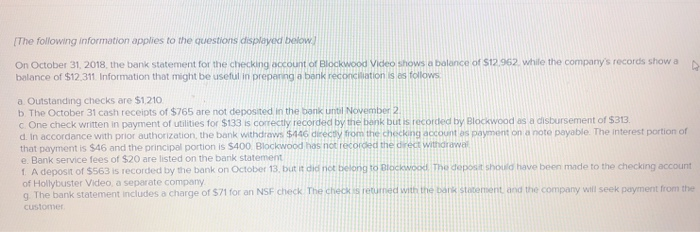

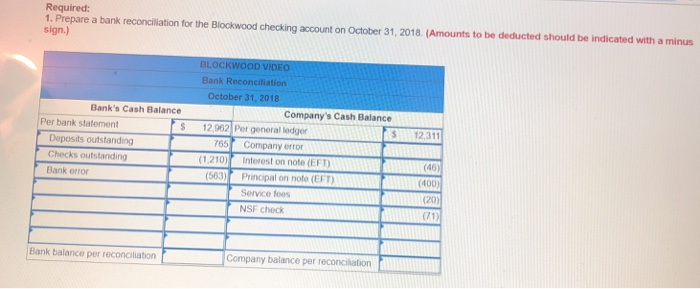

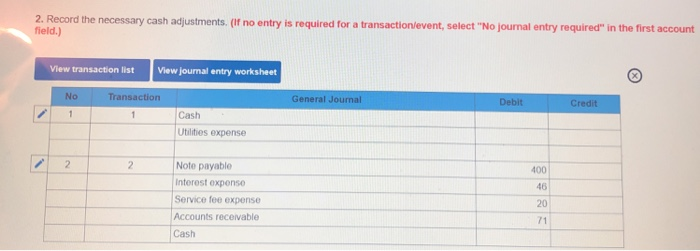

(The following information applies to the questions displayecd below On October 31.2018, the bank statement for the checkng account of balance of $12.311 Information that might be useful in preparng a bank reconciation is as folloWS Blockwood Video shows a balance of s12 962 while the company's records showa a Outstanding checks are $1.210 b The October 31 cash receipts of $765 are not deposited in the bank unbi November 2 c One check written in payment of utilities for $133 is correctly recorded by the benk but is recorded by Blockwood as a disbursement of $313 d in accordance with prior authorization, the bank withdraws $446 directy from the checking account as payment on a note payable. The interest portion of that payment is $46 and the principal portion is $400 Blockwood has not recorded the drect withdrawa e. Bank service fees of $20 are listed on the bank statement 1 A deposit of $563 is recorded by the bank on October 13, but i did not belong to Blockwood ihe deposit should have been made to the of Hollybuster Video, a separate company g The bank statement includes a charge or $71 for an NSF check The checkis retuned with the bank stotement customer of $71 for an NSF check The checkis reurned with the bark statement and the company will seek poyment from the Required: 1. Prepare a bank reconcililation for the Blockwood checking account on October 31, 2018. (Amounts to be deducted should be indicated with a minus sign.) Bank Reconciliation October 31, 2018 Bank's Cash Balance Company's Cash Balance Per bank statement S 12,962 Per general ledger 12,311 Deposits outstanding Checks outstanding Bank error mpany error 1210) Interest on note (EFT (563) Principal on noto (EFT Service fees NSF check (46 (400 (20) (71 Bank balance per reconciliation Company balance per reconcikation d the necessary cash adjustments. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet Transaction General Journal Debit Credit Cash Utilities expense Note payable Interest expense Service fee expense Accounts receivable Cash 400 46 20 71