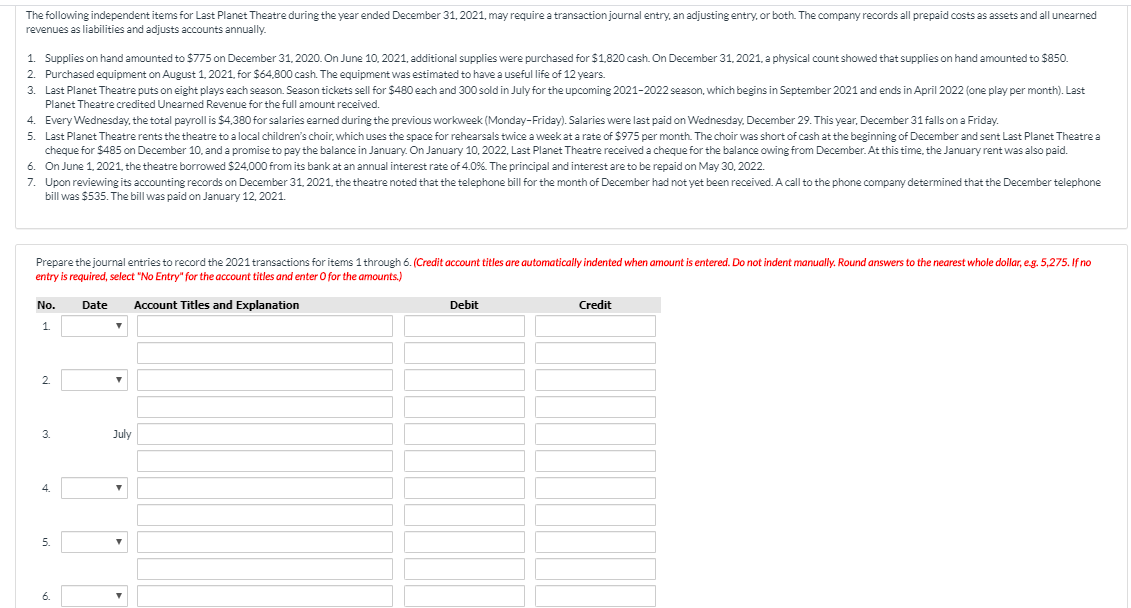

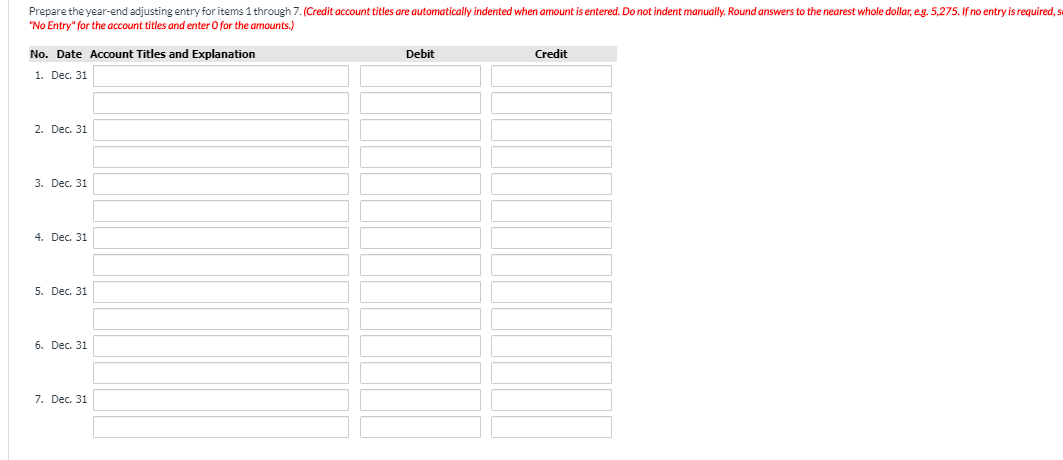

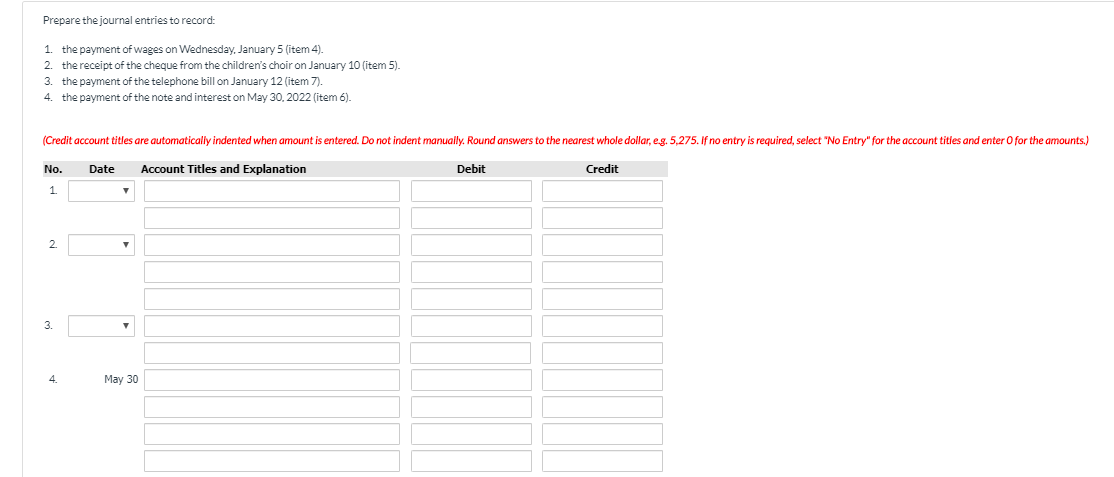

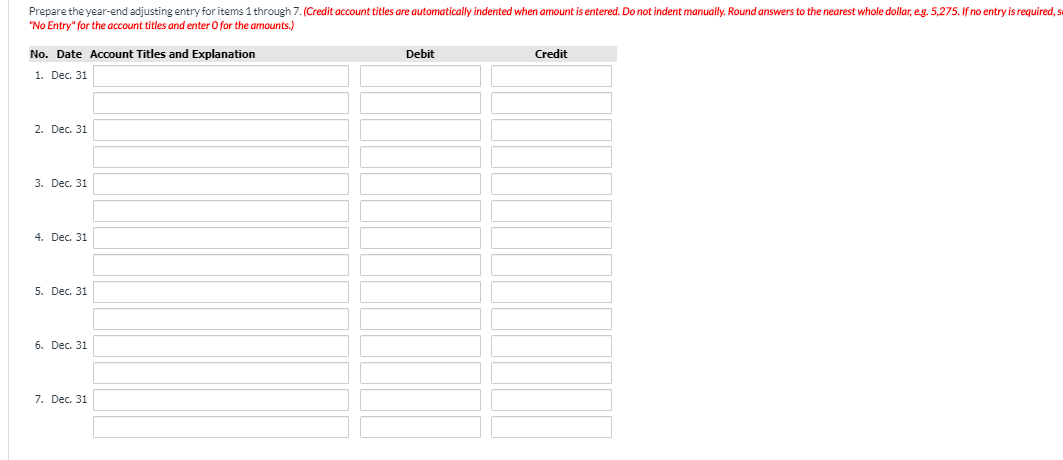

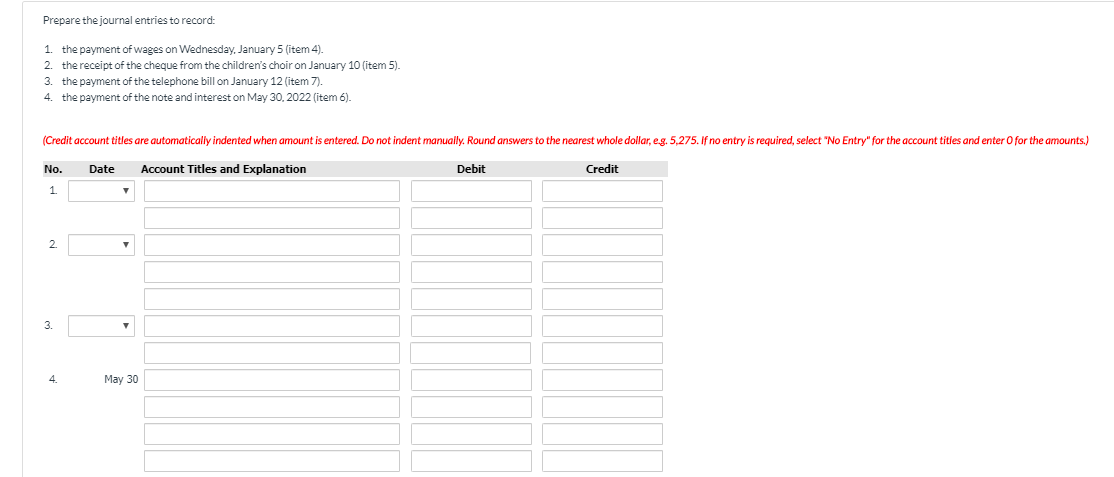

The following independent items for Last Planet Theatre during the year ended December 31, 2021, may require a transaction journal entry, an adjusting entry, or both. The company records all prepaid costs as assets and all unearned revenues as liabilities and adjusts accounts annually. 1. Supplies on hand amounted to $775 on December 31, 2020. On June 10, 2021, additional supplies were purchased for $1.820 cash On December 31, 2021, a physical count showed that supplies on hand amounted to $850. 2. Purchased equipment on August 1.2021, for $64,800 cash. The equipment was estimated to have a useful life of 12 years. 3. Last Planet Theatre puts on eight plays each season. Season tickets sell for $480 each and 300 sold in July for the upcoming 2021-2022 season, which begins in September 2021 and ends in April 2022 (one play per month). Last Planet Theatre credited Unearned Revenue for the full amount received. 4. Every Wednesday, the total payroll is $4.380 for salaries earned during the previous workweek (Monday-Friday). Salaries were last paid on Wednesday, December 29. This year, December 31 falls on a Friday. Y's choir, which uses the space for rehearsals twice a week at a rate of $975 per month The choir was short of cash at the beginning of December and sent Last Planet Theatre a cheque for $485 on December 10, and a promise to pay the balance in January. On January 10, 2022, Last Planet Theatre received a cheque for the balance owing from December. At this time, the January rent was also paid. 6. On June 1, 2021, the theatre borrowed $24,000 from its bank at an annual interest rate of 4.0%. The principal and interest are to be repaid on May 30, 2022. 7. Upon reviewing its accounting records on December 31, 2021, the theatre noted that the telephone bill for the month of December had not yet been received. A call to the phone company determined that the December telephone bill was $535. The bill was paid on January 12, 2021. Prepare the journal entries to record the 2021 transactions for items 1 through 6. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to the nearest whole dollar, e.g. 5,275. If no entry is required, select "No Entry"for the account titles and enter for the amounts.) No. Date Account Titles and Explanation Debit Credit 1 July Prepare the year-end adjusting entry for items 1 through 7. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to the nearest whole dollar, eg. 5,275. If no entry is required, "No Entry"for the account titles and enter for the amounts.) Debit Credit No. Date Account Titles and Explanation 1. Dec. 31 2. Dec. 31 3. Dec. 31 4. Dec. 31 5. Dec. 31 6. Dec. 31 7. Dec. 31 Prepare the journal entries to record: 1. the payment of wages on Wednesday, January 5 (item 4). 2. the receipt of the cheque from the children's choir on January 10 (item 5). 3. the payment of the telephone bill on January 12 (item 7). 4. the payment of the note and interest on May 30, 2022 (item 6). (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to the nearest whole dollar, eg. 5,275. If no entry is required, select "No Entry" for the account tities and enter for the amounts.) No. Date Account Titles and Explanation Debit Credit May 30