Answered step by step

Verified Expert Solution

Question

1 Approved Answer

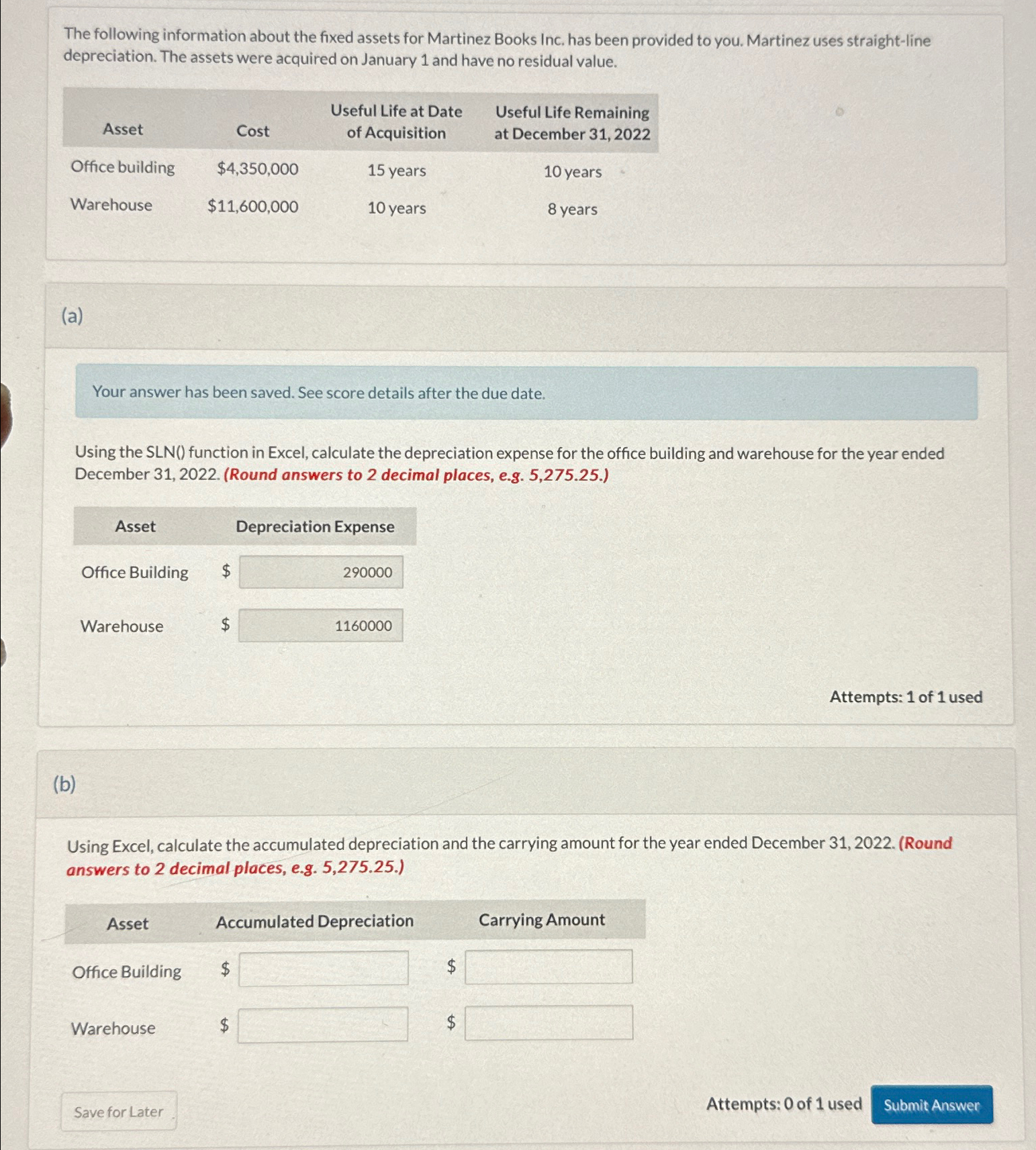

The following information about the fixed assets for Martinez Books Inc. has been provided to you. Martinez uses straight-line depreciation. The assets were acquired

The following information about the fixed assets for Martinez Books Inc. has been provided to you. Martinez uses straight-line depreciation. The assets were acquired on January 1 and have no residual value. Useful Life at Date Asset Cost of Acquisition Useful Life Remaining at December 31, 2022 Office building $4,350,000 15 years 10 years Warehouse $11,600,000 10 years 8 years (a) Your answer has been saved. See score details after the due date. Using the SLN() function in Excel, calculate the depreciation expense for the office building and warehouse for the year ended December 31, 2022. (Round answers to 2 decimal places, e.g. 5,275.25.) Depreciation Expense Asset Office Building $ 290000 Warehouse $ 1160000 Attempts: 1 of 1 used (b) Using Excel, calculate the accumulated depreciation and the carrying amount for the year ended December 31, 2022. (Round answers to 2 decimal places, e.g. 5,275.25.) Asset Accumulated Depreciation Carrying Amount Office Building Warehouse $ Save for Later Attempts: 0 of 1 used Submit Answer

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the depreciation expense for the office building and warehouse using the SLN function in Excel you can follow these steps 1 For th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started