Question

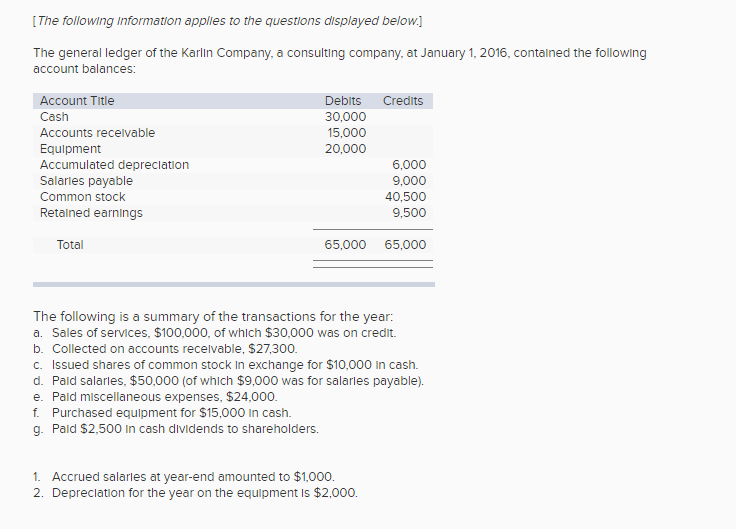

[ The following information applies to the questions displayed below .] Sales of services, $100,000, of which $30,000 was on credit. Collected on accounts receivable,

| [The following information applies to the questions displayed below.] |

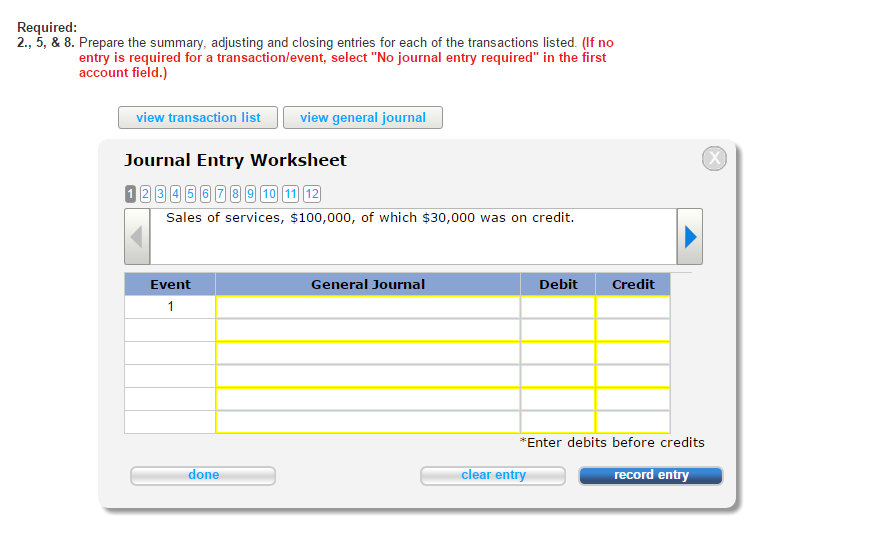

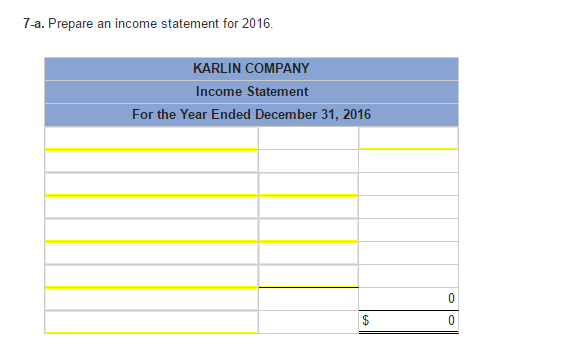

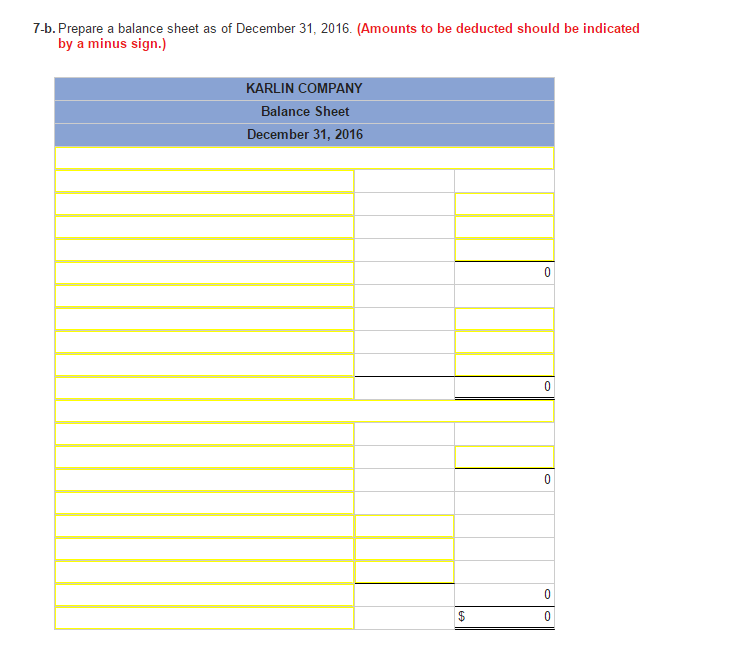

Sales of services, $100,000, of which $30,000 was on credit.

Collected on accounts receivable, $27,300.

Issued shares of common stock in exchange for $10,000 in cash.

Paid salaries, $50,000 (of which $9,000 was for salaries payable).

Paid miscellaneous expenses, $24,000.

Purchased equipment for $15,000 in cash.

Paid $2,500 in cash dividends to shareholders.

Record the adjusting journal entry for accrued salaries at year-end that amounted to $1,000.

Record the adjusting journal entry for annual depreciation of $2,000.

Record the entry to close the revenue accounts using the income summary.

Record the entry to close the expense accounts using the income summary. (Use a single entry, not a separate entry for each expense account.)

Record the entry to close the income summary account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started