Answered step by step

Verified Expert Solution

Question

1 Approved Answer

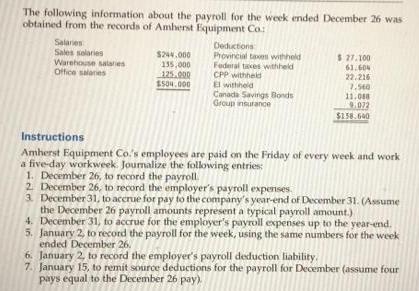

The following information about the payroll for the week ended December 26 was obtained from the records of Amherst Equipment Co Salaries Sales salaries

The following information about the payroll for the week ended December 26 was obtained from the records of Amherst Equipment Co Salaries Sales salaries Warehouse salaries Office salaries $244.000 135,000 125.000 $504.000 Deductions Provincial taxes withheld Federal taxes withheld CPP withheld El withheld Canada Savings Bonds Group insurance $ 27.100 61.604 22.216 7.540 11.088 072 $158.640 Instructions Amherst Equipment Co.'s employees are paid on the Friday of every week and work a five-day workweek. Journalize the following entries: 1. December 26, to record the payroll. 2 December 26, to record the employer's payroll expenses. 3. December 31, to accrue for pay to the company's year-end of December 31. (Assume the December 26 payroll amounts represent a typical payroll amount.) 4. December 31, to accrue for the employer's payroll expenses up to the year-end. 5. January 2, to record the payroll for the week, using the same numbers for the week ended December 26. 6. January 2, to record the employer's payroll deduction liability. 7. January 15, to remit source deductions for the payroll for December (assume four pays equal to the December 26 pay).

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 December 26 Debit Salaries Expense 50...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started