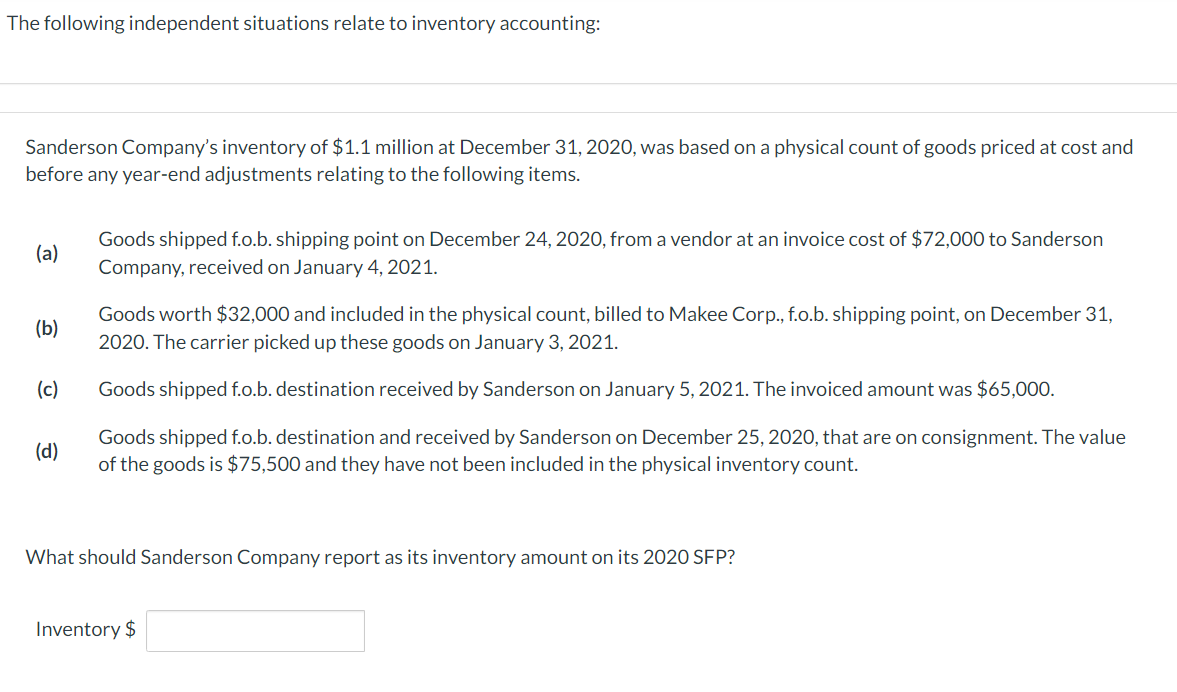

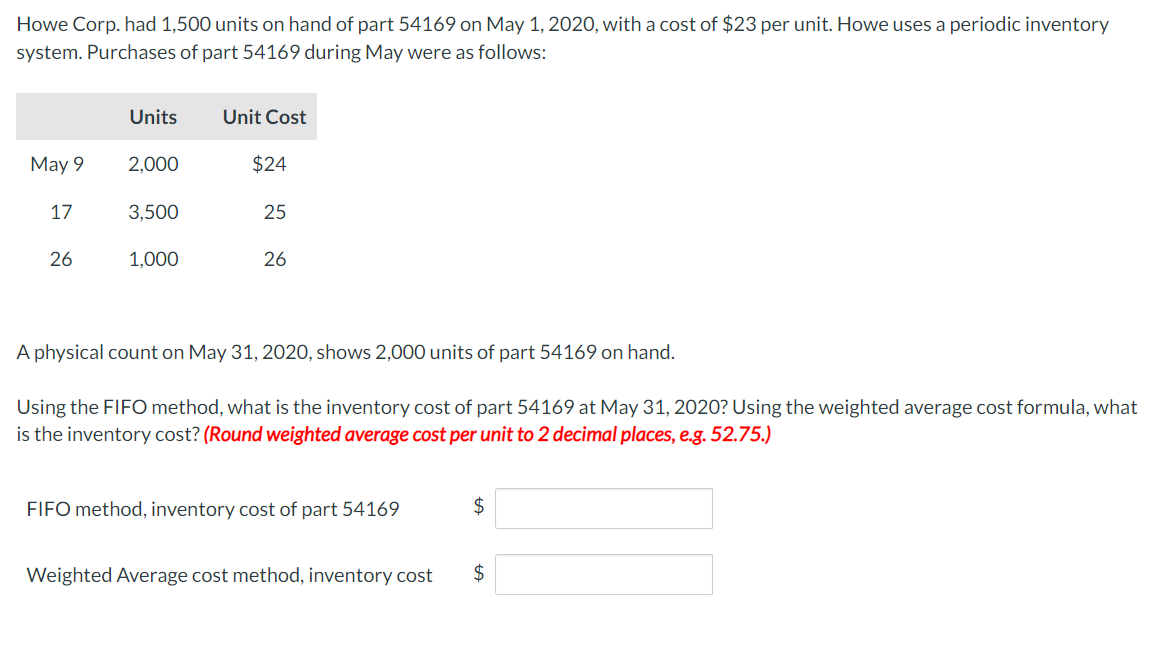

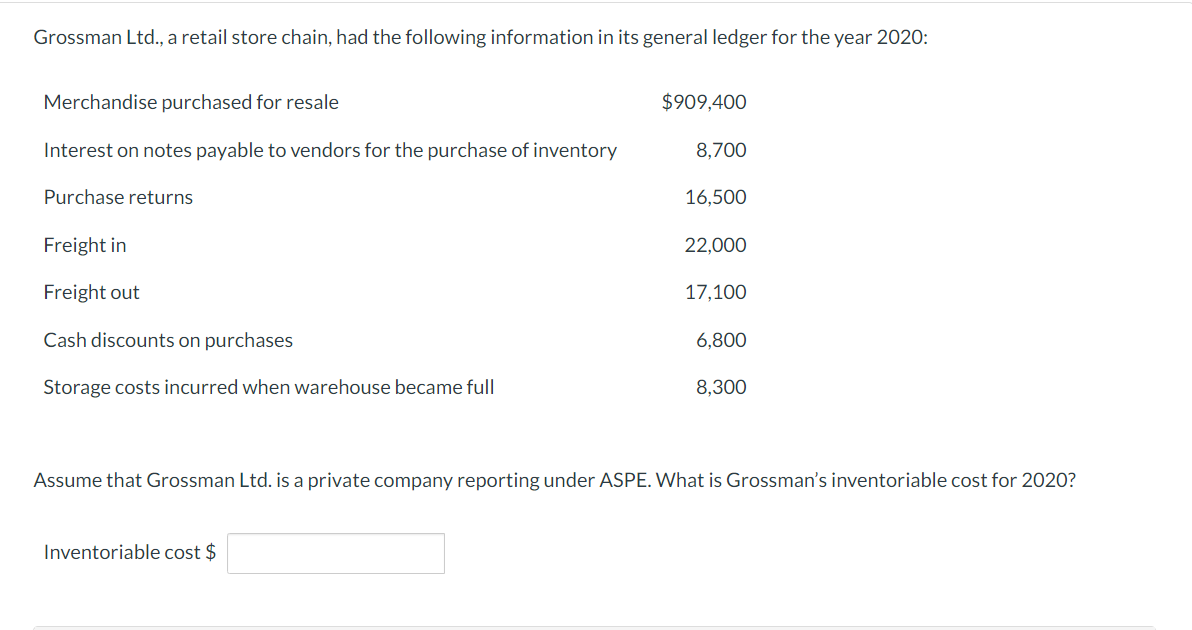

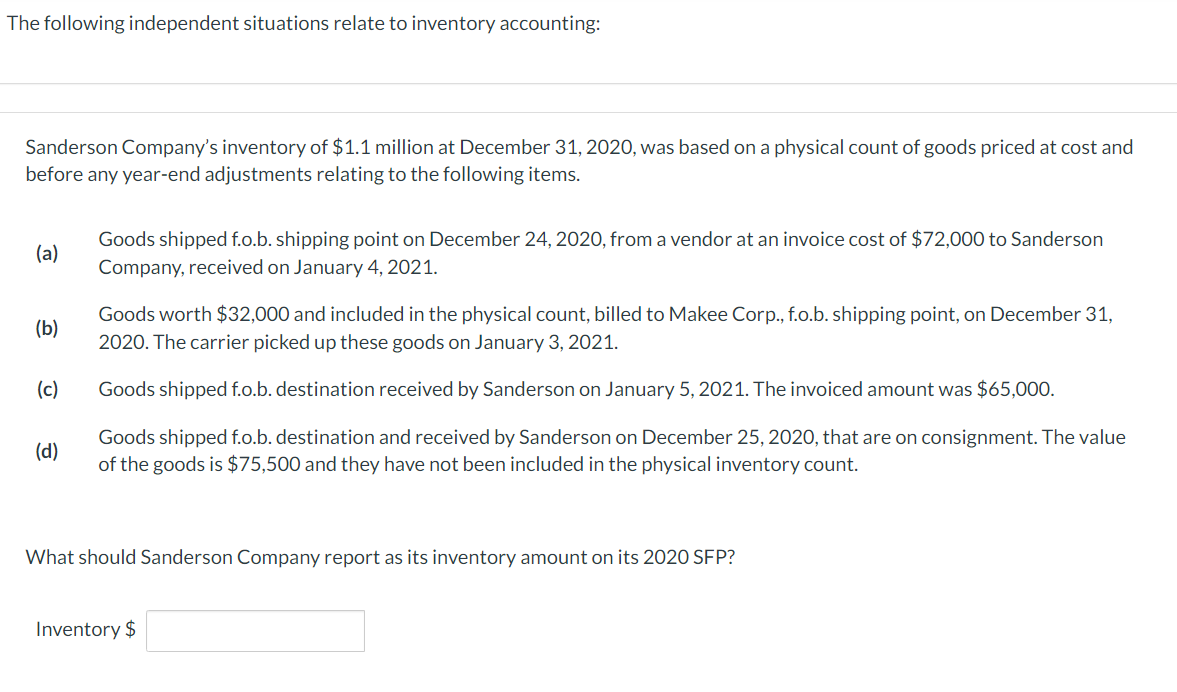

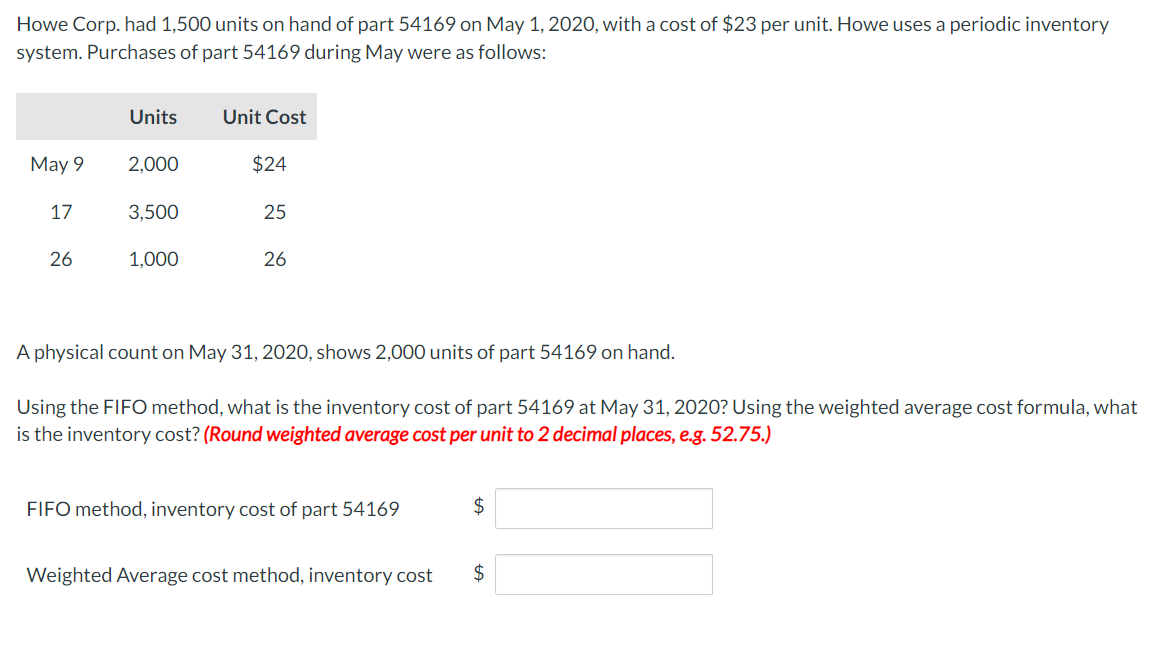

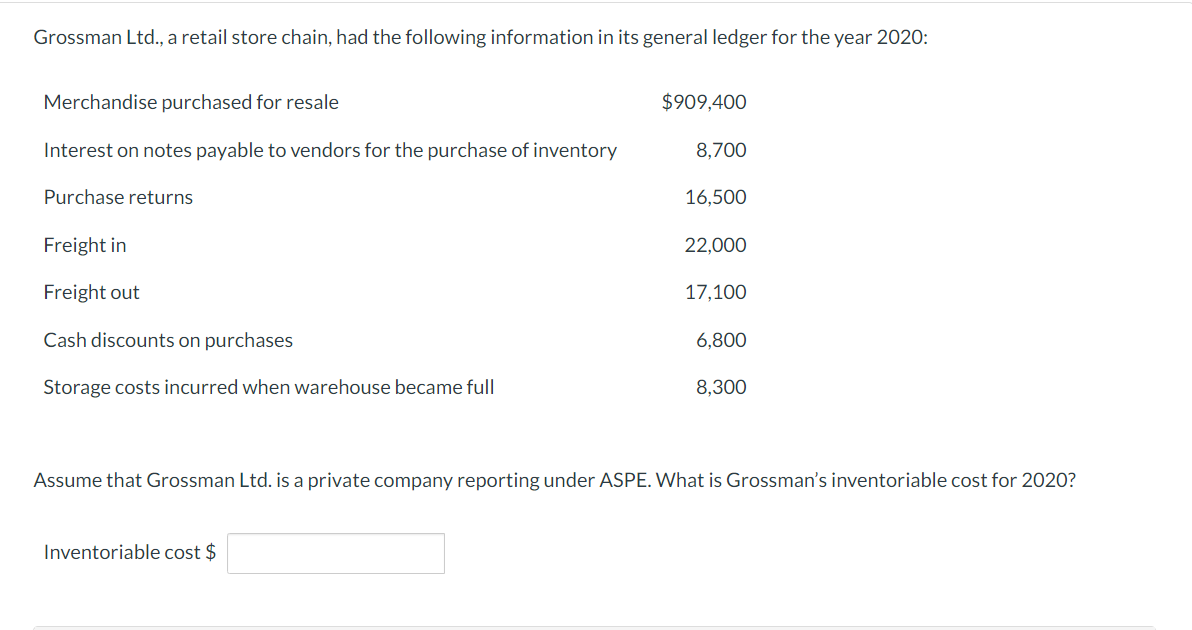

The following independent situations relate to inventory accounting: Sanderson Company's inventory of $1.1 million at December 31, 2020, was based on a physical count of goods priced at cost and before any year-end adjustments relating to the following items. (a) Goods shipped f.o.b. shipping point on December 24, 2020, from a vendor at an invoice cost of $72,000 to Sanderson Company, received on January 4, 2021. (b) Goods worth $32,000 and included in the physical count, billed to Makee Corp., f.o.b. shipping point, on December 31, 2020. The carrier picked up these goods on January 3, 2021. (c) Goods shipped f.o.b. destination received by Sanderson on January 5, 2021. The invoiced amount was $65,000. (d) Goods shipped f.o.b. destination and received by Sanderson on December 25, 2020, that are on consignment. The value of the goods is $75,500 and they have not been incl ded in the physical inventory count. What should Sanderson Company report as its inventory amount on its 2020 SFP? Inventory $ Howe Corp. had 1,500 units on hand of part 54169 on May 1, 2020, with a cost of $23 per unit. Howe uses a periodic inventory system. Purchases of part 54169 during May were as follows: Units Unit Cost May 9 2.000 $24 17 3,500 25 26 1,000 26 A physical count on May 31, 2020, shows 2,000 units of part 54169 on hand. Using the FIFO method, what is the inventory cost of part 54169 at May 31, 2020? Using the weighted average cost formula, what is the inventory cost? (Round weighted average cost per unit to 2 decimal places, e.g. 52.75.) FIFO method, inventory cost of part 54169 $ Weighted Average cost method, inventory cost $ Grossman Ltd., a retail store chain, had the following information in its general ledger for the year 2020: Merchandise purchased for resale $909,400 Interest on notes payable to vendors for the purchase of inventory 8,700 Purchase returns 16,500 Freight in 22,000 Freight out 17,100 Cash discounts on purchases 6,800 Storage costs incurred when warehouse became full 8,300 Assume that Grossman Ltd. is a private company reporting under ASPE. What is Grossman's inventoriable cost for 2020? Inventoriable cost $