Answered step by step

Verified Expert Solution

Question

1 Approved Answer

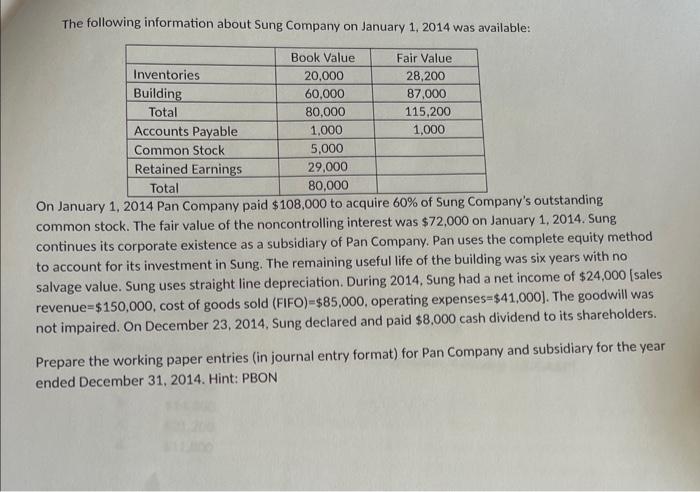

The following information about Sung Company on January 1, 2014 was available: Book Value Fair Value: Inventories 20,000 28,200 Building 60,000 87,000 Total 80,000

The following information about Sung Company on January 1, 2014 was available: Book Value Fair Value: Inventories 20,000 28,200 Building 60,000 87,000 Total 80,000 115,200 Accounts Payable 1,000 1,000 Common Stock 5,000 Retained Earnings 29,000 Total 80,000 On January 1, 2014 Pan Company paid $108,000 to acquire 60% of Sung Company's outstanding common stock. The fair value of the noncontrolling interest was $72,000 on January 1, 2014. Sung continues its corporate existence as a subsidiary of Pan Company. Pan uses the complete equity method to account for its investment in Sung. The remaining useful life of the building was six years with no salvage value. Sung uses straight line depreciation. During 2014, Sung had a net income of $24,000 [sales revenue $150,000, cost of goods sold (FIFO)=$85,000, operating expenses $41,000]. The goodwill was not impaired. On December 23, 2014, Sung declared and paid $8,000 cash dividend to its shareholders. Prepare the working paper entries (in journal entry format) for Pan Company and subsidiary for the year ended December 31, 2014. Hint: PBON

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the working paper entries for Pan Company and its subsidiary Sung Company for the year en...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started