Answered step by step

Verified Expert Solution

Question

1 Approved Answer

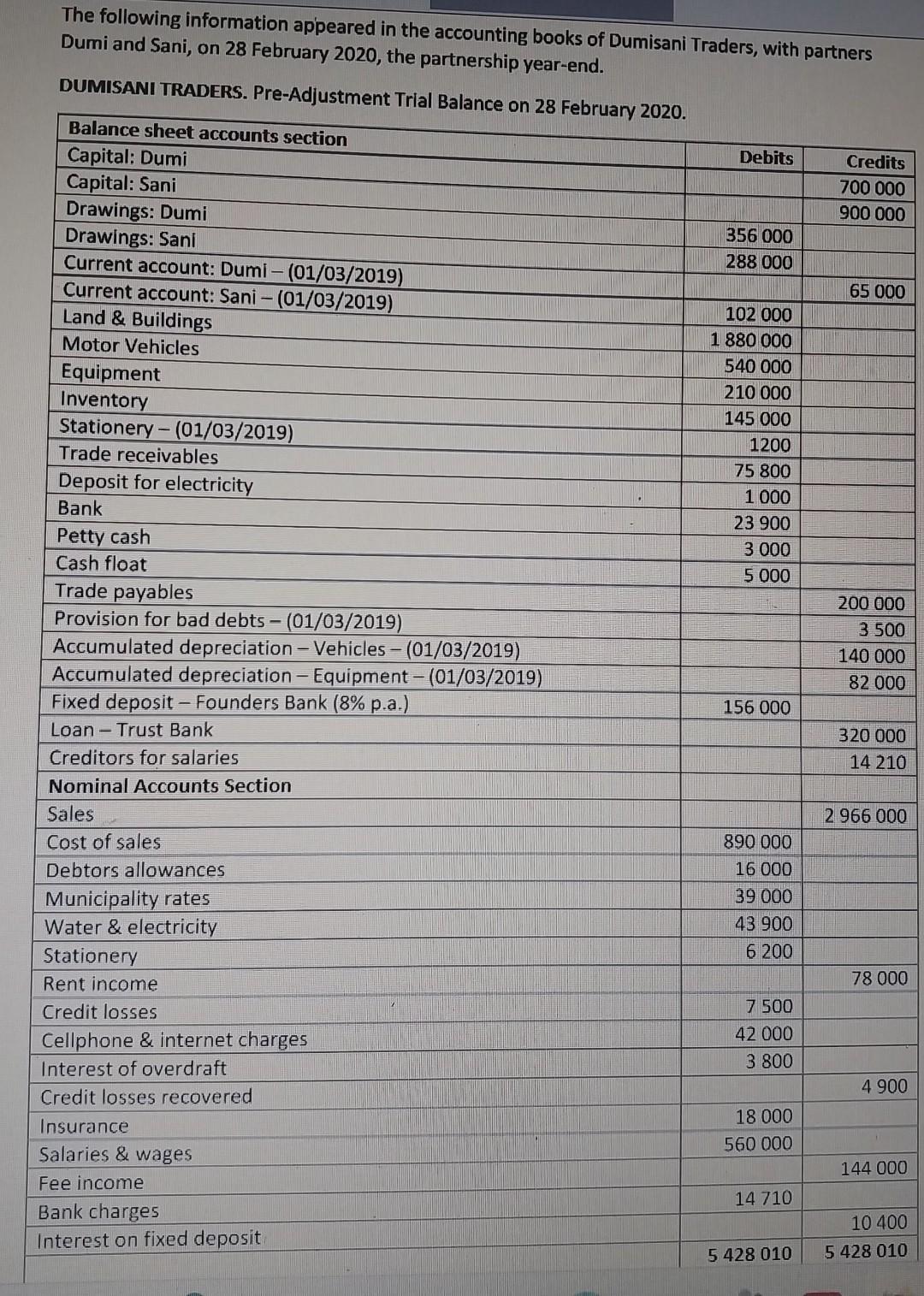

The following information appeared in the accounting books of Dumisani Traders, with partners Dumi and Sani, on 28 February 2020, the partnership year-end. DUMISANI

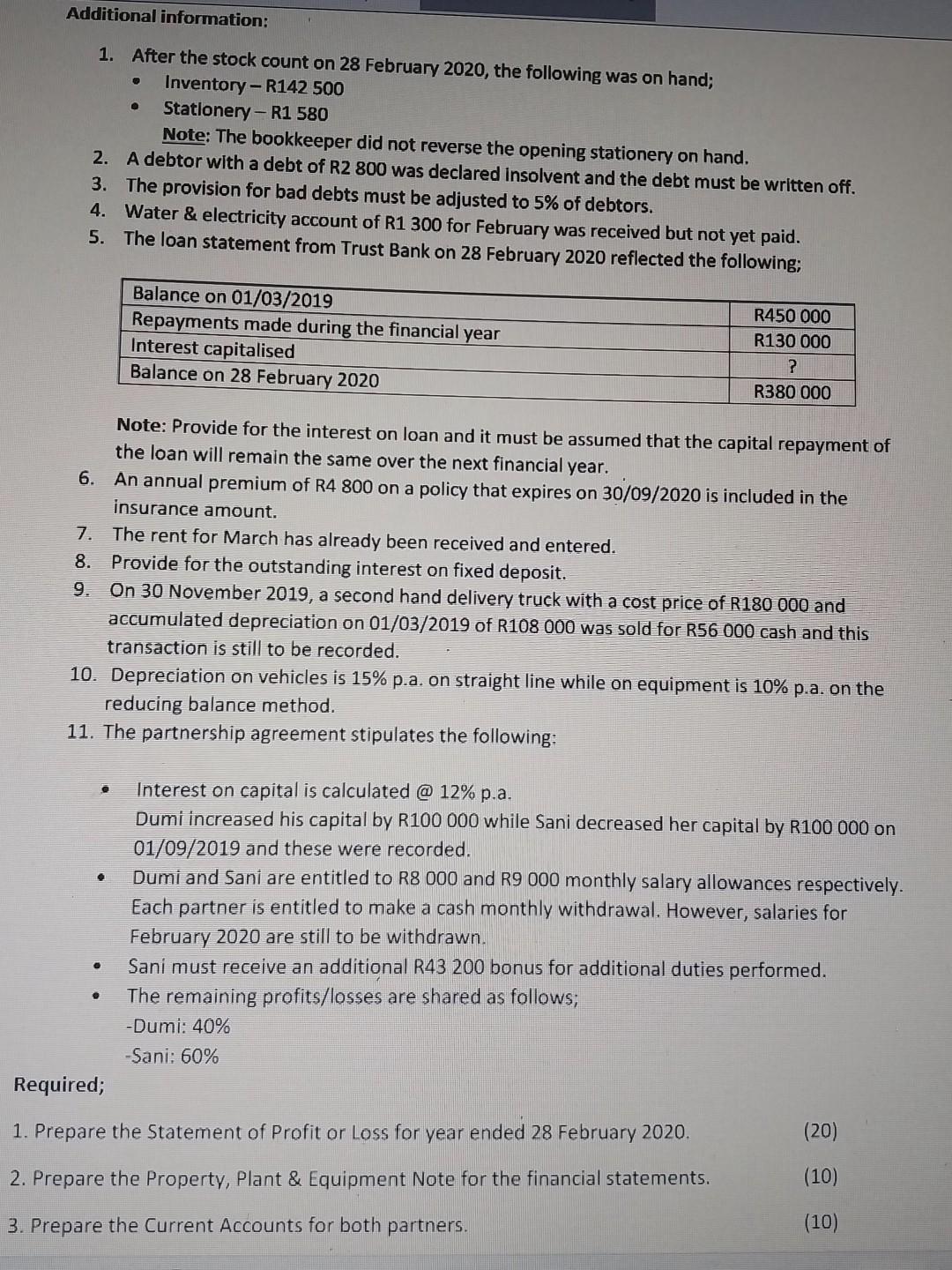

The following information appeared in the accounting books of Dumisani Traders, with partners Dumi and Sani, on 28 February 2020, the partnership year-end. DUMISANI TRADERS. Pre-Adjustment Trial Balance on 28 February 2020. Balance sheet accounts section Capital: Dumi Capital: Sani Drawings: Dumi Drawings: Sani Current account: Dumi- (01/03/2019) Current account: Sani - (01/03/2019) Land & Buildings Motor Vehicles Equipment Inventory Stationery-(01/03/2019) Trade receivables Deposit for electricity Bank Petty cash Cash float Trade payables Provision for bad debts- (01/03/2019) Accumulated depreciation - Vehicles -(01/03/2019) Accumulated depreciation - Equipment - (01/03/2019) Fixed deposit - Founders Bank (8% p.a.) Loan-Trust Bank Creditors for salaries Nominal Accounts Section Sales Cost of sales Debtors allowances Municipality rates Water & electricity Stationery Rent income Credit losses Cellphone & internet charges Interest of overdraft Credit losses recovered Insurance Salaries & wages Fee income Bank charges Interest on fixed deposit. Debits 356 000 288 000 102 000 1 880 000 540 000 210 000 145 000 1200 75 800 1 000 23 900 3 000 5 000 156 000 890 000 16 000 39 000 43 900 6 200 7 500 42 000 3 800 18 000 560 000 14 710 5 428 010 Credits 700 000 900 000 65 000 200 000 3.500 140 000 82 000 320 000 14 210 2 966 000 78 000 4 900 144 000 10 400 5 428 010 Additional information: 1. After the stock count on 28 February 2020, the following was on hand; Inventory - R142 500 Stationery - R1 580 Note: The bookkeeper did not reverse the opening stationery on hand. 2. A debtor with a debt of R2 800 was declared insolvent and the debt must be written off. 3. The provision for bad debts must be adjusted to 5% of debtors. 4. Water & electricity account of R1 300 for February was received but not yet paid. 5. The loan statement from Trust Bank on 28 February 2020 reflected the following; Note: Provide for the interest on loan and it must be assumed that the capital repayment of the loan will remain the same over the next financial year. 6. An annual premium of R4 800 on a policy that expires on 30/09/2020 is included in the insurance amount. Balance on 01/03/2019 Repayments made during the financial year Interest capitalised Balance on 28 February 2020 7. The rent for March has already been received and entered. 8. Provide for the outstanding interest on fixed deposit. 9. On 30 November 2019, a second hand delivery truck with a cost price of R180 000 and accumulated depreciation on 01/03/2019 of R108 000 was sold for R56 000 cash and this transaction is still to be recorded. 10. Depreciation on vehicles is 15% p.a. on straight line while on equipment is 10% p.a. on the reducing balance method. 11. The partnership agreement stipulates the following: R450 000 R130 000 ? R380 000 Interest on capital is calculated @ 12% p.a. Dumi increased his capital by R100 000 while Sani decreased her capital by R100 000 on 01/09/2019 and these were recorded. Dumi and Sani are entitled to R8 000 and R9 000 monthly salary allowances respectively. Each partner is entitled to make a cash monthly withdrawal. However, salaries for February 2020 are still to be withdrawn. Sani must receive an additional R43 200 bonus for additional duties performed. The remaining profits/losses are shared as follows; -Dumi: 40% -Sani: 60% Required; 1. Prepare the Statement of Profit or Loss for year ended 28 February 2020. 2. Prepare the Property, Plant & Equipment Note for the financial statements. 3. Prepare the Current Accounts for both partners. (20) (10) (10)

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Statement of Profit or Loss for the year ended 28 February 2020 Sales R2966000 Less Cost of Sales R890000 Gross Profit R2076000 Operating Expenses R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started