Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[ The following information applies to the questions displayed below .] Starbooks Corporation provides an online bookstore for electronic books. The following is a simplified

[The following information applies to the questions displayed below.]

Starbooks Corporation provides an online bookstore for electronic books. The following is a simplified list of accounts and amounts reported in its accounting records. The accounts have normal debit or credit balances. Assume the year ended on September 30, 2021.

| Accounts Payable | $ 610 |

|---|---|

| Accounts Receivable | 310 |

| Accumulated Depreciation | 910 |

| Cash | 310 |

| Common Stock | 210 |

| Deferred Revenue | 210 |

| Depreciation Expense | 310 |

| Equipment | 3,210 |

| Income Tax Expense | 310 |

| Interest Revenue | 110 |

| Notes Payable (long-term) | 210 |

| Notes Payable (short-term) | 510 |

| Prepaid Rent | 110 |

| Rent Expense | 410 |

| Retained Earnings | 1,510 |

| Salaries and Wages Expense | 2,210 |

| Service Revenue | 6,230 |

| Supplies | 510 |

| Supplies Expense | 210 |

| Travel Expense | 2,610 |

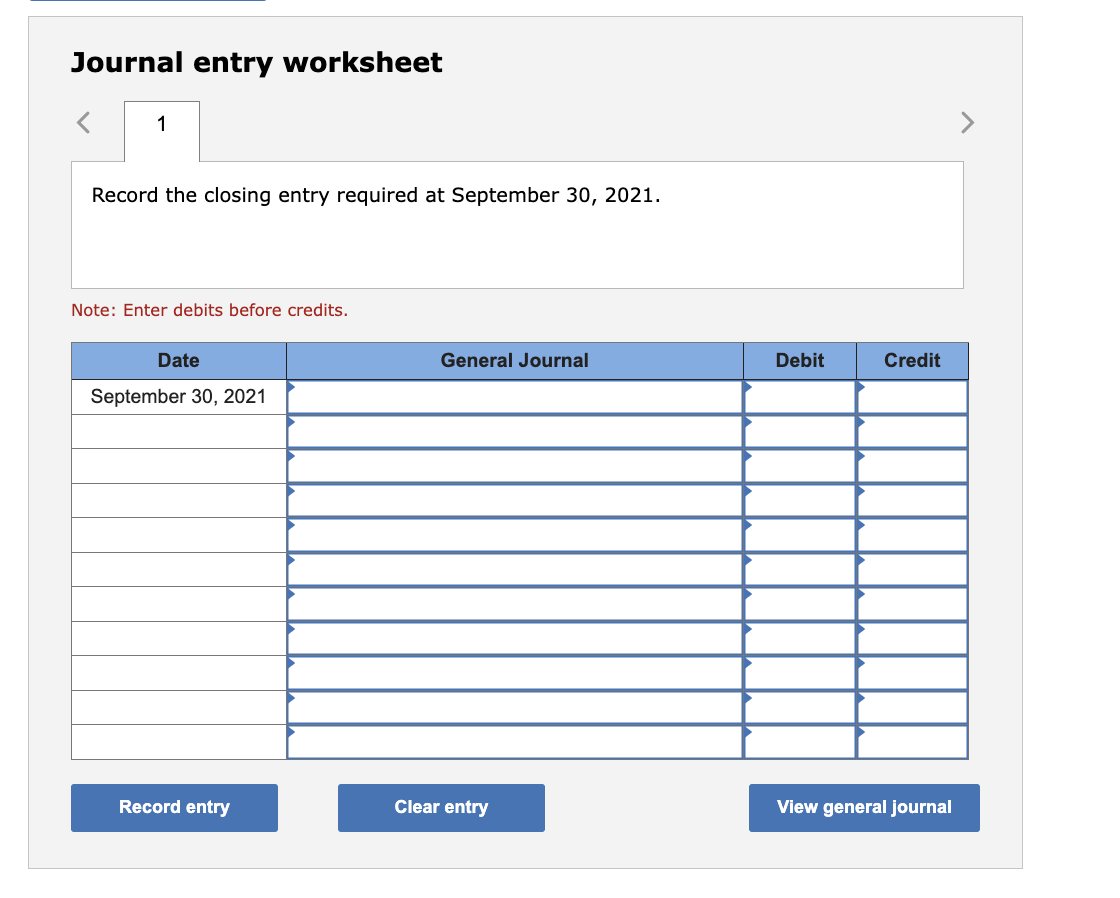

- Prepare the closing entry required at September 30, 2021. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started