlanta and Boston have equity of $15,200 and $21,800, respectively, which company is in the more profitable business? Complete this question by entering your answers in the tabs below. Reg A1 Reg A2 Reg B Compute the gross margin percentages and return-on-sales ratios of Atlanta and Boston. (Round your answers to the nearest whole number.) Boston Atlanta % 96 Gross margin percentages Return-on-sales ratios 90 % Req A2 > The following income statements were drawn from the annual reports of the Atlanta Company and the Boston Company Net sales Cost of goods sold Gross margin Less: Operating expenses Selling and administrative expenses Net income Atlanta $ 35,900 (17,620) 18,280 Boston $ 06,400 (64,140) 22,060 (11,760) $ 6,520 (13,776) $ 3,284 *All figures are reported in thousands of dollars. Required 0-1. Compute the gross margin percentages and return-on-sales ratios of Atlanta and Boston 2-2. Ascertain which of the companies is a high-end retailer based on ratlos computed. b. If Atlanta and Boston have equity of $15,200 and $21,800, respectively, which company is in the more profitable business? Complete this question by entering your answers in the tabs below. Reg A1 Reg A2 Req Ascertain which of the companies is a high-end retailer based on ratios computed. Ascertain which of the companies is a high-end retailer based on ratios computed. The following Income statements were drawn from the annual reports of the Atlanta Company and the Boston Company Atlanta $ 35,900 (17,620) 18,280 Boston $ 86,400 (64,340) 22,860 Net sales Cost of goods sold Gross margin Less: Operating expenses Selling and administrative expenses Net income (11,760) $ 6,520 (13,776) $ 8,284 "All figures are reported in thousands of dollars. Required 2-1. Compute the gross margin percentages and return-on-sales ratios of Atlanta and Boston 2-2. Ascertain which of the companies is a high-end retailer based on ratios computed. b. If Atlanta and Boston have equity of $15,200 and $21,800, respectively, which company is in the more profitable business? Complete this question by entering your answers in the tabs below. Reg A1 Reg A2 Reg B If Atlanta and Boston have equity of $15,200 and $21,800, respectively, which company is in the more profitable business? Which company is in the more profitable business?